Interchange rates are a cost for credit card transactions for merchants. Interchange is the revenue for credit card companies and issuing banks. Canada and the USA have a big overlap in purchasing habits and trends in payments. The two countries also have some big differences on how payment processing fees

Chargebacks are a common occurrence in the world of business and their rates can vary significantly from one country to another. Understanding the factors that

With the rapid growth of eCommerce and online transactions, ensuring the security of online payments has become crucial. In response to this challenge, the financial

In the world of credit card processing, chargebacks are an inevitable reality that businesses must deal with. While chargebacks serve as a valuable consumer protection

A merchant account is a type of bank account that enables businesses to accept and process digital payments, such as credit card (Visa, MasterCard, etc)

Underwriting is an essential part of payment processing. The underwriting process helps payment processors assess the risk associated with processing payments for a particular merchant.

In our world of digital transactions, credit card fraud poses a threat to all merchants who accept credit cards. For protecting yourself from credit card

Credit cards have revolutionized the way we transact, providing convenience and security for consumers worldwide. However, for merchants, accepting credit card payments comes with fees

Settlement in credit card processing refers to the final stage of a credit card transaction where funds are transferred from the cardholder’s account to the

In the world of online and card-not-present (CNP) transactions, security is of utmost importance. To combat fraudulent activities and provide an additional layer of protection,

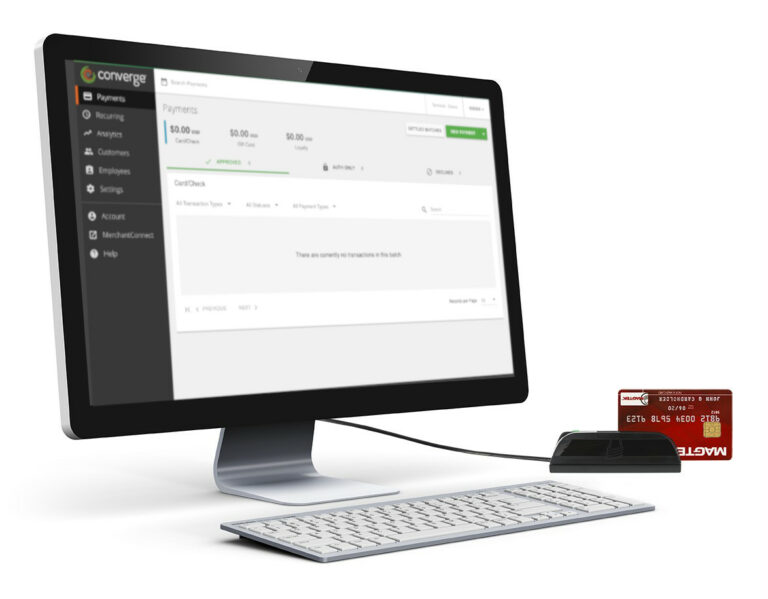

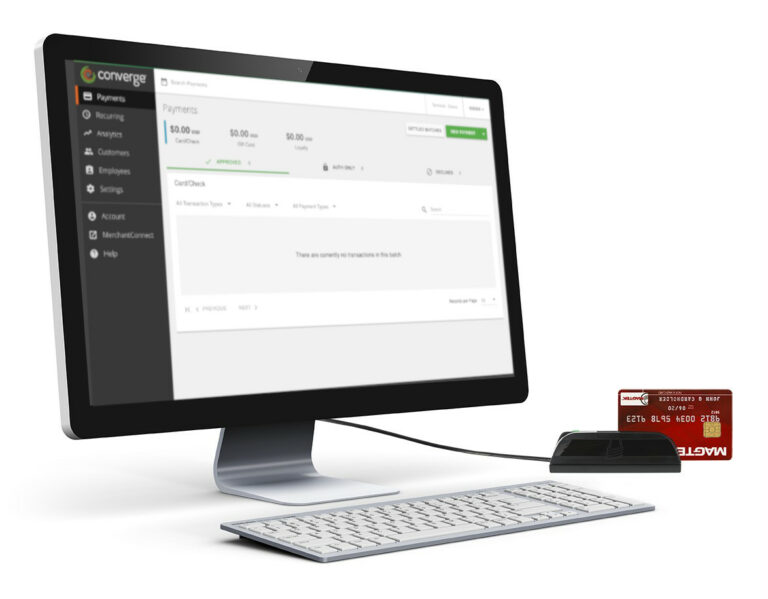

A virtual terminal is a web-based tool that allows businesses to process credit and debit card payments remotely. It is a software (aka virtual) alternative

Open banking is a concept that aims to revolutionize the financial industry by allowing customers to share their banking data with third-party providers through secure APIs.

Today’s financial and payments industry is getting much more advanced and complex. Preventing illicit activities such as money laundering, terrorist financing, and other fraudulent activities

Credit cards have been used for several decades, with their modern form emerging in the mid-20th century. The concept of credit dates back even further,

Subscription payment processing refers to the handling and management of recurring payments associated with subscription-based business models. It is sometimes called other names such as:

A merchant account is a type of bank account that allows a business to accept electronic payments, such as credit and debit card transactions. In

The industry your business is in has a big impact on your interchange rate. Industry is a key factor that determines the risk level of

Interchange rates are an important component of payment processing globally. They are set by card networks like Visa, Mastercard, and American Express, and they represent

The world of credit card processing and merchant accounts can be confusing, with various types of organizations involved and complex fee structures. Merchant accounts are

If you’re the owner of a payments business (i.e. ISO), you may be wondering if it’s the right time to sell. While the decision to

Payment processing and point-of-sale systems can be complex and frustrating at times. The Toronto Star article titled “All Stick, No Carrot: Store Owner Balks at

Digital payments have become the norm over the past 10 year. Technology like the internet and mobile devices, along with the push to online shopping

Copyright © 2024 Clearly Payments Inc. | Privacy Policy

Clearly Payments is a payment processor in Canada. The Clearly Payments name and logo are trademarks of Clearly Payments Inc payment processing in Vancouver, Canada. The Interac name and logo are trademarks of Interac Inc Canada. The Visa, MasterCard, and AMEX logos are trademarks of Visa International, MasterCard International Incorporated, and American Express Company. Clearly Payments is a Registered Partner/ISO of the Canadian Branch of U.S. Bank National Association.