Navigating the realm of payment processing unveils three key players: acquirers, ISOs, and aggregators. While all contribute to transactional fluidity, their distinct roles cater to diverse market needs. An in-depth comprehension of these differences empowers businesses to select the optimal solution for their unique requirements.

Acquirers: The Foundation of Payment Networks

At the heart of payment processing, acquirers, often referred to as acquiring banks, play a foundational role. These financial institutions establish a direct link between merchants and major payment networks like Visa, Mastercard, and American Express. Not only do acquirers authorize and process credit and debit card transactions, but they also ensure the seamless transfer of funds between merchants and consumers.

The responsibilities of acquirers extend to managing intricate settlement processes, providing merchants with comprehensive reporting and reconciliation services. Their pivotal role is not just about facilitating transactions; it’s about upholding the trust and integrity of the payment ecosystem. Through their robust services, acquirers contribute significantly to the efficiency and security of financial transactions.

ISOs: Bridging Acquirers and Merchants

Independent Sales Organizations (ISOs) or Merchant Service Providers (MSPs) operate as indispensable intermediaries, bridging the gap between acquirers and merchants. In addition to facilitating the establishment and management of payment systems, ISOs offer a unified solution for merchants’ diverse payment needs. Their collaboration with acquirers allows them to extend services beyond transactional functions.

ISOs are not just facilitators; they are business partners. Many ISOs actively engage in providing valuable marketing and sales support, tailoring solutions to meet the unique requirements of different businesses. Beyond this, a significant number of ISOs contribute to enhancing the overall merchant experience by developing cutting-edge software designed to streamline payment workflows.

PayFacs: Streamlining the Payment Landscape

Aggregators, known as Payment Service Providers (PSPs) or Payment Facilitators (PayFacs), bring a layer of consolidation to the complex payment processing chain. Through strategic partnerships with multiple acquirers and ISOs, they empower merchants with a diverse array of payment options while simplifying the management of these services. Acting as a single point of contact, aggregators eliminate the need for merchants to navigate relationships with various providers.

In addition to streamlining the merchant experience, aggregators often go the extra mile by offering supplementary services. These may include robust fraud prevention mechanisms and advanced reporting tools. Utilizing dedicated software platforms, aggregators seamlessly integrate the services of different acquirers and ISOs, elevating the overall efficiency of the payment process.

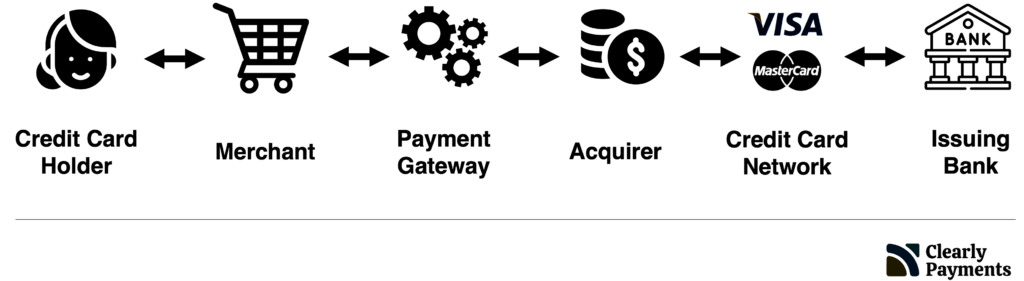

The Flow of a Credit Card Transaction

One way to look at the difference between acquirers, ISOs, and PayFacs is to look at the flow of a credit card transaction. At the core of a credit card transaction is the acquirer. You can think of both the ISO and the PayFac as the Payment Gateway stage. Under the covers, the acquirer has the backend relationships.

- Credit Card Holder: The individual who owns the credit card initiates an online transaction through a merchant’s website, software, or mobile application.

- Merchant: The business, equipped with a payment form or shopping cart, engages the credit card holder in the transaction process. The online payment page of the business displays pertinent information, including payment options, pricing, taxes, and messages indicating approval or decline.

- Payment Gateway or Credit Card Machine: Functioning as either software or hardware, the payment gateway or credit card machine facilitates payments from the merchant’s store or website. Provided by a merchant services provider like Clearly Payments, this step involves validating the consumer’s credit card and transmitting transaction information to the Acquirer.

- Acquirer: The acquirer, akin to a “bank” for the merchant, assumes the risk by underwriting their credit. It processes the credit card payment and directs the transaction information to the credit card network, such as Visa, Mastercard, Discover, or American Express.

- Credit Card Network: The credit card network conducts verification on the credit card’s validity and communicates with the issuing bank, the institution that issued the credit card to the consumer.

- Issuing Bank: Responsible for providing credit to consumers, the issuing bank verifies the credit card’s functionality and ensures there are sufficient funds to approve the transaction.

This overview captures the fundamental steps in a credit card transaction within the payment processing system, recognizing that there are additional intricacies behind the scenes.

Choosing the Right Type of Payment Processor

Acquirers almost exclusively use ISOs as their sales channel. If you have a merchant account from an acquirer, its likely that it was sold to you through an ISO. Acquirers are not typically known for their speed and customer service, therefore most merchants tend to be happier with ISOs or PayFacs.

Understanding the nuances between ISOs and PayFacs is crucial for businesses aiming to choose the most suitable payment processing solution. ISO/MSPs provide merchants with dedicated accounts, granting greater control over the payment process. This nuanced control, however, comes with the trade-off of potentially more intricate management.

On the other hand, PSPs/PayFacs offer a more streamlined experience by centralizing the management of the merchant account. This simplified approach, while reducing some aspects of control, enhances ease of integration and overall convenience. When deciding between these options, businesses should weigh factors such as desired control levels, ease of integration, and access to diverse payment options.

Get the best merchant account with Clearly Payments

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service