Maintained to reflect market changes, statistics, network rules, pricing structures, and prevailing cost dynamics.

Accepting card payments is no longer optional for most businesses. Across North America, electronic payments now represent the majority of transactions, meaning nearly every merchant needs a reliable payment terminal. But while choosing a processor gets most of the attention, how you acquire your payment terminal can quietly become one

People are now expecting the checkout process to be touchless. The concerns of health, safety, and minimizing the transmission of disease are top of mind.

Online shopping and eCommerce is quickly becoming the new normal. Consumers have started to comfortably make purchases online from their computers or mobile devices. All

Payments is an industry that is evolving quickly. The rise of online and mobile shopping is one of the reasons for this rapid transformation. With

There is no “one size fits all” in payment processing. If you’re looking for the top payment processor, figure out what is important to you.

The types of payments that people use has continually been evolving. The first form of money came about around 5000 B.C., but modern payments have

It’s no mystery that Clearly Payments is on a mission to offer the lowest cost payment processing. It’s been written about many times and many

Small businesses make up 85% of all businesses in Canada. They are the foundation of our economy. It’s so important that small businesses get reliable

EMV is a secure payment technology standard that is used worldwide. EMV is managed by a handful of credit card networks: Visa, American Express, Discover, JCB,

Online shopping and eCommerce is growing extremely fast in Canada. It has been growing around 20% per year and 2020 has seen an explosion of

When you pay for something at the store, it has become a relief for consumers, and the merchant, when the payment terminal supports contactless payments.

This article is about helping you get the best POS system for your business. A POS system (point-of-sale) is the software and hardware allowing a

WordPress is the most popular platform to manage content on websites. If you’ve chosen WordPress, you’re in good hands. Hundreds of millions of other websites

Teaser rates are a part of marketing. Quite often they are used to acquire new customers by having a discount. For example, “join now and

Many businesses don’t know how much they should be paying for credit card processing. However, we can guarantee you that the average merchant is paying

WordPress is one of the most common platforms to run websites. There are around 450 million websites that use WordPress. That means around 20% of

We’ve been working on our “best of” series for payment processing, such as the best credit card machines and best payment processors. In this article,

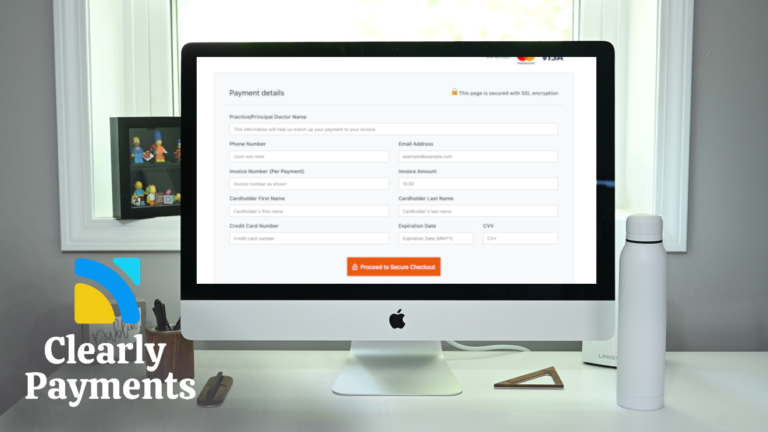

There are specific needs in dental credit card processing that we have seen as we’ve worked with many dentists. First and foremost, low-cost is critical.

One of our working principles is based on our belief that a successful company is opportunity-focused, not problem-focused. Opportunities produce results and growth. Problem-solving tends

Credit card machines have been around since around 1960. They started as credit card imprinters and moved to magnetic stripes in the 1970s. They’ve evolved

Merchants are paying too much on payment processing. That’s a fact. Most merchants have the opportunity to save significantly on accepting payments if they follow

We believe the most important unit of success in a company is learning. That’s right, it’s not revenue or profit or growth rate. We feel