In the world of credit cards, security, and data protection are paramount concerns. Credit card fraud is a prevalent and ever-evolving threat, and it’s crucial to understand the key elements that make up the security features of a credit card. Magnetic stripe cards have been in use for decades and they store essential information on three tracks.

In this article, we’ll give an overview of what Track 1, Track 2, and Track 3 data are in magnetic stripe credit cards and why they are crucial for the functioning and security of these financial instruments.

What Are Magnetic Stripe Credit Cards?

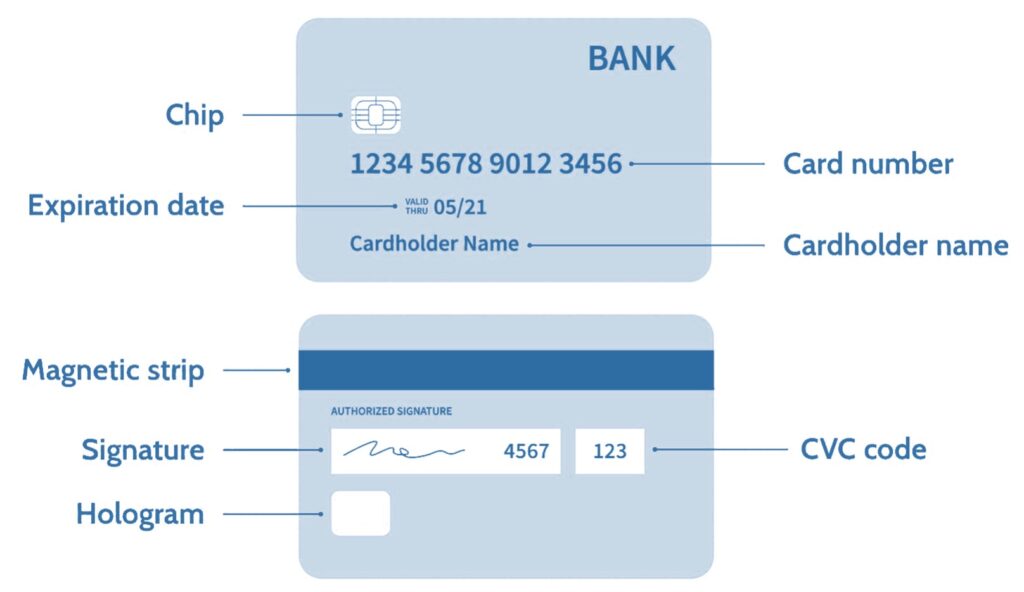

Magnetic stripe credit cards, often simply referred to as “magstripe” cards, are a type of payment card that utilizes a magnetic stripe on the back to store essential cardholder information. The magnetic stripe is typically composed of tiny magnetic particles that are encoded with information using a specific format.

A magnetic stripe card contains three tracks that store different sets of information. Each track has a distinct purpose and is read by card readers, such as ATMs and point-of-sale terminals, to perform various functions. Let’s explore the details of each track:

The History of Magnetic Stripe Credit Cards

The history of magnetic stripe credit cards is a story of technological innovation that began in the late 1950s when IBM engineer Forrest Parry created the first magnetic stripe card. These early magnetic stripe cards were made of paper and featured a magnetic stripe, paving the way for secure data storage and retrieval. In the 1970s, magnetic stripes found their first practical application in automated teller machines (ATMs), revolutionizing the way people accessed their bank accounts. In 1979, Visa introduced the first credit card with a magnetic stripe, quickly followed by other major credit card companies. This marked the beginning of their widespread use in financial transactions.

In the 2000s, as security concerns grew, the financial industry began transitioning to EMV (Europay, MasterCard, and Visa) chip cards, embedding microchips for enhanced security. While magnetic stripe credit cards are still used, many countries have adopted chip cards to combat fraud more effectively. These chip cards generate unique transaction codes for each payment, making them significantly more secure and less susceptible to cloning and fraud. The history of magnetic stripe credit cards reflects the ongoing evolution of payment technology, with a focus on enhancing security and convenience for consumers.

Track 1 Data on Magnetic Stripe Credit Cards

Track 1 data on a magnetic stripe credit card is one of the three tracks used to store information on the card’s stripe. Track 1 data is encoded in an alphanumeric format, which means it can contain both letters and numbers. This track plays a vital role in facilitating credit card transactions and is often utilized in scenarios where the cardholder’s name needs to be included in the transaction, such as at hotels or some retail establishments.

Here’s what you can typically find in Track 1 data on a magnetic stripe credit card:

Cardholder’s Name: The primary purpose of Track 1 data is to store the cardholder’s name. This name can be used for verification purposes in transactions where the name must match the name on the card.

Primary Account Number (PAN): The PAN is a unique number that identifies the credit card account. It’s the long string of numbers on the front of the card. Track 1 data includes the PAN, allowing the card reader to identify the account associated with the card.

Card Expiration Date: The expiration date of the credit card is crucial for verifying the card’s validity. Track 1 data includes this information, which is used by the card reader to ensure the card is still active.

Discretionary Data: Discretionary data is additional information that issuers may choose to include in Track 1 data for their own purposes. This can vary among different card issuers and institutions.

Track 1 data is mainly used when the cardholder’s name needs to be verified during a transaction. For instance, when you check into a hotel, the receptionist may need to verify that the name on your card matches the name on your reservation. In such cases, Track 1 data is essential. However, for most everyday retail transactions, Track 2 data, which contains the PAN and expiration date but not the cardholder’s name, is sufficient for authorization.

It’s important to note that the use of magnetic stripe cards, including Track 1 data, has been associated with security concerns, as this data can be easily skimmed by criminals. This has led to the adoption of more secure technologies, such as EMV chip cards, which offer greater protection against fraud. Nonetheless, magnetic stripe cards, including Track 1 data, are still in use, especially in regions where chip card adoption is not yet universal.

Track 2 Data on Magnetic Stripe Credit Cards

Track 2 data is encoded in a numerical format and primarily contains essential information necessary for processing credit card transactions. It is the most commonly used track in card transactions and is often employed in situations where the cardholder’s name is not required for verification.

Here’s what you can typically find in Track 2 data on a magnetic stripe credit card:

Primary Account Number (PAN): The PAN is a unique number assigned to each credit card account, and it is the core identifier of the account. This is the long string of numbers on the front of the card, and Track 2 data contains this number. It is essential for identifying the specific account associated with the card.

Card Expiration Date: The card’s expiration date is included in Track 2 data. This information is crucial for verifying the card’s validity during a transaction. The card reader checks whether the card is still within its expiration date.

Discretionary Data: Similar to Track 1 data, Track 2 data can also include discretionary data, which is additional information that issuers may choose to include for their own purposes. The content of discretionary data may vary between different card issuers and institutions.

Track 2 data is used in most everyday retail transactions where verifying the cardholder’s name is not required. It is considered sufficient for authorizing payments in situations where only the PAN and expiration date need to be validated.

Track 3 Data on Magnetic Stripe Credit Cards

Track 3 data on magnetic stripe credit cards is the least commonly used and least standardized of the three tracks. Unlike Track 1 and Track 2 data, Track 3 does not have a well-defined or standardized format, and its contents can vary significantly from one card to another. In fact, Track 3 data is rarely used for everyday credit card transactions and is typically reserved for specialized or proprietary applications.

Here’s what you need to know about Track 3 data on magnetic stripe credit cards:

Format: Track 3 data is encoded in a numerical format, just like Track 2 data. However, the structure and content of Track 3 are not regulated or standardized to the same extent as Track 1 and Track 2.

Information Stored: The contents of Track 3 data can vary widely depending on the card issuer and the specific application for which the card is intended. While some cards may use Track 3 for certain additional information, such as custom authentication data or access control details, there is no universal standard for what is stored in Track 3.

Usage: Track 3 is not commonly used in traditional credit and debit card transactions. It is typically reserved for specialized purposes and applications. For example, some proprietary access cards or secure identification cards may utilize Track 3 to store specific data required for access control systems or custom security protocols.

Due to its non-standardized nature and limited use in traditional financial transactions, Track 3 data is not as well-known or widely used as Track 1 and Track 2 data. For everyday credit card payments and most typical card reader systems, the information encoded in Track 1 and Track 2 is sufficient.

The Importance of Track 1 and Track 2 Data

The primary purpose of Track 1 and Track 2 data on magnetic stripe credit cards is to facilitate payment processing and verification during transactions. When you swipe your card at a point-of-sale terminal or use it at an ATM, the reader reads either Track 1 or Track 2 data to obtain the necessary information to authorize the transaction. This data includes the card’s account number and expiration date, which are critical for verifying the card’s authenticity and ensuring that there are sufficient funds in the account to cover the transaction.

For security reasons, Track 1 and Track 2 data do not contain sensitive information like the card’s security code (CVV or CVC) or the cardholder’s PIN. These additional security measures are used to protect against unauthorized access to the cardholder’s funds and personal information.

The Role of Track 3 Data on Credit Cards

Track 3 data, although present on some magnetic stripe cards, is not commonly used for everyday transactions. It is often reserved for proprietary applications specific to certain institutions, such as access cards for buildings or restricted areas. This track can be customized to store information relevant to these specific purposes, making it highly versatile but less standardized.

The lack of standardization in Track 3 data means that its content can vary significantly from one card to another. Its usage is generally limited to specialized systems where the cardholder’s information and authentication require a level of customization beyond what Track 1 and Track 2 can provide.

Security Concerns and the Shift to EMV Chips

While magnetic stripe cards have been in use for decades, they are not without their security flaws. One of the most significant issues with magnetic stripe cards is their susceptibility to skimming, where criminals can steal the card’s data by tampering with card readers. To combat this, many countries have shifted to EMV chip technology, which provides enhanced security through the use of embedded microchips.

EMV cards are significantly more secure than magnetic stripe cards because they generate a unique transaction code for each payment, making it nearly impossible for fraudsters to clone the card. This technology has led to a decrease in card-present fraud, as it is much more challenging for criminals to steal sensitive data.