When most people think about credit card payments, names like Visa or Mastercard come to mind. But while these credit card networks provide the infrastructure for transactions, they don’t deal directly with the businesses accepting payments. That job belongs to payment processors — the companies that provide merchant accounts, handle

In the world of digital payment processing, merchants encounter a variety of fees that impact their bottom line. Interchange fees are a crucial aspect of

Credit card fraud is an unfortunate reality that businesses must face in today’s digital age. Year after year, credit card fraud attempts are on the

Digital payments has become a core foundational capability with the growth of the internet and mobile devices. People want convenience, speed, and security rolled into

In the rapidly advancing world of payments and eCommerce, merchants find themselves navigating a landscape of risk in payment processing. While these technologies bring unparalleled

Since 2009, the financial landscape has been undergoing a transformation with the emergence of cryptocurrencies. As digital currencies grow in popularity, merchants around the world

As technological advancements continue to unfold, the payment landscape in the United States is poised for a transformative journey in 2024 and beyond. These key

In payment processing, American Express (Amex) has historically been considered a less-preferred option for merchants due to higher transaction rates and perceived complexities. However, a transformative

Navigating the realm of payment processing unveils three key players: acquirers, ISOs, and aggregators. While all contribute to transactional fluidity, their distinct roles cater to

In the world of eCommerce and online payments, one of the crucial decisions that merchants face is selecting the right online payment gateway. An efficient

In the intricate landscape of payment processing, merchants encounter a myriad of options, each playing a pivotal role in the facilitation of financial transactions. This

In the rapidly evolving world of e-commerce and digital transactions, the choice of a payment gateway is a crucial decision for businesses. A payment gateway

In the intricate landscape of payment processing, merchants are confronted with a choice between three types of payment processors: Acquirers, Independent Sales Organizations (ISOs or

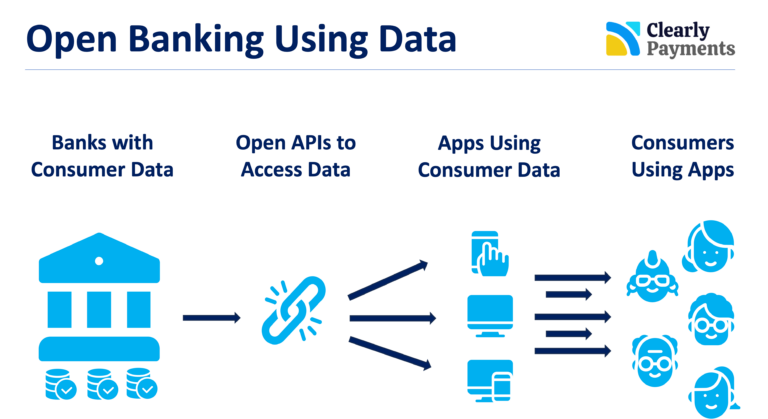

Canada has been actively engaged in open banking initiatives, aiming to empower consumers with greater control over their financial data and enhance the sophistication and

In the competitive landscape of the Heating, Ventilation, and Air Conditioning (HVAC) industry, businesses are constantly seeking innovative solutions to enhance their services. One crucial

As we move into 2024, the world of payment processing will continue to evolve and innovate. Fintech overall is ripe for disruption and is evolving

In a time defined by globalization, businesses often look to cross international borders for expansion. One pivotal tool that facilitates this global reach is the

In the world of business, understanding how to navigate credit card processing fees is essential for financial success. These fees typically range from 1.5% to

In the HVAC industry, staying ahead of the curve is crucial for success. One such advancement that has revolutionized the way HVAC companies operate is

Reconciliation is the process of matching financial records to ensure they align correctly. Credit card statements, with their detailed transaction records, simplify the reconciliation process.

In the dynamic realm of payment processing, rigorous adherence to regulatory requirements is the bedrock of a secure and efficient financial ecosystem. Canada, celebrated for

In the fast-paced world of commerce, credit card transactions have become an indispensable part of our daily lives. The convenience and simplicity of swiping a

Copyright 2025 Clearly Payments Inc. | Privacy Policy

Clearly Payments is a payment processor in Canada. The Clearly Payments name and logo are trademarks of Clearly Payments Inc payment processing in Vancouver, Canada. The Interac name and logo are trademarks of Interac Inc Canada. The Visa, MasterCard, and AMEX logos are trademarks of Visa International, MasterCard International Incorporated, and American Express Company. Clearly Payments is a Registered Partner/ISO of the Canadian Branch of U.S. Bank National Association.