The payment processing industry is a sector of the financial industry that handles electronic payment transactions. It includes companies that provide payment processing services, such as credit card processing, debit card processing, electronic fund transfers, and online payment processing. These services allow businesses to securely transfer money electronically and make purchases online or in-store using payment cards or other electronic payment methods.

Payment processing market size

The payment processing industry is big business. There are about 470 billion credit card transactions per year across the globe, mostly from Visa, UnionPay, Mastercard, American Express, JCB, Diners Club, and Discover cards.

In the USA, there are about 40 billion credit card transaction per year with Visa taking roughly 40% of the market share. The amount that people spend using credit cards in North America is over $3 trillion per year and that is growing by about 10% per year. Payment processing fees add up to around $85 billion per year.

It’s easy to understand why the payments industry is so competitive. Traditionally, payment processing has been dominated by a few very large banks. However, recently smaller companies have been able to enter the market and compete on new software and great customer experiences.

One interesting trend is that the amount of people that use cash and checks as a payment method is falling off a cliff in favour of digital payments, in particular credit cards. The US Federal Reserve has some pretty good studies on payment card trends.

Merchants are the customers in payment processing

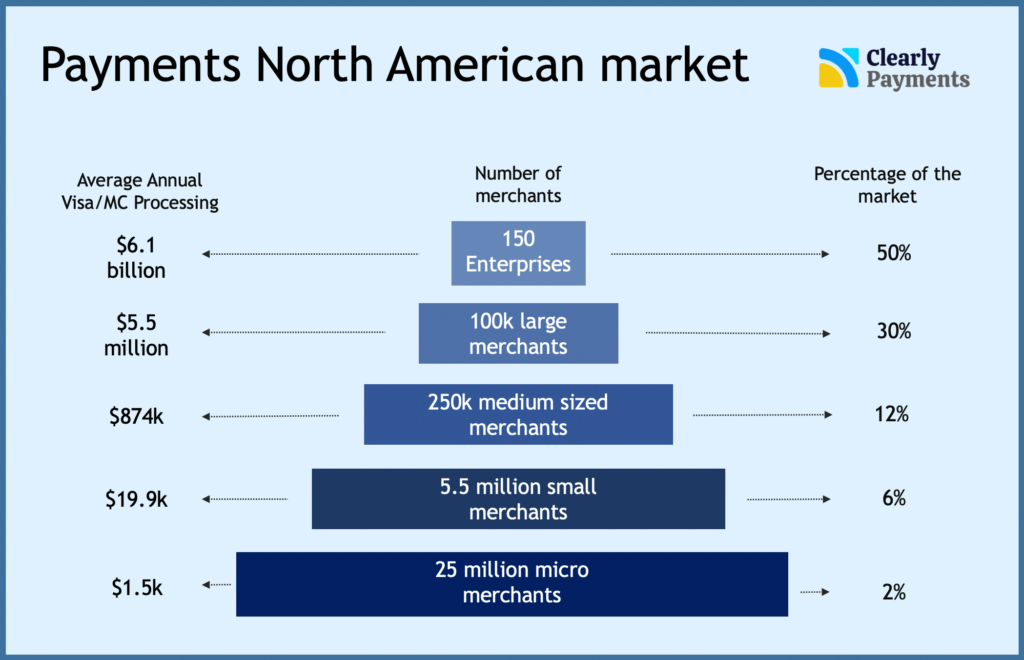

There are more than 31 million businesses (merchants) in North America. There are roughly 29 million businesses in the USA and 2 million in Canada. Approximately 36% of all merchants accept credit cards. The rest use cash, checks, or money transfers. But as we’ve described, credit cards are growing quickly and the number of businesses with merchant accounts is growing fast.

There is a fee to use credit cards, roughly 2.3% of the total dollar amount processed. You can read more about the average amount merchants pay. The merchants pay the fees to the credit card processing value chain described below for the ability to accept credit cards. Therefore, merchants are the true customer in the payment processing industry. Here is a full article on how fees work in payment processing.

As you can imagine, the largest 150 merchants generate more than half of the total payments in North America. The smallest 80% of merchants only generate 2% of revenue.

The payment processing value chain

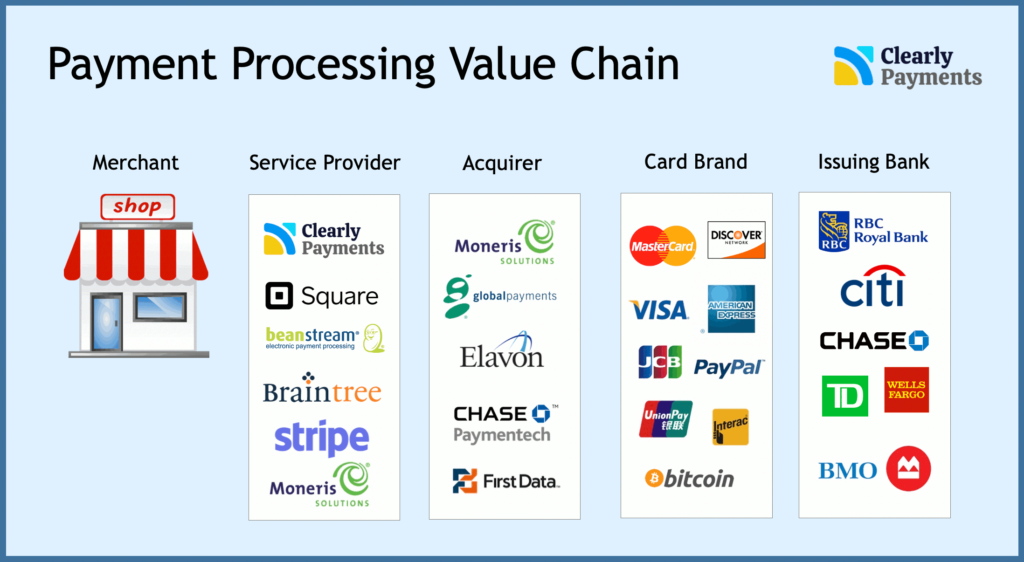

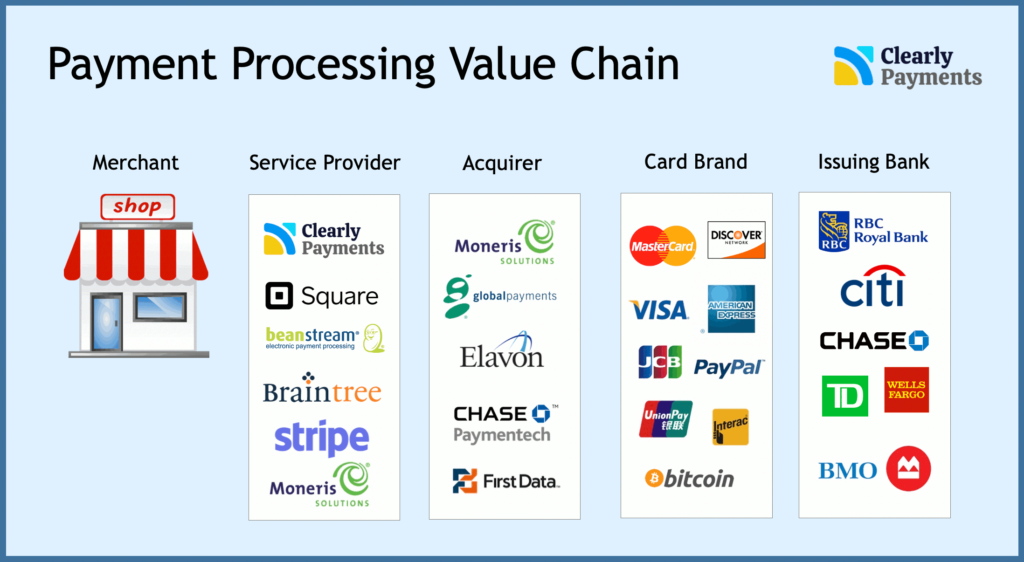

The credit card processing value chain includes the companies that generate revenue directly off of a credit card transaction. Sometimes the group of companies are known as payment processors as a general term, however, they each have very different roles.

It is important to note that there are some missing companies or value-added services that play a vital part in the value chain, such as credit card terminal manufacturers or fraud prevention systems. They are not included in the value chain because they do not directly generate revenue from a credit card transaction. They generate revenue of the sale of hardware and software.

Issuing bank (or credit card issuer)

The credit card issuers (or issuing banks) are the companies (banks or credit unions) that people get their credit cards from. Chase and Citi are a couple of the largest in the USA while TD and RBC are the largest in Canada. The issuing bank decides things like the interest rate that cardholders pay, the limit, foreign fees, etc. Read our full article on what is an issuing bank.

Card brand (or credit card network or card association)

A card brand (or credit card network or card association) are the players that sets interchange rates and govern the rules of the program. That’s Visa, MasterCard, Diners, Discover, etc. Read our full article on what is a credit card network.

Acquirer (or payment processor or underwriter)

This is where definitions can get complicated. An acquirer (or acquiring bank) actually process credit card transactions, take on the underwriting risk, and hold the merchant account for merchants. Sometimes people use the term “processor” as a general term for “payment processor” or “merchant services provider” but they are technically different. The main difference is defined by who provides the technology that communicates with the issuing bank, which is the acquirer. Read our full article on what is an acquirer.

Service provider (or merchant service provider or payment processor)

Merchant service providers provide the sales, support, and software to merchants. Sometimes they build their own software, sometimes they white label it. These are the players that merchants primarily work with. These can also be called an ISO (Independent Sales Organization) or just a payment processor.

ISOs come in a wide range of sizes from very small boutique businesses to multi-national organizations. Merchant service providers are one of the most interesting players in the value chain because they can be one of the most nimble and innovative players, bringing significant value to merchants. Read our full article on what is an ISO in payments.

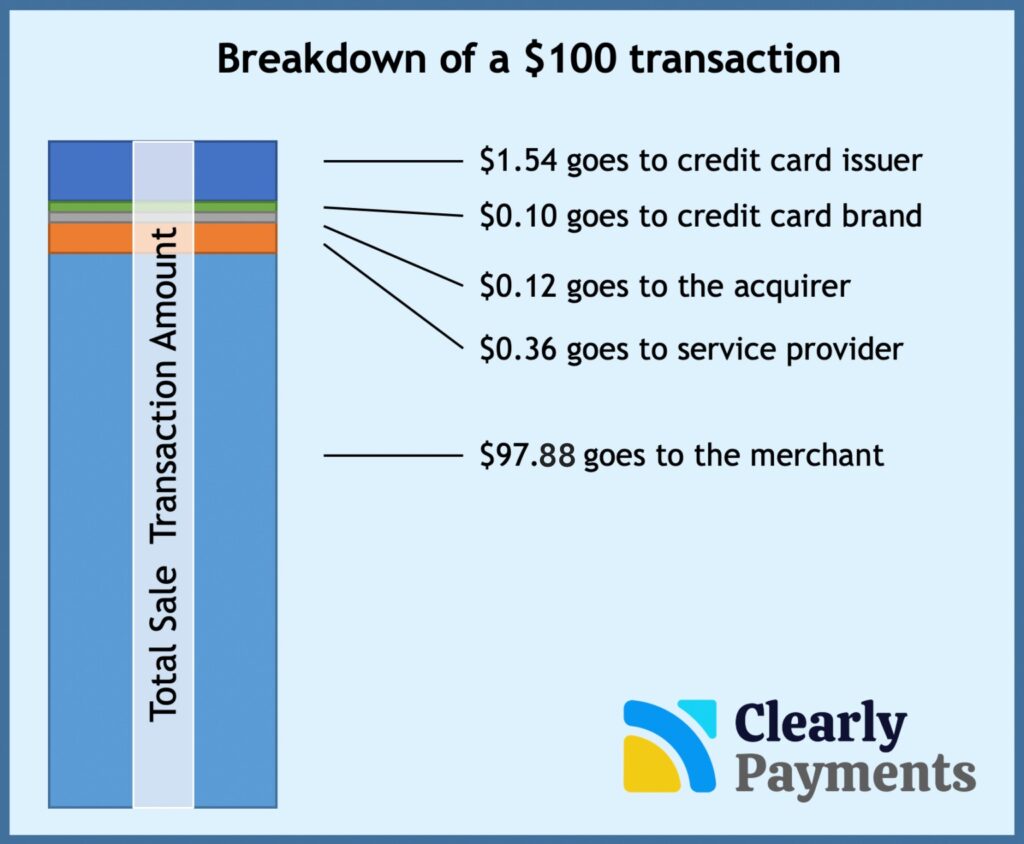

The breakup of revenue in payment processing

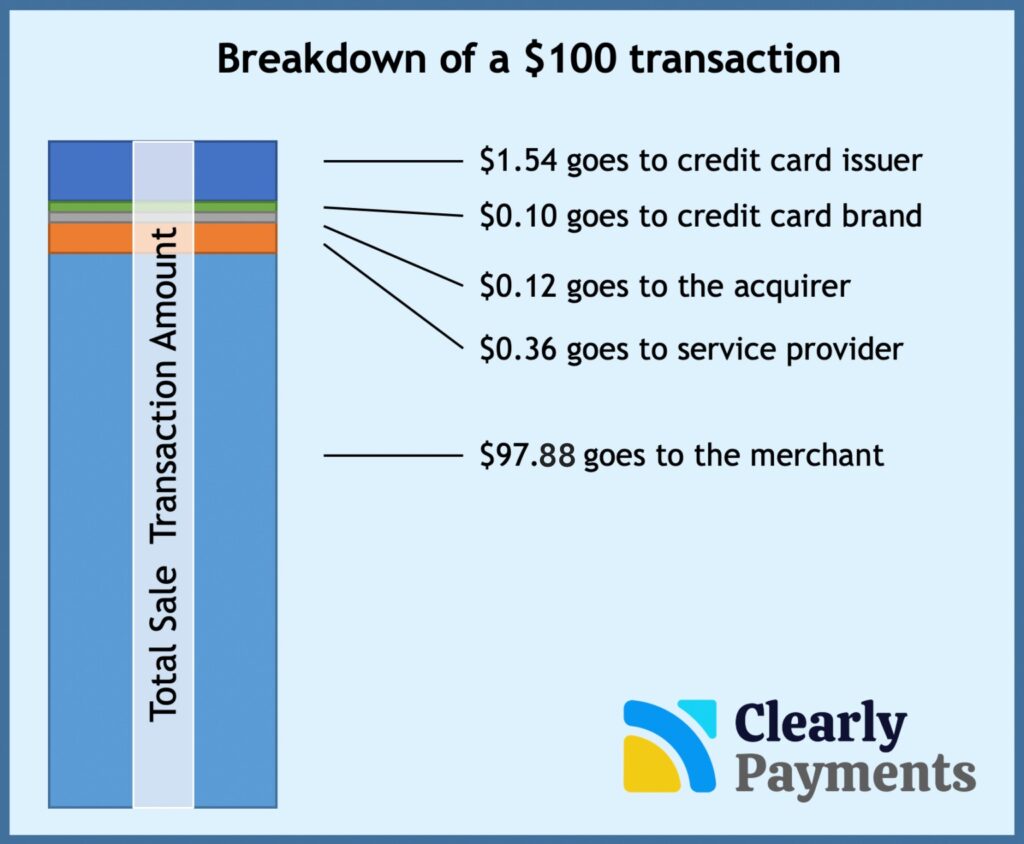

The payment processing value chain works together to enable merchants to accept credit cards and to ensure consumers have a safe, efficient, and secure way to pay. For this service, companies in the value chain split up an overall fee of around 2.12% of the transaction amount. This is just a rough estimate. Merchants can pay as low as around 2% and as high as 8% to 10%. This article explains why some merchants pay higher payment processing fees.

The fees merchants pay include the interchange fee along with other payment processing fees. Here is are some statistics on the average interchange fee.

Let’s look at an example where a consumer pays $100 for a pair of shoes. To start off, the merchant gets around $97.88 and the credit card value chain gets $2.12. This number can vary significantly. It can vary based on things such as the type of transaction and the country you’re in. In particular, many service providers (and aggregators) will mark up the fees across the value chain to collect more revenue. This is a key reason you should work with an honest service provider. Clearly Payments is one of those honest service providers 🙂

The credit card issuer takes the most of the fees, around 67%. The issuer does the hard work of getting a credit card into the hands of the consumer in the first place. Next, the service provider takes around 16% for providing the software, support, and service. Then the rest is roughly evenly split between the acquirer and credit card brand.

Trends in payment processing

Payment processing has been evolving quickly over the past two decades. There are many payment processing trends that are ongoing and will have a significant impact on the industry over time.

The key trends we see are the growth of eCommerce, the prevalence of mobile devices, open banking, the prevalence of the internet, real-time payments, digital currency (i.e. cryptocurrency), and artificial intelligence. Clearly Payments will continue to leverage these trends to build a better experience for merchants and reduce the cost of payment processing. Read about more my perspective on the trends in payments.

We see a future of payments where transactions are low-cost, borderless, real-time, and simple. If you have any questions or insight for us, email me at kalle@clearlypayments.com.