Credit card processing is one of the “must-haves” for a lot of businesses. This is especially true because the world is moving to a cashless and internet-based economy. Payment processing is more similar to a utility, such as electricity or water. Unlike a traditional utility which has very few suppliers and frequently only one option, there is a lot of choice in payment providers. You can do a simple Google search on payment providers and you’ll see many options.

In credit card processing, there is a very wide range in what merchants pay due to the number of payment providers and the vast array of pricing tactics used. The many different pricing tactics make it quite difficult to compare and contrast payment providers. That’s why we recommend using your effective rate when comparing the costs.

In general, merchants will pay anywhere from 2% to 5% of their credit card processing amount in fees. This wide range is most impacted by three things: 1) whether you are accepting credit cards in person or not, 2) the markup that your credit card processor is charging you, and 3) the type of credit card your customer is using.

The amount merchants pay for payment processing

We stated that merchants typically pay an effective rate between 2% and 5% for payment processing. Let’s unpack this a little by categorizing merchants into three main types.

One main factor determining the rate a merchant pays is whether transactions are done in person or not. Credit card transactions that are done remotely (online or by phone) have more fraud, therefore it is riskier, which is why remote transactions cost more. A mid-level MasterCard for an in-person transaction will have an interchange rate of 1.22%. This same credit card used online will have an interchange rate of 2.3%. That’s a difference of 1.08%. Quite large.

In-person versus remote transactions make the first two buckets. Keep in mind, interchange is only part of the fees that merchants pay. You can learn more about interchange in the article what is interchange.

Type of Merchant | Estimated Average Cost |

|---|---|

Merchants that accept payments in person | 2% and $0.12 per transaction |

Merchants that accept payments online or remotely | 2.8% and $0.20 per transaction |

Merchants with high-end or luxury customer base | 3.2% and $0.15 per transaction

|

The third bucket is about how luxury the merchants’ customers are. Fancier credit cards are more expensive for merchants. More luxury people carry fancier credit cards. On average, you will see luxury stores have a much higher payment processing cost. To show this in an example, the interchange rate for a basic Visa credit card is 1.25%. The interchange rate for an AMEX Platinum is 2.40%. That’s 1.15% difference which is very significant.

If someone was going to ask us what the overall average effective rate a merchant pays for credit card processing, our answer would be 2.50% and $0.10 per transaction. This includes all businesses, physical and online. As online shopping continues to grow, that average will go up.

Ways to reduce your credit card processing fees

There are merchants we have talked to that have told us their credit card processing rates are zero. We wish that was true, because that is our mission. However, there is no possibility to accept credit cards for free without someone losing money. In the case of the merchants that thought their credit card processing was free, it was because they were told by a sale representative. This is something you have to watch out for. As the 3rd fundamental law of economics states, there is no such thing as a free lunch. Payment processing is not free. However, there are ways you can reduce your credit card processing fees.

Conduct transactions in-person when possible

More businesses are moving online, so in-person payment transactions are becoming more rare. However, online or remote payment transactions are more expensive than in-person transactions. One tactic some merchants are taking is to try to take payments physically in their store whenever possible. This could save you 1% on each transaction.

Use Square or Stripe if you process less than $100,000 per year

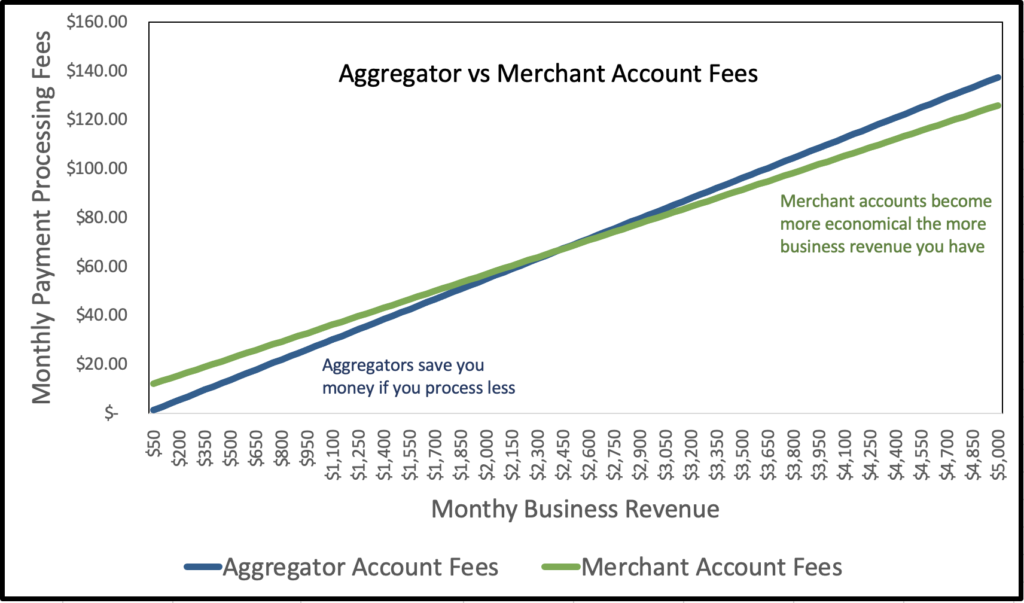

When you use a company like Square or Stripe, you are sharing a merchant account. They are called payment aggregators. Aggregators provide a lower fixed cost in monthly fees. When you are a smaller business, all fixed costs matter. You can read our in-depth article on the pricing of an aggregator vs a merchant account.

The $10 to $15 per month fixed fee that you generally need to pay with merchant account providers matters when you are processing less than $100,000 per year. Even though aggregators charge 2.9%, which is higher than a merchant account, the percentage difference is not a significant if you are processing a low amount. Use an aggregator if you process small amounts.

Get a merchant account if you process more than $100,000 per year

Once you reach the level of at least $100,000 per year in credit card processing, it’s time to think about moving off of PayPal, Stripe, or Square and move to your own dedicated merchant account. The higher the amount you process, the more it will reduce your payment processing cost to move to a dedicated merchant account. The below chart from our article comparing merchant account vs aggregators fees highlights the cost savings. If you are processing more than $100,000 per year, get a merchant account.

Where to get low cost credit card processing

The most effective way to get low cost credit card processing is to work with a transparent and reputable payment processor. When choosing a provider, ensure they offer payments in cost plus pricing, otherwise known as interchange plus.

Clearly Payments has a mission to lower the cost for merchants to accept credit cards. If you process more than $100,000 per year, reach out to Clearly payments to compare your pricing you would get.