Teaser rates are a part of marketing. Quite often they are used to acquire new customers by having a discount. For example, “join now and get 25% off for six months.” That’s a great benefit. However, sometimes those advertised teaser rates can be misleading. You will see this in many industries and certainly payment processing.

How teaser rates are used in payment processing

When you see payment processing advertising, you should pay close attention to the rates you see. You’ll see numbers like 1.41%. They sound great, especially if you’re with a higher priced payment processor like Square or PayPal where you’re paying 2.9% to 3.4% plus large transaction fees.

Unfortunately, 1.41% is misleading. Merchants will not have an overall average of 1.41%. You’ll only get that rate if a consumer uses a specific type of credit card and you take the payment over a specific credit card machine. It’s likely that only 20% of your transactions will get that rate.

Some payment processors use numbers such as 1.41% to get you to sign up. When you see these low rates, the payment processor is likely using a pricing method called tiered pricing that includes a merchant discount rate (MDR). Tiered pricing is one of the most complex and misleading pricing methods. In the end, merchants on tiered pricing may have the highest pricing of all merchants. Even worse, it’s possible that you’ll have cancellation fees once realize your rates are too high.

Costco credit card processing teaser rates

Costco is a fantastic store. They serve millions of people with well-priced products and services. One thing they also offer is Costco credit card processing. However, Costco outsources this credit card processing to another company.

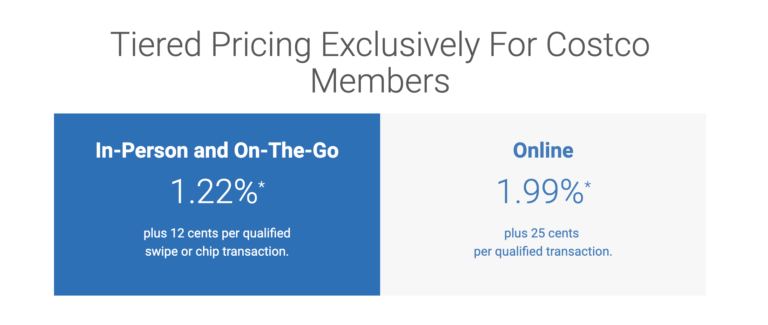

The posted credit card processing rates from Costco are a prime example of teaser rates. They are not totally wrong, but they are definitely very misleading. You’ll see on their website that there are rates such as 1.22%. This is below the actual cost of most credit card transactions. If they charged this rate for all payment processing, they would be losing money. As a merchant, you will only get this rate when a customer uses a certain credit card and you run the card on a certain credit card machine.

In the end, merchants will not pay an overall effective payment processing rate of 1.22%. For a store such as Costco that is supposed to be merchant friendly, this type of teaser pricing is not good for merchants because it’s not clear. We love Costco, but this is very misleading for merchants 🙁

Find out the effective payment processing rate you'll end up paying

The key is to ask the payment processor what your effective rate will be. Ask if they ever increase rates. Ask if there is a cancellation fee. And run through an example: ask what the rate will be for an RBC Avion Infinite Visa on your credit card machine (or with online payments if that’s how you run your business).

To get the most transparent pricing, go with interchange plus pricing, flat-fee pricing, or get membership pricing. What really matters, in the end, is your effective rate for payment processing. The effective rate is the total amount you pay in fees compared to the amount you run through credit cards. You effective rate will not be 1.22% unfortunately, but we’re working to get you there.

Clearly Payments has never come head-to-head with another payment processor and been beat on pricing. Our mission is to drive down the cost of payment processing with world-class service. Period.