Maintained to reflect market changes, statistics, network rules, pricing structures, and prevailing cost dynamics.

It’s a Monday morning in the near future. Your fridge has already reordered groceries. Your car insurance premium dropped overnight after your AI renegotiated pricing across multiple providers. A delayed flight triggered an automatic rebooking before you woke up. Several software subscriptions adjusted themselves based on actual usage. You didn’t

When traveling abroad, using credit has become a convenient and widely accepted method of payment for travelers. With the increasing global connectivity, merchants and payment

Credit cards are one of the most popular and convenient forms of payment worldwide. Over the past few decades, we have witnessed a remarkable surge

Businesses that accept credit cards are continuously seeking ways to streamline their operations and maximize efficiency. That’s what you do to build a company. One

In today’s digital age, electronic payment methods have become increasingly prevalent in our daily lives. Whether it’s swiping a credit card, making an online purchase,

Digital payments and credit card use is growing. This means more merchant accounts are being opened. A merchant account is a type of bank account

Chargebacks can pose significant challenges for merchants, impacting their revenue, reputation, and overall business operations. However, merchants have the opportunity to dispute chargebacks and present

Chargebacks are an integral part of the payment processing industry, representing a mechanism for customers to dispute transactions and seek refunds. For merchants and payment

Future delivery allows customers to purchase goods or services that will be delivered at a later date. This approach offers convenience and flexibility to both

The concept of cash is undergoing a transformation. With the rise of mobile payments, online banking, credit card use, cryptocurrency, and contactless transactions, the prospect

Credit card processing companies have developed various pricing models for processing credit card transactions. A key cost in credit card processing are interchange fees, which

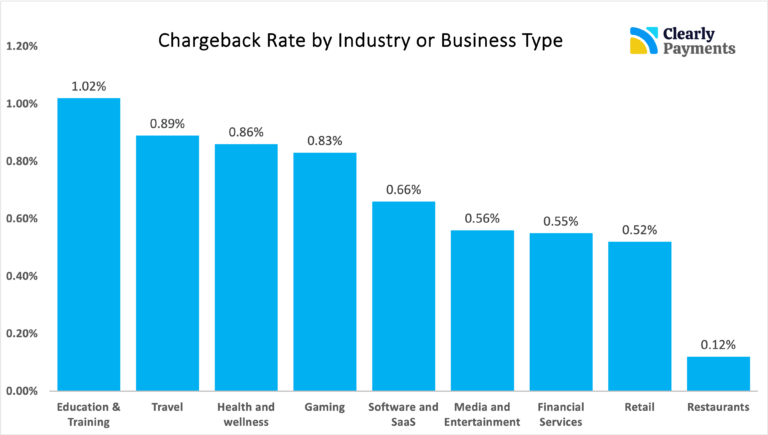

The concept of chargebacks has become increasingly important for businesses across various industries. A chargeback occurs when a customer disputes a credit card transaction and

In today’s digital era, online transactions have become increasingly prevalent, making payment security a top priority for businesses and consumers alike. One critical component of

Chargebacks are a common occurrence in the world of business and their rates can vary significantly from one country to another. Understanding the factors that

With the rapid growth of eCommerce and online transactions, ensuring the security of online payments has become crucial. In response to this challenge, the financial

In the world of credit card processing, chargebacks are an inevitable reality that businesses must deal with. While chargebacks serve as a valuable consumer protection

A merchant account is a type of bank account that enables businesses to accept and process digital payments, such as credit card (Visa, MasterCard, etc)

Underwriting is an essential part of payment processing. The underwriting process helps payment processors assess the risk associated with processing payments for a particular merchant.

In our world of digital transactions, credit card fraud poses a threat to all merchants who accept credit cards. For protecting yourself from credit card

Credit cards have revolutionized the way we transact, providing convenience and security for consumers worldwide. However, for merchants, accepting credit card payments comes with fees

Settlement in credit card processing refers to the final stage of a credit card transaction where funds are transferred from the cardholder’s account to the

In the world of online and card-not-present (CNP) transactions, security is of utmost importance. To combat fraudulent activities and provide an additional layer of protection,