Why Credit Cards Get Declined

It can be awkward when you’ve sold items and your customer’s credit card gets declined. The best way to deal with that situation is to have the power of knowledge. This is to provide you all the basic information you need on why credit cards get declined. Who declines a credit card First, let’s assume […]

Comparing pricing for merchant accounts vs aggregators

There is a cost for merchants to accept credit cards. You most likely already know this. Payment processors provide the software and hardware, services around fund transfers, and customer support. In addition, payment processors take risk for giving credit to merchants during the process of accepting credit cards. One example scenario of the type of […]

Payment Processing for Accountants and Accounting Firms

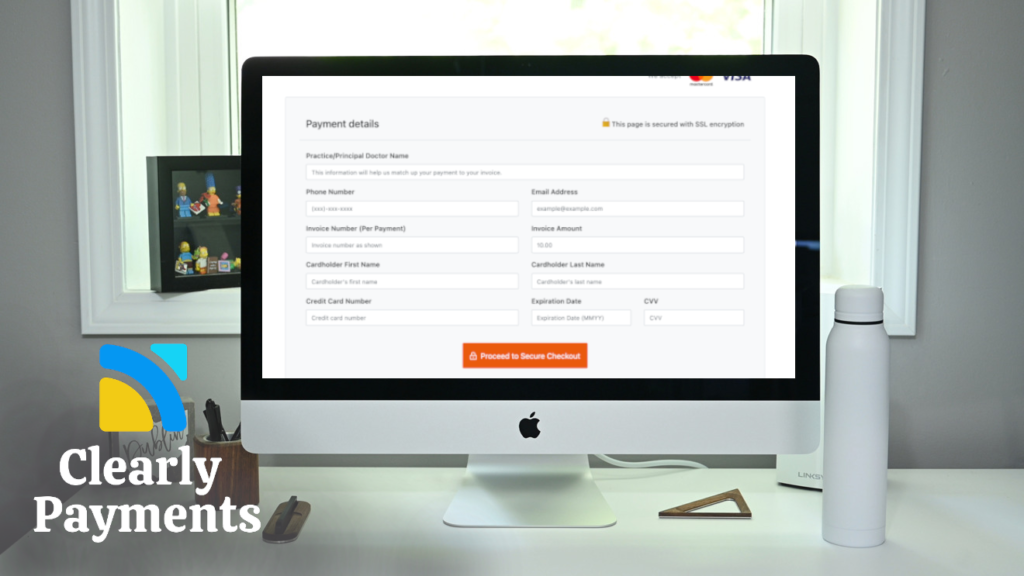

Accountants generally have a few top priorities when looking for a payment processor. This includes 1) the ability to let clients accept credit cards online, 2) the ability to send and track invoices easily, and 3) really low credit card processing rates. Let Clients Accept Credit Cards Online The most convenient way for clients to […]

The Simplest Way to Add eCommerce to your Website

Online shopping and eCommerce is quickly becoming the new normal. Consumers have started to comfortably make purchases online from their computers or mobile devices. All the large retailers have deployed online shopping. It’s imperative that the medium and smaller businesses maximize their online exposure to compete. Thankfully, adding eCommerce to your website is simple and […]

Generate revenue from payment processing

Payments is an industry that is evolving quickly. The rise of online and mobile shopping is one of the reasons for this rapid transformation. With this change, comes opportunity to generate revenue and create new forms of value for your customers. Clearly Payments has a partner platform for businesses to capitalize on payment processing. The […]

Flexible and low cost online payments in Canada

Online shopping and eCommerce is growing extremely fast in Canada. It has been growing around 20% per year and 2020 has seen an explosion of growth due to COVID. Online shopping grew more than 30% in 2020. Consumers are now quite comfortable with online shopping, even to the point where people buy groceries and cars […]

Build passive income while helping local businesses

Clearly Payments, a Canadian payment processor that was built from the ground up to have the lowest payment processing fees, has launched an Ambassador Program. People in the community can take part in a program that builds passive income at the same time as helping local businesses reduce their payment processing fees. A true win-win. The […]

Dentists deploy contactless payments for social distancing

Patients prefer convenience, speed, and minimal contact when they pay after their dental visit. This trend, particularly minimal contact, has been slowly gaining traction for years, however, COVID 19 has accelerated this movement dramatically. Contactless payments minimizes the risk of contracting COVID 19 during the payment process for both patients and healthcare workers. Dentists are […]

Payment processing for RMTs

RMTs (Registered Massage Therapists) and general massage therapists are in a competitive business. The core of a successful RMT is repeat business. When you have a repeat client, the CLTV (customer lifetime value) of a customer drastically increases. This means higher growth and higher profitability. One of the ways massage therapists have grown is with […]

Top reasons businesses should accept credit cards

Accepting credit cards cost money for a business. That is likely the the main reason a business might not want to accept credit cards. It costs somewhere between 2% and 5% and there are many reasons for the wide range of cost. If you work with a good payment processor, you’ll be able to keep […]