MCC stands for Merchant Category Code. It is a four-digit number assigned to businesses to categorize the type of goods or services they offer. The MCC is used primarily in the financial industry to facilitate payment processing, reporting, and analysis. The code helps identify and classify merchants based on their business activities.

There are thousands of unique Merchant Category Codes (MCCs) in use. MCCs are standardized and maintained by organizations such as the International Organization for Standardization (ISO) and major payment networks like Visa and Mastercard. Each MCC represents a specific industry or business category, allowing for consistent classification and analysis of transactions across the payment ecosystem.

The history of Merchant Category Codes (MCCs)

Merchant Category Codes (MCCs) have a rich history that dates back to the emergence of electronic payment systems in the late 1960s and early 1970s.

As the credit card industry began to grow, there was a need to classify merchants based on their business activities for transaction processing and reporting purposes. Initially, Bank of America introduced a system of Standard Industry Codes (SIC) for their BankAmericard transactions. However, as the industry expanded, there arose a need for a standardized coding system that could be universally adopted. Thus, MCCs were introduced in the early 1970s as a four-digit code assigned to each merchant category.

The development and maintenance of MCCs involved collaboration between organizations such as the International Organization for Standardization (ISO), Visa, and Mastercard. They worked together to create and update the MCC lists, ensuring consistency and reflecting the evolving industry classifications.

Today, MCCs are globally recognized and widely used in the payment industry, facilitating transaction analysis, interchange fee determination, and the provision of specialized services tailored to specific merchant categories.

The structure and meaning of MCC

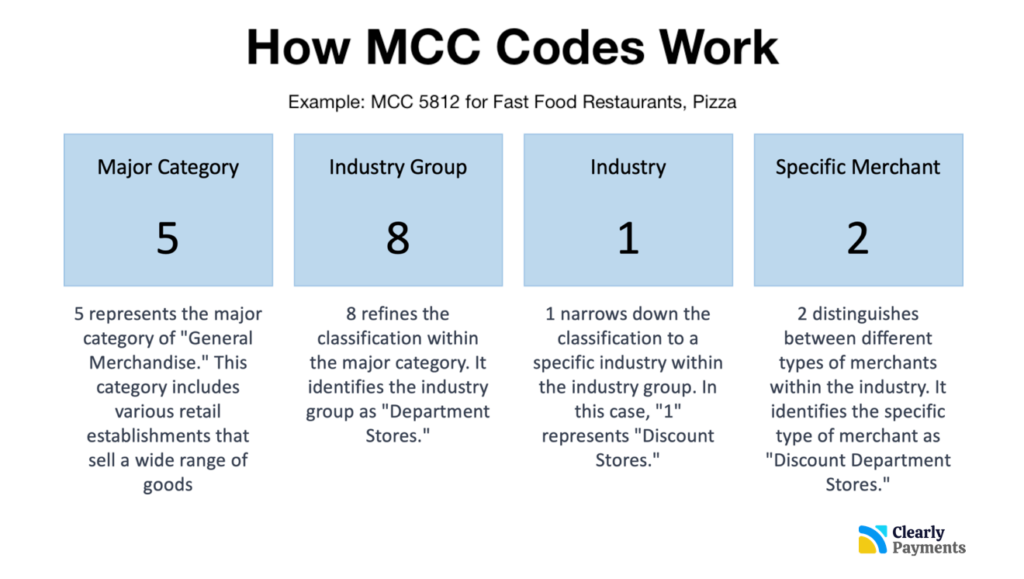

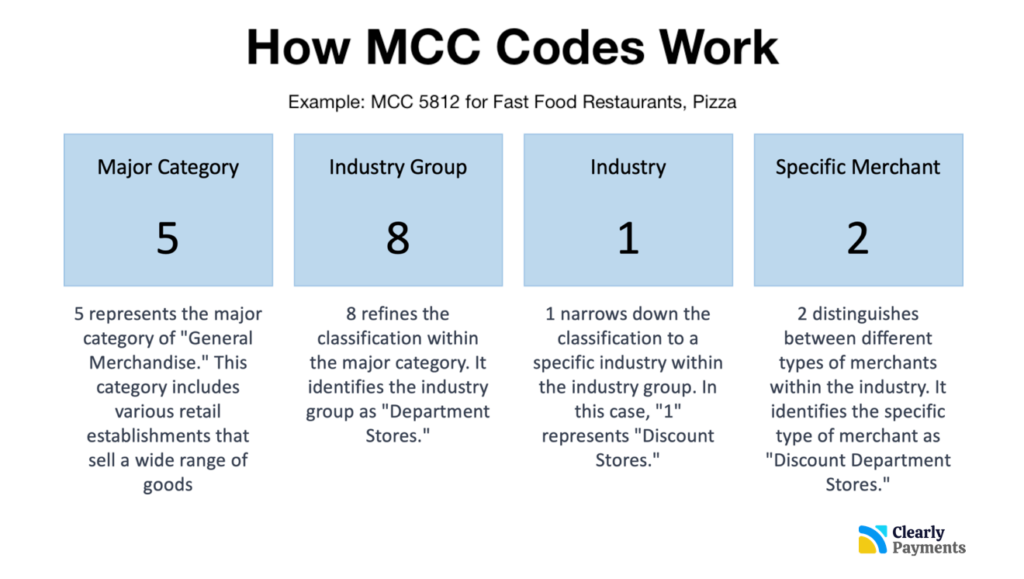

The structure of Merchant Category Codes (MCCs) consists of a four-digit numerical code. Each digit within the code has a specific meaning and contributes to the overall classification of the merchant. Here is the breakdown of the structure of an MCC:

Major Category: The first digit of the MCC represents the major category of the merchant’s business. This digit broadly categorizes the industry or sector in which the merchant operates. For example, a digit of “5” generally represents the category of “Retail.”

Industry Group: The second digit further refines the classification by identifying the industry group within the major category. It provides additional specificity within the broader category. Continuing with the example of “Retail,” a second digit of “6” might indicate “Apparel and Accessories.”

Industry: The third digit narrows down the classification to a specific industry within the industry group. It provides more granularity and specifies the type of goods or services the merchant offers. For instance, within the “Apparel and Accessories” group, a third digit of “1” might represent “Men’s Clothing.”

Specific Merchant: The fourth digit represents a specific merchant or business within the industry. It further distinguishes between different types of merchants within the same industry. For example, within the “Men’s Clothing” industry, a fourth digit of “2” might indicate “Men’s Formal Wear.”

By considering all four digits of the MCC, one can identify the major category, industry group, industry, and specific type of merchant. This structure allows for consistent classification and analysis of merchants based on their business activities in the payment processing and financial industry.

While the specific list of MCCs can vary slightly depending on the payment card network, here are some examples of the most common MCCs that we see in payments.

- 5411: Grocery Stores and Supermarkets

- 5812: Eating Places and Restaurants

- 5499: Miscellaneous Food Stores (e.g., Convenience Stores)

- 5541: Gas Stations

- 5941: Sporting Goods Stores

- 5942: Book Stores

- 5912: Drug Stores and Pharmacies

- 7832: Motion Picture Theaters

- 7011: Lodging (Hotels, Motels)

Choosing the best MCC is important because it can help you reduce your rates in payment processing as you’ll see below in how an MCC is used in payment processing.

The ways an MCC is used in payments

MCC (Merchant Category Code) is used in payment processing primarily for the purpose of determining interchange fees, which are fees paid between the merchant’s acquiring bank and the cardholder’s issuing bank. Here’s how MCC is used in payment processing:

Interchange Fee Determination: Each MCC is associated with a specific interchange fee rate. When a transaction occurs, the MCC is used to identify the type of merchant involved. The payment processor or acquiring bank references the MCC to determine the appropriate interchange fee to be charged for that transaction. Interchange fees may vary based on factors such as the type of card used (credit or debit) and the specific MCC category.

Fee Structure: Different MCC categories have different fee structures associated with them. For example, transactions made at grocery stores may have a lower interchange fee compared to transactions at luxury retailers. The MCC helps classify the merchant’s business type, enabling the payment processor to apply the correct fee structure.

Pricing and Contracts: MCCs can also influence the pricing and contracts between the merchant and the acquiring bank or payment processor. Merchants may negotiate their payment processing rates based on their MCC category. For instance, a merchant in a low-risk MCC category may have more favorable pricing terms compared to a high-risk category.

Reporting and Analysis: Payment processors and financial institutions use MCC data for reporting and analysis purposes. By aggregating transaction data based on MCCs, they can generate reports that provide insights into transaction volumes, spending patterns, and industry trends. This information helps them evaluate the performance of different MCC categories and make informed business decisions.

MCC with the lowest interchange rates

The specific interchange rates associated with Merchant Category Codes (MCCs) can vary based on several factors, including the card brand, payment network, and specific contractual agreements. However, certain MCC categories generally tend to have lower interchange rates compared to others. While these are general observations and exceptions can exist, some examples of MCC categories that often have lower interchange rates are:

Supermarkets and Grocery Stores (MCC 5411): Transactions at supermarkets and grocery stores typically fall under this MCC, and they often have lower interchange rates due to the high volume and low-risk nature of these transactions.

Gas Stations (MCC 5541): Fuel purchases made at gas stations often fall under this MCC, and they may have relatively lower interchange rates as they are considered lower risk.

Utilities and Government Services (MCC 9400): Payments to utilities, such as electric, water, and gas services, as well as government-related services, often have lower interchange rates.

Education (MCC 8211): Payments related to educational institutions, such as schools, universities, and educational services, may have lower interchange rates.

Nonprofit Organizations (MCC 8398): Transactions made with registered nonprofit organizations often have lower interchange rates as they may be subject to special pricing arrangements.

It’s important to note that interchange rates can be influenced by various factors, and they are subject to change over time. Additionally, specific rates can vary depending on the payment network, card brand, and the terms of the merchant’s agreement with their payment processor or acquiring bank.