Credit cards are one of the most widely used payment methods in North America. For consumers, they provide convenience, security, and rewards. For merchants, they are a way to capture sales, appeal to customers, and keep up with evolving payment habits.

How many businesses actually accept credit cards in 2025? The answer depends on how we define “business.” Yet, the statistics paint a clear picture: acceptance is nearly universal among merchants in the United States and Canada, and transaction volumes continue to climb year over year.

This article explores the data in detail, from total business counts to acceptance rates, transaction volumes, and even how these countries compare globally.

Executive Summary

In 2025, credit card acceptance is nearly universal across businesses in the United States and Canada. While not every registered business takes customer payments, the vast majority of merchants do. In both countries, cards remain one of the top payment methods, driving trillions of dollars in transaction volume annually.

Key findings:

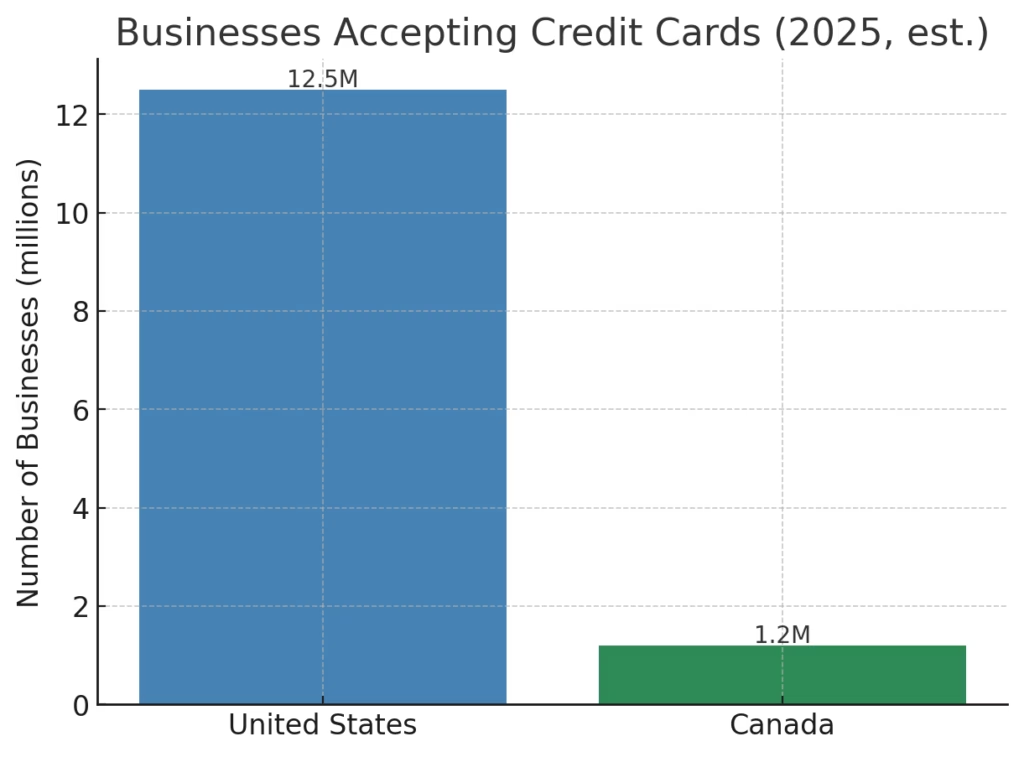

- In the United States, an estimated 11–14 million merchant businesses accept credit cards, representing about 94% of all merchants.

- In Canada, approximately 1.1–1.3 million merchant businesses accept credit cards, accounting for 89% of merchants.

- Acceptance is universal among large retailers and e-commerce firms, while smaller or professional-service businesses are the main holdouts.

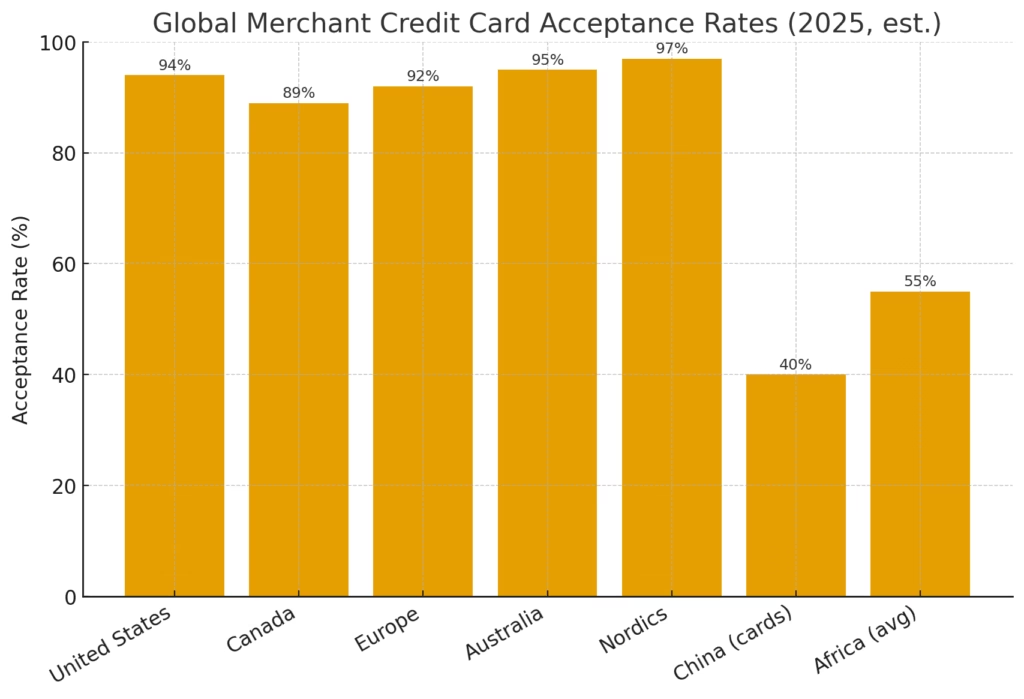

- Compared globally, North America leads most regions in card acceptance, with only Nordic countries and Australia showing slightly higher rates.

| Region | Total Registered Businesses | Estimated Merchants | Acceptance Rate | Businesses Accepting Cards | Notes |

|---|---|---|---|---|---|

| United States | ~33 million | 12–15 million | 94% | 11–14 million | Largest card market globally, >$9T annual volume |

| Canada | ~4.8 million | 1.2–1.5 million | 89% | 1.1–1.3 million | High tap-to-pay usage, ~$600B annual card spend |

| Europe | ~25 million (EU) | ~10–12 million | 92% | ~9–11 million | Strong regulation and near-universal contactless |

| Australia | ~2.5 million | ~1.2 million | 95% | ~1.1 million | Among highest global adoption |

| Nordics | ~2 million | ~1.2 million | 97% | ~1.16 million | Approaching cashless societies |

| China (cards) | ~50 million | ~20 million | ~40% | ~8 million | Cards secondary to Alipay/WeChat Pay |

| Africa (avg) | ~45 million | ~10 million | ~55% | ~5.5 million | Mobile money more dominant than cards |

Understanding the Business Universe

Before looking at credit card acceptance, it’s important to understand how many businesses exist in the first place. In the United States, government agencies such as the Small Business Administration and U.S. Census Bureau report about 33 million total business entities. This includes both employer firms with staff and nonemployer firms like sole proprietors, freelancers, or gig workers. Only around 6–7 million of these are employer businesses, while the rest are nonemployer operations that may or may not interact directly with consumers.

Canada’s business landscape is smaller but proportionally similar. According to Statistics Canada, as of December 2024, there were 1.36 million employer businesses and 3.48 million nonemployer businesses, for a total of 4.84 million. Again, not all of these are customer-facing; many exist only as holding companies or professional entities that never need to process retail transactions.

This distinction matters. When we ask how many businesses accept credit cards, we must decide whether to count all registered businesses or just those that actively take payments from customers, the merchants.

Merchant Acceptance Rates in 2025

Among merchants, acceptance of credit and debit cards is extremely high. A study in the United States found that about 94% of merchants accept card payments. In Canada, the Bank of Canada’s merchant survey reported that 89% of small and medium-sized businesses accept debit and credit cards. These percentages reflect the near-universal role of cards in modern retail.

For context, these numbers are significantly higher than two decades ago, when many small businesses resisted cards due to fees and technology barriers. With the rise of mobile point-of-sale systems, tap-to-pay, and integrated digital wallets, adoption has accelerated. Today, even micro-merchants and sole proprietors can accept cards with a simple phone attachment or an app.

How Many U.S. Businesses Accept Credit Cards?

Using the U.S. business population as a base, we can estimate the number of card-accepting businesses. If we take the realistic universe of 12–15 million active merchant entities (employers plus customer-facing nonemployers) and apply the 94% acceptance rate, the result is 11–14 million businesses accepting cards in 2025.

If we stretch the definition and apply the acceptance rate to all 33 million registered business entities, we arrive at an upper bound of 31 million. But this is more theoretical than practical. Many registered entities never need a payment terminal. The more useful estimate for the payments industry is therefore the 11–14 million merchant businesses actively taking card payments.

This scale reflects the central role of card payments in the U.S. economy. According to Federal Reserve data, credit cards account for about 31–32% of retail transactions by number, with debit cards making up another 30%. Together, card-based payments dominate the landscape. Annual credit card spending alone reaches into the multi-trillion-dollar range, with Visa, Mastercard, and other networks handling over $9–10 trillion in volume.

How Many Canadian Businesses Accept Credit Cards?

Canada shows a similar pattern, though on a smaller scale. Out of the 4.84 million registered businesses, only a portion are merchants. If we assume about 1.2–1.5 million are customer-facing, and apply the 89% acceptance rate, we arrive at 1.1–1.3 million Canadian businesses accepting credit cards.

Again, applying the acceptance rate to all registered businesses yields an upper bound of 4.3 million, but that would be misleading. The more accurate merchant-based estimate is closer to 1.2 million.

Canada’s payment habits also reveal interesting differences from the U.S. Credit cards represent about one-third of transactions by number, and usage is rising fastest in contactless form. Payments Canada reported that contactless credit payments grew 20% year over year between 2023 and 2024. Canadians are among the world’s most enthusiastic adopters of tap-to-pay, and this trend has pushed even small and rural merchants toward adoption.

Transaction Volumes and Consumer Behavior

The high rate of card acceptance directly mirrors consumer behavior. In the United States, card payments dominate daily life: credit cards for larger purchases, debit cards for smaller transactions, and digital wallets growing in both. The average U.S. household holds 3–4 credit cards, and many rely on them for rewards, points, and short-term credit.

In Canada, card usage is equally entrenched. Credit cards are not only popular for everyday purchases but also tightly integrated into loyalty programs like Aeroplan and PC Optimum. With annual transaction values estimated at CAD $600 billion on credit cards alone, cards are not just convenient but essential to the flow of commerce.

Merchant Size and Sector Differences

While acceptance is nearly universal among large retailers, there are differences at the smaller end of the spectrum.

- Large chains and big-box retailers: Acceptance is universal, often with multiple acquiring relationships and support for mobile wallets.

- Small businesses and micro-merchants: Most accept cards, but resistance remains in certain professional services (law firms, consulting, trades) and some rural or low-margin sectors.

- E-commerce: Card acceptance is essentially universal, as online businesses rely heavily on Visa, Mastercard, and American Express rails for revenue.

The trend is clear: even among small businesses, the days of “cash only” are quickly disappearing.

Global Perspective

North America is not alone in its high card acceptance. Many other advanced economies have reached similar levels, though the balance between card and other payment methods varies.

In Europe and Australia, card penetration is extremely high, with contactless now the default. The Nordic countries are at the forefront of becoming cashless, with mobile and card payments making up nearly all consumer transactions.

In China, by contrast, cards play a much smaller role. Instead, mobile wallets such as Alipay and WeChat Pay dominate. For merchants, accepting a QR-based payment is often more important than accepting a credit card.

Trends to Watch in 2025 and Beyond

Several important developments will shape how businesses continue to accept payments in the coming years.

First, contactless and mobile wallet adoption is rising rapidly. Nearly 90% of U.S. merchants now accept Apple Pay and Google Pay, and in Canada, tap-to-pay transactions are the majority of card payments.

Second, fraud and chargebacks are becoming a more pressing issue. Merchants report higher costs associated with disputes, driving investment in fraud prevention, tokenization, and better customer verification.

Third, the consolidation of processors is reshaping the acquiring landscape. Global giants like Worldpay and Global Payments continue to acquire competitors, building networks that can process hundreds of billions of transactions annually. For merchants, this consolidation may mean more seamless international acceptance but also less pricing competition.