Credit cards are one of the most popular and convenient forms of payment worldwide. Over the past few decades, we have witnessed a remarkable surge in credit card usage, revolutionizing the way individuals and businesses conduct transactions. Here we explore the growth of the credit card industry, the implications, and credit card market statistics.

Credit card industry growth and statistics

Credit cards have become an integral part of modern finance, providing convenience and flexibility to consumers worldwide. The global revenue for the credit card market reached an impressive $152 billion in 2022 growing at 9.1% per year, underlining the immense scale of credit card transactions worldwide.

When examining the competitive landscape of credit card networks, Visa remains the largest player in the credit card market, commanding 40% of the global share. However, China-based UnionPay takes the second spot with 32%, dominating financial transactions in much of the Eastern Hemisphere. Mastercard follows closely with a 24% market share, while the rest, including Amex and Discover, account for just 4% of global credit card transaction volumes.

The number of credit card holders globally has steadily grown to reach 1.25 billion in 2023, representing an annual growth rate of 2.79% from 1.1 billion in 2018.

The number of credit card holders globally has steadily grown to reach 1.25 billion in 2023, representing an annual growth rate of 2.79% from 1.1 billion in 2018. The United States accounts for 166 million credit card holders, while Canada has 36 million credit card holders.

Canada leads the pack with the highest credit card adoption rate globally, as an impressive 83% of adults hold a credit card. The United States closely follows with 68% of adults possessing credit cards. Canada, Israel, and Norway emerge as the top three countries with the highest percentage, all above 70%, of adults holding credit cards, reflecting strong financial inclusion and consumer preferences in these nations.

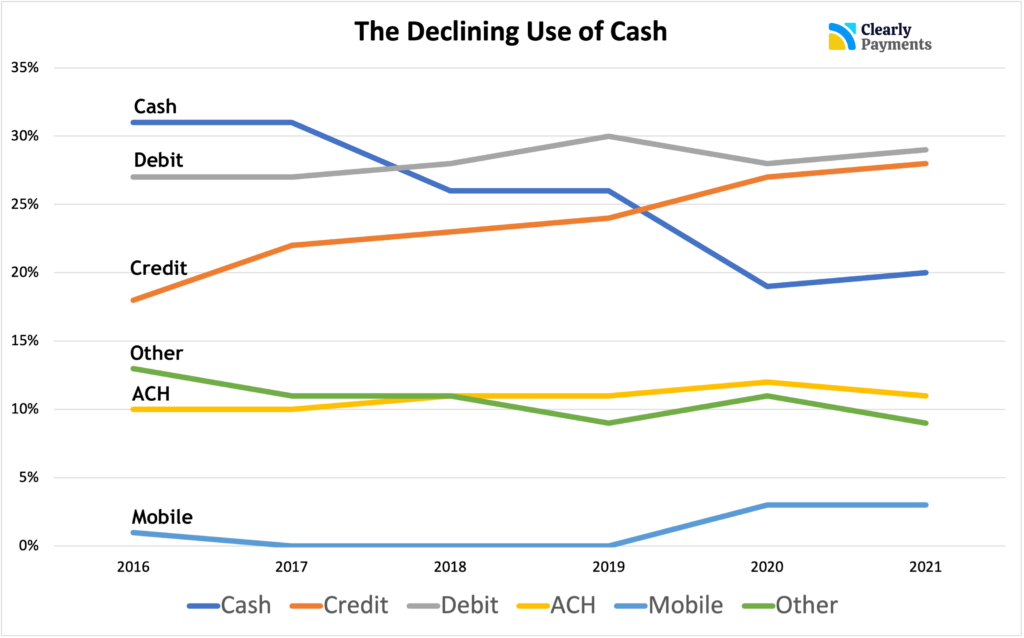

Credit card usage has had significant growth in recent years, surpassing other traditional forms of payment, notably cash, as the graph above shows. With the rise of digital transactions and the increasing convenience of credit cards, consumers are embracing credit cards as their preferred method of payment. The ease of making contactless payments and the availability of mobile wallets have accelerated this shift, further reducing the reliance on cash transactions.

Credit card debt remains a concern in both the USA and Canada. In 2023, the national average credit card debt among US credit card holders with unpaid balances is $7,300, while Canadians carry an average credit card debt of $4,000. Surprisingly, over 60% of credit card holders worldwide carry a balance on their cards, choosing not to pay their monthly bills in full, indicating a concerning trend of credit card reliance. Credit card interest rates are rising, currently averaging 21% according to the Federal Reserve. Rising inflation and the central banks’ efforts to combat inflation through interest rate increases are further increasing credit card interest rates.

As the credit card industry continues to evolve, driven by shifting consumer behaviors, technological advancements, and global economic trends, credit card issuing banks and payment processors must adapt to provide innovative and secure solutions that meet the demands of today’s ever-changing financial landscape.

If you’re looking for information on where the revenue goes and the value chain in the credit card industry, check out the article on the payment processing industry.

How many merchants accept credit cards?

Credit cards are accepted by millions of merchants, including retail stores, restaurants, hotels, online retailers, service providers, and more. Large retail chains, as well as small businesses, typically accept credit card payments to accommodate customer preferences and offer a convenient and widely recognized payment method.

There are approximately 335 million businesses in the world. Around 44 million merchants accept Visa, 37 million accept MasterCard, 31 million accept AMEX, and 30 million accept Discover. It’s also interesting to note that China UnionPay, the most popular payment card in China is accepted by 55 million merchants. However, China UnionPay includes both credit card and debit card payments.

There are 335 million merchants in the world. 44 million merchants accept Visa, 37 million accept MasterCard, 31 million accept AMEX, and 30 million accept Discover. Keep in mind, if a merchant accepts one type of credit card, they frequently accept multiple types. It can be estimated that about 15% of businesses globally accept credit cards.

In Canada, there are 1.21 million businesses in 2023. Of these, 1.19 million (97.9%) are small businesses, 22,700 (1.9%) are medium-sized businesses, and 2,868 (0.2%) are large businesses. 72% of Canadian businesses accept credit cards totaling 875,000 businesses.

According to the U.S. Small Business Administration, there are 32.5 million American businesses in 2023, but there’s a catch. 36% of totaling 11.7 million businesses accept credit cards.

The reason people have credit cards

The convenience and flexibility credit cards offer have made them a preferred payment option for 1.25 billion people in 2023. From secure online payments to earning rewards on purchases, credit cards provide a range of benefits that cater to consumers’ needs. Here are some reasons why people use credit cards.

Convenience and global acceptance

Credit cards offer unparalleled convenience, allowing users to make purchases without carrying physical cash. Their wide acceptance by merchants, both online and offline, has made them an integral part of everyday life. The number of credit cards in circulation worldwide reached a staggering 5.6 billion in 2023, showcasing the immense popularity and widespread adoption of this payment method

Enhanced consumer protection

Credit cards provide an additional layer of security for consumers. With built-in fraud detection and dispute resolution mechanisms, credit cards offer consumers a sense of confidence and protection against unauthorized transactions. If a consumer sees an incorrect charge, they can issue a chargeback.

Digital economy and eCommerce expansion

The rapid growth of the digital economy and the rise of online shopping have fuelled the demand for credit cards. Online shopping, subscription services, and digital content consumption have become an integral part of modern lifestyles. Global retail eCommerce sales reached $4.5 trillion in 2022, with credit cards being a dominant payment method in this digital landscape.

Rewards and incentive programs

Credit card companies entice users with rewards, cashback programs, travel perks, and other incentives. These reward systems have become increasingly sophisticated, providing consumers with benefits for their spending. The total value of credit card rewards in the United States alone exceeded $200 billion in 2022, illustrating the immense appeal and popularity of these programs.

Building credit and financial flexibility

Credit cards can play a vital role in establishing and building an individual’s credit history. According to the Federal Reserve, as of Q3 2022, the total outstanding credit card debt in the United States amounted to $784 billion, showcasing the widespread usage and the role credit cards play in financial flexibility and borrowing opportunities.

The future and trends of credit cards

The credit card industry is experiencing dynamic shifts and innovations as it adapts to changing consumer behaviors, technological advancements, and emerging market trends. Several key trends are shaping the future of credit cards, and understanding these developments is crucial for financial institutions, payment processors, and consumers alike.

Contactless Payments and Mobile Wallets: Contactless payments and mobile wallets are gaining rapid popularity, enabling users to make quick and secure transactions with just a tap or a wave of their smartphones or contactless cards. As consumers increasingly seek contactless options for speed and hygiene, the adoption of these payment methods is expected to surge in the future.

Biometric Authentication: With concerns over data security and identity theft, biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming integral to credit card security. These advanced authentication techniques provide an additional layer of protection and offer a seamless user experience.

Personalized Rewards and Incentives: Credit card issuers are enhancing customer loyalty by providing personalized rewards and incentives tailored to individual spending habits. The future of credit cards will likely see increased customization of reward programs to maximize customer engagement and satisfaction.

Open Banking and Integration: Open banking initiatives are fostering increased collaboration between financial institutions and FinTech companies. The future of credit cards may see seamless integration with other financial services, enabling users to access a comprehensive suite of financial tools through a single platform.

Digital-First Approach: With the increasing prevalence of online shopping and digital payments, credit card companies are adopting a digital-first approach. This includes optimizing online account management, virtual cards, and seamless integration with eCommerce platforms to meet the needs of consumers.

The future of credit cards promises a dynamic landscape of enhanced security, convenience, and personalized services. From contactless payments to sustainable initiatives, the credit card industry is continuously evolving to meet the demands of modern consumers while safeguarding their financial interests.