Checks feel like a legacy payment method, but they continue to move enormous amounts of money in 2026. While check usage volume keeps declining, check payment value remains stubbornly high, particularly in business and government payments. This creates confusion for merchants, journalists, and policymakers who see checks “dying” but still encounter them every day.

This article breaks down who still uses checks, where they are used, and why they persist, using payment data by country, industry, and use case, with practical implications for merchants.

Quick Facts: Checks (Cheques) in 2026

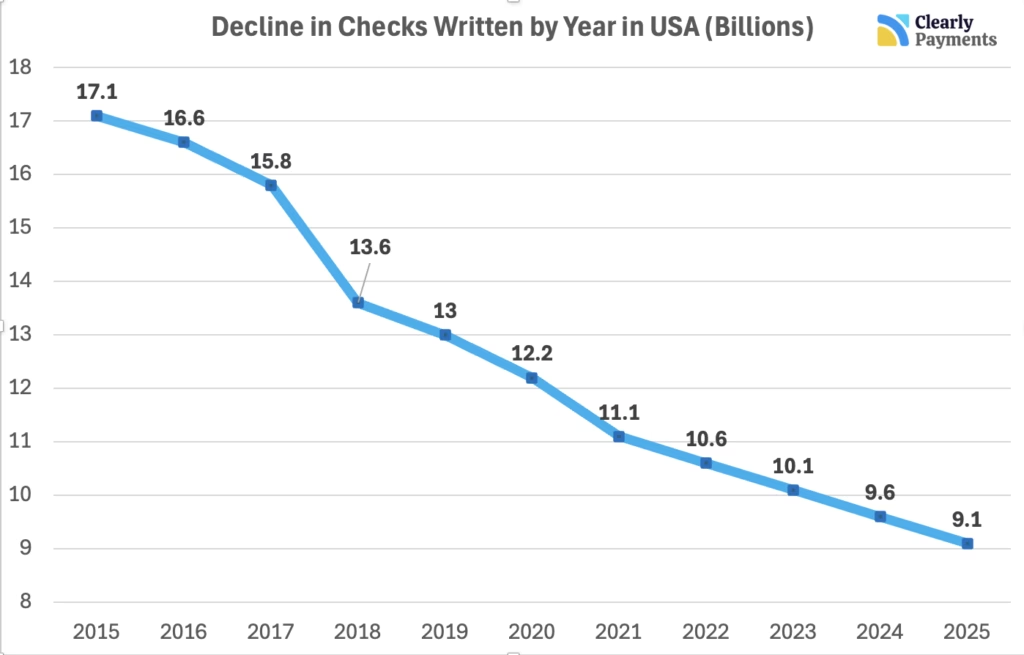

- United States: About 9.1 billion checks were paid in 2025

- Check volume continues to decline, but total value has remained relatively stable.

-

In Canada, cheques account for only ~2% of payment volume but ~24% of payment value, while in the United States they represent roughly 3–4% of volume and ~15–20% of value, showing cheques are now used mainly for high-value, legacy transactions rather than everyday payments.

- B2B trend: Business check usage has fallen dramatically over time, from 81% of B2B payments in 2004 to about 26% in 2024.

- Fraud: Checks remain the most frequently targeted payment method, with 63% of organizations reporting check fraud activity in 2024.

What “Still Uses Checks” Really Means in 2026

When people talk about checks, they often lump very different payment behaviors together. In practice, checks survive in specific segments, not broadly across the economy.

Checks today fall into three distinct categories:

- Consumer checks, which are declining rapidly

- Business checks, which are declining slowly but remain common for invoices

- Government checks, which are declining the slowest due to policy and procurement constraints

Consumer use is fading fastest. Business and government use persists because checks are deeply embedded in approval workflows, accounting systems, and regulatory processes.

Checks by Country: Where They Still Matter

In 2026, checks are no longer a mass-market payment method, but they remain a high-value, institutional one.

In countries like the United States and Canada, check volume has collapsed relative to digital payments, yet check value remains disproportionately large, driven by B2B invoices, government disbursements, and legacy industries.

Outside North America, many developed markets have largely eliminated checks for everyday use, leaving only niche business or regulatory use cases. Across regions, the same pattern appears, checks disappear fastest where payments are frequent and consumer-driven, but persist where payments are infrequent, high-value, approval-heavy, and embedded in long-standing workflows.

| Country / Region | Annual Check Volume | Annual Check Value | Check Share of Total Payments (Volume) | Check Share of Total Payments (Value) | Trend Notes |

|---|---|---|---|---|---|

| United States | ~11.1 billion checks (2021 data) | ~$27.4 trillion (2021) | Low and falling | Moderate share of value | Consumer use continues to decline; business & government still generate high-value checks, average check value rising |

| Canada | ~379 million (2023) | ~$2.9 trillion (2023) | ~2 % | ~24 % | Consumer volume tiny; check value still significant due to business & institutional payments |

| United Kingdom | Low, not routinely reported | Low | <1 % | <5 % | Checks largely phased out in everyday payments; residual use in niche business contexts |

| Nordic Countries | Minimal | Minimal | ~0 % | ~0 % | Most checks eliminated; digital and bank transfer rails dominate |

| India | Diminished but measurable | Significant in business | (~10 %)* | (Higher share of value)* | Banks report declining use but legacy processes and large ticket business checks persist |

| France | Low to moderate in business | Moderate | <5 %* | <15 %* | Consumer checks rare; business/institutional holds some check activity |

| Japan | Low in consumer payments | Moderate * | <5 %* | ~10 %* | Business and corporate payments still include some check volume |

| Australia | Declining | Low | <5 % | <10 % | Shift to electronic payments; checks remain in business workflows |

| Mexico & LATAM | Variable by market | Moderate | (Varies) | (Varies) | Checks still used in certain corporate and government contexts |

Why Checks Are Declining: Fraud, Cost, Speed

Checks are declining because they underperform across nearly every dimension that matters in modern payments. What was once a familiar and trusted method is now widely viewed as slower, riskier, and more expensive than digital alternatives. The decline is not driven by a single factor, but by several reinforcing pressures that make checks increasingly hard to justify.

The below graph shows the annual number of checks written in the United States. Check usage has fallen by nearly 50% over the past decade.

The biggest drivers behind the decline of checks:

- Check fraud is disproportionately high: Checks remain the most targeted payment method. In 2024, 63% of organizations reported experiencing check fraud, and checks accounted for roughly 60%+ of reported payment fraud incidents by volume. Fraud methods such as mail theft, altered payees, forged signatures, and counterfeit checks exploit the fact that checks rely on static, visible account information and physical delivery.

- The true cost of checks is hidden and rising: While checks avoid card interchange fees, treasury and banking studies estimate the fully loaded cost per check at $4–$8 once labor, mail handling, deposits, reconciliation, exception management, and fraud remediation are included. For businesses processing large check volumes, this becomes a meaningful operating expense.

- Settlement is slow and unpredictable: Checks typically take 3–7 business days to settle when mailing, clearing, and bank holds are included. Large or unusual checks often face extended holds, delaying access to funds. By comparison, ACH, EFT, and real-time payment rails increasingly offer same-day or next-day settlement.

- Volume is collapsing faster than value: In the US, check volume fell from 13.6 billion payments in 2018 to 11.1 billion in 2021, while total check value stayed near $27 trillion. This has pushed average check value higher, from roughly $1,900 to over $2,400, signaling that checks are being pushed out of everyday use and confined to fewer, larger, legacy transactions.

- B2B payment behavior has fundamentally shifted: Checks once represented 81% of B2B payments in 2004, but by 2024 that share had dropped to approximately 26%. Businesses increasingly expect faster confirmation, structured remittance data, and predictable settlement, areas where checks perform poorly without manual workarounds.

- Banks now treat checks as higher risk: Financial institutions apply stricter holds, enhanced monitoring, and tighter controls to check deposits. Insurance coverage for check fraud often carries higher deductibles and narrower protection compared to electronic payments, increasing risk exposure for merchants.

- Digital alternatives now outperform checks on every metric: Modern payment methods reduce manual handling by 70–90%, settle faster, provide better fraud detection, and simplify reconciliation. As more transactions move digital, checks become operational outliers that require separate processes and controls.

Bottom line: checks are declining because they are now the highest-risk, slowest, and least efficient payment method still in widespread use. Their remaining presence is driven by habit and legacy workflows, not performance.

Where Checks Are Still Used in 2026

Checks are no longer a general-purpose payment method, but they remain firmly embedded in specific workflows and environments where payments are high-value, infrequent, approval-heavy, or constrained by legacy systems. In 2026, checks tend to appear not because they are efficient, but because replacing them requires coordinated change across systems, counterparties, and policies. Below are the primary places where checks are still used, and why they persist.

Business-to-business (B2B) invoices and accounts payable

Checks remain common in B2B transactions, particularly for invoice-based payments with net terms. Many accounts payable departments still operate on approval chains designed around printing and mailing checks, with physical signatures and attached remittance information. Vendors may also prefer checks due to habit, internal controls, or reluctance to share banking details. As a result, checks continue to show up in wholesale trade, manufacturing, professional services, and multi-location businesses, even as ACH and EFT adoption grows.

Construction, contracting, and trades

Construction is one of the most check-intensive industries left. Progress payments, holdbacks, retainers, and milestone billing all align well with check-based workflows. Payments are often tied to physical site visits, inspections, or sign-offs, and many subcontractors operate with varying levels of banking and technology sophistication. In these environments, checks function as a flexible coordination tool, despite their inefficiency.

Real estate, property management, and strata

Checks remain visible in real estate-related payments, particularly outside of rent collection. Security deposit refunds, vendor payments for repairs, strata disbursements, and one-off reimbursements are frequently issued by check. While many landlords have digitized inbound rent payments, outbound payments often lag due to legacy property management software and manual approval processes.

Healthcare and insurance reimbursements

In healthcare, checks persist as a default fallback for reimbursements and refunds. Insurance providers, clinics, and benefits administrators often deal with fragmented provider networks, one-time payees, and complex compliance requirements. When electronic delivery fails or payee information is incomplete, checks are still widely used to ensure payments are completed.

Government and public-sector payments

Governments remain among the slowest adopters of new payment rails. Checks are still used for tax refunds, grants, vendor payments, and certain benefit disbursements. Procurement rules, audit requirements, inclusivity concerns, and long system replacement cycles all contribute to the continued use of checks. For merchants serving government entities, check payments remain a practical reality.

Refunds, rebates, and one-time disbursements

Checks are frequently used for outbound payments where recipients are unknown, temporary, or infrequent. Examples include customer refunds, legal settlements, insurance payouts, class-action distributions, and rebates. In these cases, checks are seen as a universal method that does not require prior enrollment or digital onboarding.

Older consumers and legacy household payments

While consumer check usage has declined sharply, a shrinking but persistent segment of households still relies on checks. Common use cases include rent paid to small landlords, gifts for formal occasions, payments to local contractors, and mail-based bill payments. These payments are typically low-frequency but continue to appear in merchant operations.

What merchants should do in 2026

Merchants do not need to eliminate checks overnight, but they should manage them intentionally.

- Segment customers who still pay by check

- Offer digital alternatives that match invoice and remittance needs

- Use incentives and gentle pressure rather than mandates

- Strengthen controls for remaining check acceptance

The goal is not to shame customers, but to reduce cost, risk, and delay.