To get a merchant account, you can go to an acquirer or an ISO (Independent Sales Organization). In summary, acquirers run the transaction processing technology and they partner with ISOs to do the sales, service, and provide other value-add services.

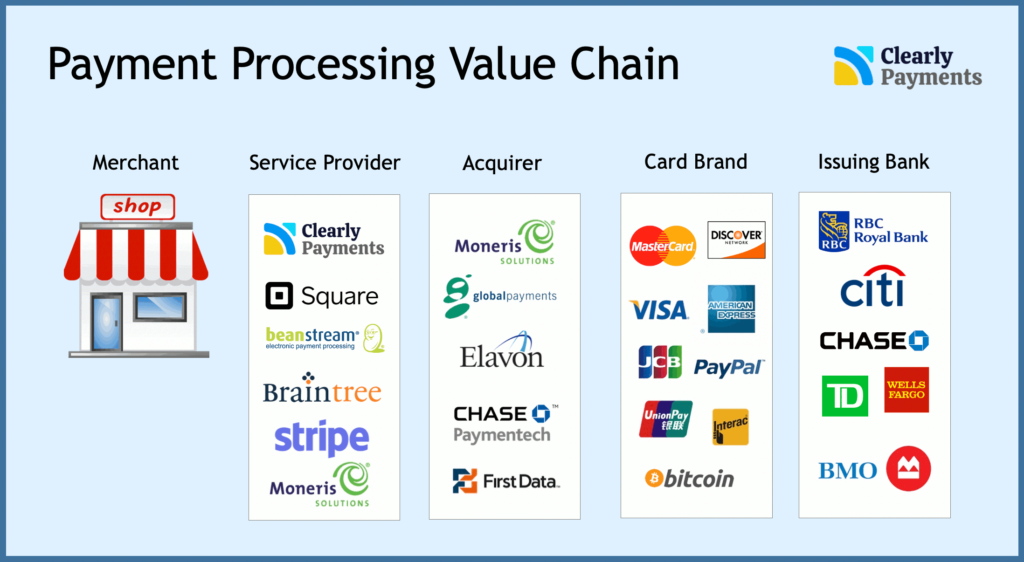

Most merchant accounts in Canada and USA are sold by ISOs. Approximately 80% of merchant accounts are sold through ISOs. ISOs can be further categorized into bank ISOs or non-bank ISOs. The below value chain gives a high-level picture of how the payment industry typically works. In this chart, ISOs fit into the “Service Provider” category.

This article goes into the details of the difference between acquirers, bank ISOs, and non-bank ISOs. If you wanted to dig deeper into issuing banks, read our articles on what is an issuing bank and what is an acquiring bank.

What is an acquirer in credit card payment processing?

Acquirers (acquiring banks) actually run the technology to process a debit card or credit card transaction. They have the technology that receives transaction data from a merchant and they communicate with financial institutions to approve credit card transactions.

Acquirers do have sales teams that sell merchant accounts, however, acquirers put more of their focus on transaction processing operations than direct sales. Most of their sales go through ISOs.

What is an ISO in credit card payment processing?

ISO stands for Independent Sales Organization. ISOs are merchant service providers that work with one or more acquirers to resell payment processing technology and services. If an ISO is good enough and provides a lot of value, there will be some ISOs that sell for other ISOs. For example, Clearly Payments is an ISO that has other ISOs as partners that help sell our services. Here’s a full article on how ISOs work.

The larger ISOs also develop their own technology and value-added services. Visa publishes a list of all the existing ISOs in the world. It is also helpful to distinguish that ISOs can either be bank ISOs or non-bank ISOs, described below.

What is the difference between a bank ISO and a non-bank ISO in payment processing?

Banks sell payment processing to businesses. It makes sense. If a merchant decides to set up a business bank account, why not sell them payment processing at the same time. This increases the banks average revenue per user (ARPU). Some banks are acquirers, but most banks and credit unions are ISOs.

CIBC, for example, is an ISO of USA acquirer Global Payments. Another example is that Scotiabank is an ISO of USA acquirer Chase. Most banks will brand the products of acquirers so it is very difficult to know if a bank is an acquirer or an ISO.

The benefit of using a bank ISO is that you are consolidating your financial services if you have your bank account at the same institution. This simplifies the number of organizations you work with. The downfall bank ISOs is that you generally get very “cookie-cutter” products and services. The largest complaint most merchants have is that the customer service can vary wildly resulting in a poor experience from bank ISOs. Historically, banks are not known for the best customer service.

Of course, you can have a poor experience with a non-bank ISO, but if you can find the right ISO, they can potentially be some of the most cutting-edge payment providers in the world with exceptional customer service. This is what Clearly Payments aims to be.

What is the difference between an acquirer and an ISO in payment processing?

In the end, ISOs sell the same products and services as acquirers. The difference with an ISO is that they can have a wider range of products because they can work with multiple acquirers to package up customized products. ISOs then have the opportunity to offer a solution that is better fitting for certain merchants.

In general, it is difficult to determine if you are working with an ISO or an acquirer because most of the technology is white labeled, meaning it has the logo of whichever company is selling and servicing it.

When it comes down to price, there is generally little difference overall in which type of processor is cheaper. However, ISOs have more of an opportunity to be nimble and keep their cost structure down so can work on thinner margins than acquirers. This is particularly true for non-bank ISOs. What is more common is that there are payment processors that have a culture of aggressive sales teams and pricing methods, regardless if they are acquirers or ISOs. Unfortunately, aggressive pricing is common in the payments industry. This is why it’s ultra-important to look for a payment process with good values.

In our opinion, non-bank ISOs are the best providers of payment processing. They can work with multiple providers to offer best-of-breed products, can build their own innovative software on top of acquirers that further adds value, and they can have the nimbleness to offer exceptional customer service.

Are you looking to start an ISO?

Our leadership team has been in the payments business for many years. We work with referral partners, ISOs, integration partners, and other channel partners. We have worked with thousands of merchants with every type of payment under the sun.

If you’re looking to start and ISO, we can help. We can be your guide and help you understand the industry, management, strategy and financial modelling, operations setup, and sales process to get you up and running.

We can set up customers on the Clearly Payments platform while you prepare then transfer them over. Work with us as long as you want until you’re ready to fly on your own. If you’re interested to get contact kalle@clearlypayments.com.