The payment processing market in the United States has demonstrated robust growth, driven by rising consumer demand for digital payments, advancements in financial technology, and the expansion of e-commerce.

This report provides a comprehensive analysis of the U.S. payment processing landscape, covering market size, merchant demographics, transaction volumes, major players, and key trends shaping the industry.

What is the Payment Processing Market

The payment processing market is an ecosystem that enables the secure, efficient transfer of funds from customers to merchants for goods and services. This market includes a range of services and technologies that facilitate the acceptance, authorization, and settlement of payments across various channels, including online, in-store, and mobile.

The value chain in payment processing involves multiple parties that play specific roles in facilitating transactions. Key stages in the payment processing value chain include:

Merchant: The merchant is the entity selling goods or services and accepting payments. Merchants partner with acquirers or payment processors to enable transactions. They require secure systems like point-of-sale (POS) terminals, online checkout gateways, or mobile payment solutions to process payments.

Payment Processor: ISO/PayFac: The payment processor handles the sales, support, onboarding, and sometimes technology for merchants, such as the payment terminals and payment gateway. They can also offer additional services like fraud detection, chargeback management, and analytics.

Acquirer (Merchant’s Bank): The acquirer, often referred to as the acquiring bank, is the financial institution or processor that partners with merchants to process their transactions. The acquirer manages the merchant’s account, receives transaction requests, and forwards them to the appropriate card network or issuing bank for approval. Acquirers also handle transaction settlement and ensure funds are deposited into the merchant’s account.

Card Networks (Visa, Mastercard, etc.): Card networks, such as Visa, Mastercard, American Express, and Discover, play a critical role by routing transaction data between acquirers and issuers (cardholders’ banks). These networks establish and enforce security standards, manage authorization, and facilitate the global infrastructure for secure, reliable payment flows. They also set interchange fees that cover transaction costs and risks.

Issuing Bank (Cardholder’s Bank): The issuer is the financial institution that provides the consumer with a payment card (credit, debit, or prepaid). When a transaction request is routed to the issuer, it verifies the cardholder’s credentials, checks for sufficient funds or credit, and approves or declines the transaction. The issuer takes on the risk of credit and extends funds to complete the transaction on behalf of the cardholder.

Market Size and Growth

The U.S. payment processing market remains a major player in the global economy, with transaction volumes that highlight the sector’s vast scale and continued expansion.

In 2023, the total volume of card-based transactions, which includes credit, debit, and other electronic payments, reached over $10 trillion. This growth is driven by increased adoption of digital payment methods, evolving consumer behavior, and an expanding e-commerce sector.

Total Transaction Volume: The U.S. market’s total transaction volume in 2023 was over $10 trillion, encompassing credit and debit card transactions as well as Automated Clearing House (ACH) payments.

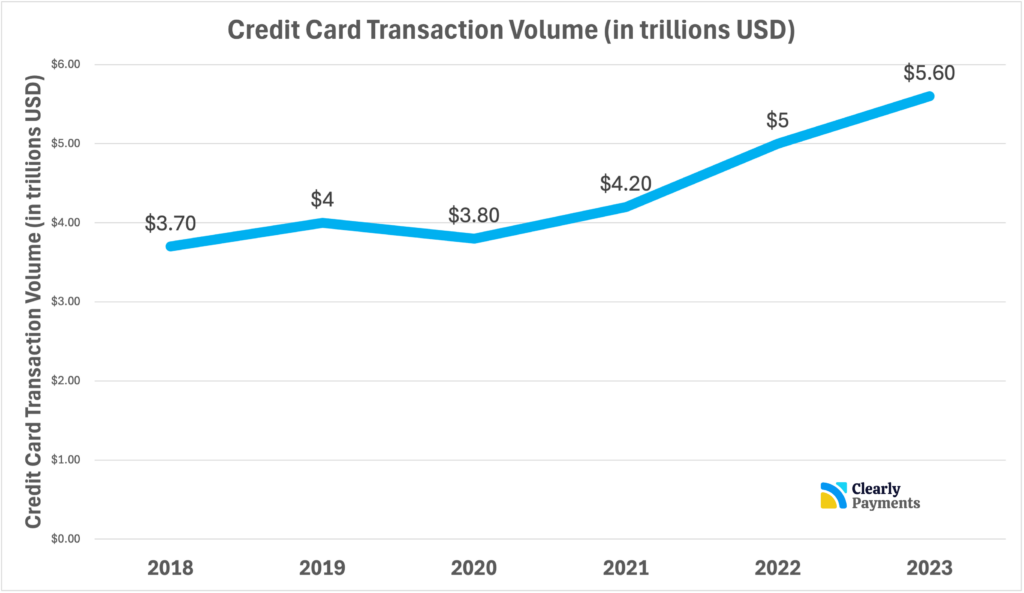

Credit Card Transaction Volume: Credit card payments specifically accounted for around $5.6 trillion, marking an 11% increase from the previous year. This rise underscores credit cards’ central role in consumer spending, spurred by rewards programs and convenience factors.

Digital and E-commerce Transactions: Digital and e-commerce transactions alone represented an estimated $2 trillion segment of the market. As consumers increasingly turn to online shopping and mobile payments, this segment is expected to experience steady growth, driven by the convenience and accessibility of digital payment methods.

| Year | Credit Card Transaction Volume (USD) |

|---|---|

| 2018 | $3.7 trillion |

| 2019 | $4.0 trillion |

| 2020 | $3.8 trillion |

| 2021 | $4.2 trillion |

| 2022 | $5.0 trillion |

| 2023 | $5.6 trillion |

The U.S. payment processing market is projected to grow at a compound annual growth rate (CAGR) of 5% to 7% over the next five years, as businesses and consumers continue to embrace digital payments, contactless technology, and alternative payment options.

The Number of Payment Processors in the USA

The U.S. payment processing industry is essential to the country’s economy, supporting millions of businesses with access to secure, efficient payment solutions. Payment processors in the U.S. include merchant acquirers, Independent Sales Organizations (ISOs), and Payment Facilitators (PayFacs), each serving different segments of the business market and catering to diverse needs.

The U.S. is home to around 30.7 million active businesses as of 2023, with over 99% of these classified as small or medium-sized enterprises (SMEs). SMEs, often with annual revenues below $1 million, typically require flexible and cost-effective payment processing solutions, which is where ISOs and PayFacs play a significant role.

Larger businesses, particularly those with over $100,000 in annual sales, often opt for dedicated merchant accounts with traditional acquirers for higher transaction volumes and additional account services. Here’s a breakdown of each type of payment processor and their role in this market:

Merchant Acquirers

- Number of Acquirers: The U.S. hosts over 320 active merchant acquirers.

- Transaction Volume: Collectively, merchant acquirers handle more than $9 trillion in annual transaction volume.

- Role: Merchant acquirers provide dedicated accounts for individual businesses, enabling them to accept card payments with full transaction transparency and tailored support. They serve larger enterprises and high-volume merchants who require custom processing solutions and high-level risk management.

Independent Sales Organizations (ISOs)

- Number of ISOs: Approximately 3,500 ISOs operate across North America.

- Specialization: ISOs focus primarily on onboarding and servicing small and medium-sized businesses, providing affordable and flexible access to payment processing.

- Function: ISOs act as intermediaries for merchant acquirers, distributing payment services to smaller merchants who may not meet the high volume or revenue requirements to work directly with acquirers. They play a crucial role in broadening access to payment solutions, particularly for businesses new to credit card acceptance.

Payment Facilitators (PayFacs)

- Estimated Number of PayFacs: There are currently an estimated 750 PayFacs in the United States.

- Market Role: PayFacs, such as Square, Stripe, and Shopify Payments, allow sub-merchants (typically small businesses and startups) to share a single master merchant account. This model simplifies onboarding, enabling rapid, seamless access to payment processing with lower setup requirements.

- Transaction Volume and Growth: The PayFac model is growing rapidly, driven by demand for digital payments and e-commerce. Globally, PayFac transaction volume is expected to exceed $4 trillion by 2025, with the U.S. market contributing a significant share.

Debit vs Credit Card Processing in the USA

In the U.S., both debit and credit card processing contribute significantly to consumer spending, but they serve slightly different market needs. Credit cards accounted for around $5.6 trillion in transaction volume in 2023, driven by rewards programs, credit access, and consumer preference for flexible payments.

Debit cards, on the other hand, saw slightly lower but substantial volumes, reaching approximately $4.7 trillion as consumers increasingly use them for everyday purchases and direct-from-account spending.

While credit cards dominate in terms of total transaction value, debit card usage has surged, especially in e-commerce and mobile payments, due to its lower processing fees and appeal to budget-conscious consumers. This balance highlights the complementary roles of debit and credit cards in the U.S. payment ecosystem.

Credit Card Usage and Circulation

Credit cards remain a cornerstone of consumer spending in the U.S., with an extensive reach and high transaction volumes. As of 2023, there were approximately 1.1 billion credit cards in circulation, with an increasing number issued each year. Credit card usage is primarily driven by consumers’ demand for rewards programs, convenience, and the flexibility of deferred payments.

In 2023, credit card transactions totaled about $5.6 trillion, reflecting an 11% increase from the previous year. This growth is attributed to expanding e-commerce, higher consumer spending, and rising adoption of contactless payments. The average American carries around four credit cards, underscoring their role as a preferred payment method. Additionally, revolving credit balances are at record levels, indicating robust credit utilization among consumers.

As of 2023, the number of credit cards in circulation in the United States, categorized by major credit card networks, is as follows:

| Credit Card Network | Number of Cards in Circulation (millions) |

|---|---|

| Visa | 345 |

| Mastercard | 240 |

| American Express | 53 |

| Discover | 57 |

These figures highlight Visa’s leading position in the U.S. credit card market, followed by Mastercard, Discover, and American Express.

With advancements in digital wallets and online shopping, credit cards have also become integral to digital payment channels, allowing for seamless, secure payments across a range of platforms. The U.S. credit card market’s adaptability and incentives continue to drive both circulation and usage, making it a key component of the country’s financial ecosystem.

Major Payment Processors by Size as of 2024

The U.S. payment processing landscape includes various major acquirers, Independent Sales Organizations (ISOs), Payment Facilitators (PayFacs), and other payment processors. These companies support millions of merchants by providing essential payment infrastructure, facilitating secure transactions, and offering tailored solutions for different industries.

The U.S. payment processing market is driven by major players, each providing specialized services to cater to different industries and business sizes. Below is a comprehensive table of the largest processors, acquirers, and ISOs, sorted by their 2023 transaction volumes.

| Payment Processor / Acquirer / ISO | Estimated Transaction Volume (2023) | Market Focus | Notable Features and Services |

|---|---|---|---|

| FIS (Worldpay) | $2 trillion | E-commerce, retail, global businesses | Advanced fraud prevention, broad suite of payment solutions |

| Fiserv (First Data) | $1.8 trillion | Small to large businesses, retail | Clover POS systems, broad merchant service offerings |

| Global Payments | $1.3 trillion | Healthcare, B2B, education | Omnichannel solutions, strong in specialized sectors |

| Chase Payment Solutions | $1.1 trillion | Retail, corporate, e-commerce | Integrated bank services, competitive pricing for Chase clients |

| TSYS (Total System Services) | $0.9 trillion | Small and medium businesses, fintech | Comprehensive payment solutions, strong in mobile and digital |

| Elavon (U.S. Bank) | $450 billion | Hospitality, healthcare, retail | Strong presence in hospitality, multi-channel payment solutions |

| Stripe | $350 billion | E-commerce, subscription businesses | Developer-friendly API, popular with tech and subscription models |

| Wells Fargo Merchant Services | $300 billion | Small and large businesses, retail | Backed by Wells Fargo’s financial services, robust security |

| Square (Block, Inc.) | $200 billion | Small businesses, restaurants, retail | PayFac model, rapid onboarding, Square POS for small merchants |

| North (formerly North American Bancard) | Over $100 billion | Various industries | Comprehensive payment solutions, credit card processing, e-commerce |

| EVO Payments | Over $100 billion | U.S. and Europe | Multi-channel processing, secure solutions for merchants and institutions |

| Adyen | $150 billion | Global e-commerce, digital businesses | Unified global payment platform, multi-currency support |

| Heartland Payment Systems | $80 billion | Retail, small and large businesses | Payroll and business solutions, part of Global Payments’ portfolio |

Key Insights

- FIS (Worldpay) and Fiserv (First Data) are the largest payment processors by transaction volume, providing comprehensive solutions across sectors. FIS specializes in e-commerce and global businesses, while Fiserv’s Clover POS systems are popular among small to medium-sized businesses.

- Global Payments has a strong presence in healthcare and B2B sectors, catering to industries with specific regulatory and processing needs.

- Chase Payment Solutions leverages its banking relationships and provides integrated payment options for retail, corporate, and online clients, handling over $1 trillion annually.

- TSYS is known for supporting mobile and digital payments, with a focus on small businesses and fintech partnerships, making it a go-to processor for tech-forward solutions.

- Square and Stripe, operating under the PayFac model, are popular among small businesses and e-commerce merchants. Square’s POS system supports in-person sales for small merchants, while Stripe’s API-driven platform caters to online businesses and subscription models.

- Adyen offers a unified global payment platform with multi-currency capabilities, appealing to large e-commerce businesses with international reach.

- Elavon and Wells Fargo Merchant Services cater to a broad range of industries, with Elavon notable in hospitality and Wells Fargo strong in providing retail payment solutions.

These companies dominate the payment processing landscape in the U.S., each focusing on specific markets or sectors while delivering secure, flexible, and scalable solutions that meet the needs of various types of businesses.

Emerging Trends and Future Outlook

Several trends are shaping the future of payment processing in the U.S., from digital wallet adoption to enhanced security measures.

Digital Wallets and Contactless Payments: Digital wallets like Apple Pay, Google Wallet, and Samsung Pay have become mainstream, particularly in e-commerce and contactless payments. Digital wallets accounted for almost 50% of online transactions in 2023, and their usage is expected to surpass 54% by 2025.

Buy Now, Pay Later (BNPL): BNPL options have gained traction as consumers look for flexible payment options. Nearly 30% of U.S. consumers used BNPL services at least once in 2023, and this number is expected to grow as more merchants offer BNPL options.

Artificial Intelligence (AI) and Machine Learning (ML): Fraud detection and prevention have become a priority, with AI and ML systems being increasingly adopted to identify suspicious transactions and reduce chargebacks.

Regulatory Changes: New regulations focusing on data privacy and security standards are anticipated in the coming years, impacting how payment processors handle personal and transactional data. Enhanced regulations, particularly around consumer rights and data protection, will shape compliance requirements for industry players.