Chargebacks are a common occurrence in the world of business and their rates can vary significantly from one country to another. Understanding the factors that contribute to these discrepancies is crucial for merchants, financial institutions, and policymakers.

In this article, we go into the factors influencing chargeback rates by country and explore their implications on businesses and consumers alike. We have also published an article that includes chargeback statistics by industry and chargeback reason.

Why countries have different chargeback rates

Understanding the factors that contribute to higher chargeback rates in countries is helpful for businesses and policymakers alike. By identifying the underlying causes, stakeholders can develop targeted strategies to mitigate chargebacks and promote more secure and efficient transactions. Several factors can contribute to higher chargeback rates in countries. Here are a few possible reasons:

-

Consumer Protection Laws: Countries with strong consumer protection laws may empower consumers to dispute charges more frequently, leading to higher chargeback rates. Such laws can offer greater buyer rights and make it easier for consumers to initiate chargebacks.

-

Payment Infrastructure: The quality and security of a country’s payment infrastructure can affect chargeback rates. Countries with less robust payment systems or higher instances of fraud may experience higher chargeback rates as a result.

-

Cultural Factors: Cultural norms and attitudes towards customer service, refunds, and disputes can vary between countries. In some cultures, customers may be more inclined to request chargebacks as a way to address dissatisfaction or as a means of resolving conflicts with merchants.

-

Economic Factors: Economic conditions, such as unemployment rates or income levels, can influence chargeback rates. Countries with higher financial instability or lower average incomes may see more chargebacks as customers may be more sensitive to financial issues or discrepancies.

-

Merchant Practices: The practices of local merchants can also impact chargeback rates. For instance, if merchants in a particular country engage in fraudulent or unethical business practices, it can lead to higher chargeback rates as customers seek refunds or dispute unauthorized charges.

It’s important to note that chargeback rates can vary significantly even within countries, and it’s not solely determined by the factors mentioned above. Local regulations, industry dynamics, and individual merchant policies also play a role in chargeback rates.

Statistics of chargebacks by country

Chargeback rates are calculated by dividing the total number of chargebacks within a specific time period by the total number of transactions during the same period. The resulting figure is then multiplied by 100 to express the chargeback rate as a percentage.

The formula for calculating chargeback rate is as follows:

Chargeback Rate = (Total Number of Chargebacks / Total Number of Transactions) * 100

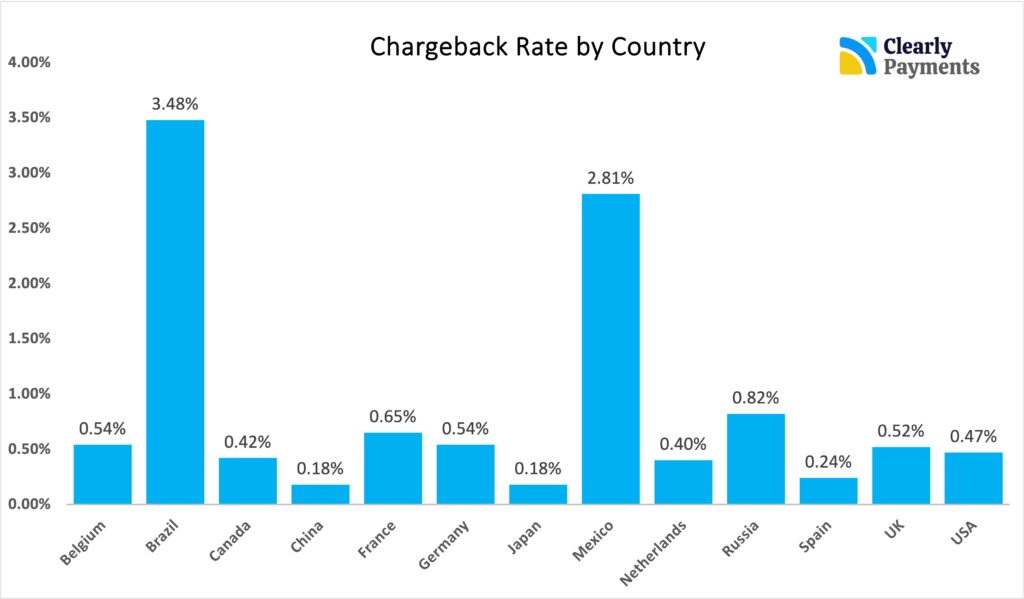

For example, if we look at the chargeback rate in Mexico, shown below, a set of merchants had 2,810 chargebacks out of 100,000 transactions in a given day. The chargeback rate was calculated as: Chargeback Rate = (2,810 / 100,000) * 100 = 2.81%

The chart above shows the chargeback rate for a select 13 countries. You can view the same chargeback data in table form below. Brazil has the highest chargeback rate while China and Japan have the lowest chargeback rate. Later in the article, we go into more detail on the chargeback rates in those countries.

Chargeback Rate by Country

| Country | Chargeback Rate |

|---|---|

| Belgium | 0.54% |

| Brazil | 3.48% |

| Canada | 0.42% |

| China | 0.18% |

| France | 0.65% |

| Germany | 0.54% |

| Japan | 0.18% |

| Mexico | 2.81% |

| Netherlands | 0.40% |

| Russia | 0.82% |

| Spain | 0.24% |

| UK | 0.52% |

| USA | 0.47% |

Please link to this page and refer to Clearly Payments if any content or data is used.

Why some countries have high chargeback rates

In order to look at why some countries have high chargeback rates, lets look at Brazil as an example. Brazil’s position as a country with the highest chargeback rates can be attributed to several key factors. Firstly, Brazil’s complex tax system, characterized by intricate regulations and a high tax burden, creates challenges for businesses, particularly SMEs. Navigating this complexity and shouldering the tax burden can lead some businesses to resort to fraudulent practices or non-compliance, ultimately resulting in an increased number of chargebacks.

Secondly, Brazil has long grappled with a significant incidence of fraud, especially in the online and eCommerce payments. Cybercriminals specifically target Brazilian consumers and businesses, leading to a substantial volume of fraudulent transactions. This prevalence of fraud not only causes financial losses for merchants but also contributes to the higher chargeback rates experienced in the country.

Furthermore, Brazil’s consumer protection laws strongly favour consumers, granting them substantial rights for disputing charges. While these laws are designed to safeguard consumer interests, they can be exploited by unscrupulous individuals who abuse the chargeback process. The leniency of consumer protection laws contributes to higher chargeback rates, as some consumers utilize chargebacks as a means of addressing dissatisfaction or resolving conflicts with merchants.

Cultural attitudes and expectations also play a role in Brazil’s high chargeback rates. Brazilian consumers are more inclined to seek chargebacks as a way to address dissatisfaction or conflicts with merchants. This cultural inclination, coupled with the lenient consumer protection laws, creates a higher propensity for chargebacks in the country.

Additionally, economic challenges, such as income inequality and financial instability, impact chargeback rates in Brazil. The country has faced economic difficulties, including high unemployment rates and currency fluctuations, which can make consumers more sensitive to financial issues. As a result, consumers are more likely to initiate chargebacks as they seek resolutions for perceived discrepancies.

Why some countries have low chargeback rates

Some countries have very low chargeback rates. Japan stands out as a country with remarkably low chargeback rates compared to many other nations. This achievement can be attributed to several key factors.

Firstly, Japan has a strong culture rooted in trust and mutual respect. This cultural emphasis on trust extends to business transactions, resulting in a higher level of trust between customers and merchants. Japanese consumers typically approach transactions with confidence, which reduces the likelihood of initiating chargebacks unless there is a genuine issue or dispute.

Secondly, the commitment to exceptional customer service in Japan is renowned. Businesses prioritize meeting customer expectations and take pride in providing outstanding service. This dedication to customer satisfaction helps to minimize situations where customers feel compelled to resort to chargebacks as a means of resolving disputes. Merchants in Japan proactively address customer concerns, aiming to provide prompt and effective solutions.

Japan also benefits from efficient dispute resolution mechanisms. The country has well-established alternative methods for resolving conflicts outside of chargebacks, such as mediation and arbitration. These channels allow customers and merchants to find mutually agreeable resolutions, reducing the reliance on chargebacks as the primary means of dispute resolution.

Stringent fraud prevention measures are another contributing factor. Japanese financial institutions and merchants have implemented robust security measures to protect against unauthorized transactions and fraudulent activities. Their proactive adoption of advanced security technologies and practices helps to minimize instances of fraudulent transactions, resulting in lower chargeback rates.

Cultural norms and etiquette also play a role in low chargeback rates. Japanese consumers adhere to social norms and etiquette, even in financial transactions. They tend to be diligent in verifying and confirming purchases before initiating them, which reduces the likelihood of mistaken or fraudulent charges. This cautious approach to transactions contributes to lower chargeback rates.

Chargeback rates in Canada and USA

The chargeback rates in the United States and Canada vary based on factors such as industry, business size, and payment method. Overall, Canada and USA have slightly lower than average chargeback rates.

In the United States, chargeback rates have historically been around average. However, as a whole, not on a per capita basis, the USA has a significant amount of chargebacks, This can be attributed to several factors, including the size and complexity of the market, a higher incidence of fraud, and a more litigious consumer culture. However, the chargeback rates can vary significantly depending on the industry and specific business practices.

In Canada, chargeback rates have generally been lower compared to the United States. This can be attributed to factors such as a smaller population, tighter regulatory frameworks, and a lower incidence of fraud.

Both the United States and Canada have implemented several measures to decrease chargebacks and promote secure and fair transactions.

In terms of fraud prevention, both countries encourage the adoption of advanced technologies and best practices to detect and prevent fraudulent transactions. This includes secure payment systems, data analytics for fraud detection, and the use of machine learning algorithms. By leveraging these tools, merchants and financial institutions can proactively identify and mitigate potential fraud risks, reducing the likelihood of chargebacks. Implementing technology such as EMV, PCI DSS, and 3D Secure has also helped reduce chargebacks.

Additionally, both countries have established dispute resolution mechanisms outside of chargebacks, such as mediation, arbitration, and small claims courts. These alternative options provide consumers and merchants with avenues to resolve conflicts in a fair and timely manner. By offering accessible and efficient dispute resolution channels, the aim is to reduce the reliance on chargebacks as the primary means of resolving disputes.

Consumer protection laws are in place to safeguard consumer rights and provide guidelines for addressing disputes. These laws ensure that consumers have recourse when facing issues with purchases, while also establishing clear expectations and responsibilities for both consumers and merchants. By setting transparent rules and procedures, these laws help create a framework for fair and equitable resolution of disputes, further mitigating the need for chargebacks.

Collaboration with industry associations is another key aspect of chargeback reduction efforts. Governments work closely with organizations such as the American Bankers Association (ABA) and the Canadian Federation of Independent Business (CFIB) to develop guidelines, best practices, and educational resources. These initiatives aim to enhance merchant understanding of chargeback regulations, facilitate the implementation of effective fraud prevention measures, and improve overall industry resilience against fraudulent activities.

Education and awareness campaigns play a vital role in promoting responsible use of chargebacks. Both consumers and merchants are targeted with educational initiatives that highlight the appropriate use of chargebacks and the consequences of misuse. By raising awareness about chargeback processes, consumer rights, and merchant responsibilities, these campaigns foster a better understanding of the role of chargebacks in resolving legitimate disputes.

Lastly, collaboration with financial institutions is crucial in combatting fraud and reducing chargebacks. Governments work together with financial institutions to share information, implement fraud detection and prevention measures, and develop early warning systems. By leveraging their expertise and resources, financial institutions can proactively monitor transactions, identify potential fraudulent activities, and take preventive actions, contributing to the overall reduction of chargeback rates.