Payment processing fees are one of the most overlooked expenses for businesses. For many retail, restaurant, and service merchants operating on thin margins, a small change in card mix or pricing model can swing thousands of dollars per year.

Across North America, the typical blended cost to accept a card payment in 2025 ranged from 1.5 percent to 3.0 percent, depending heavily on card brand, card present versus online, and pricing structure. In Canada, new fee reductions introduced by the federal government pushed average domestic consumer credit interchange down to 0.95 percent for eligible small merchants, helping lower overall costs.

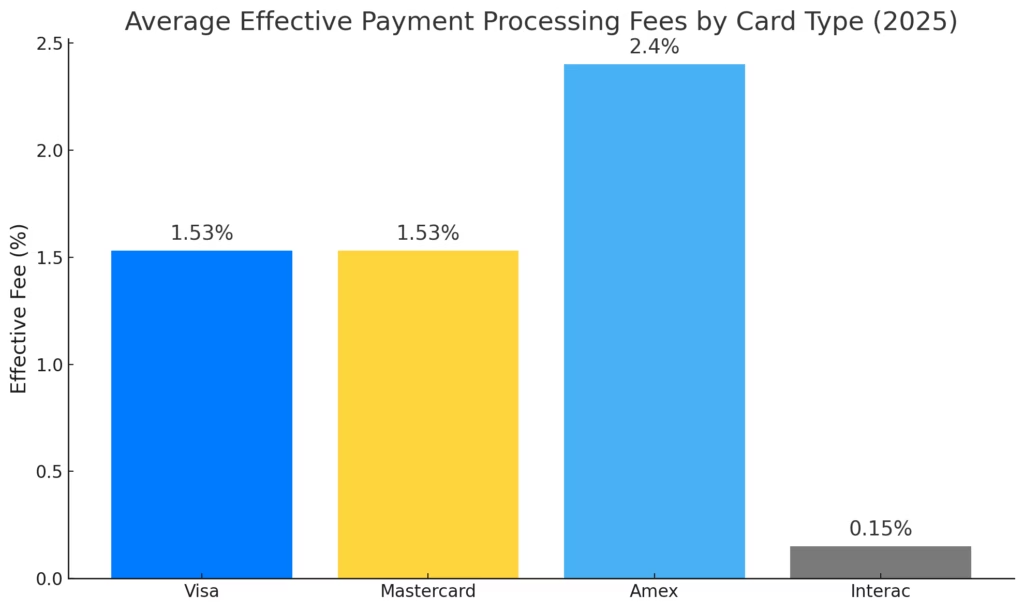

Even with these improvements, merchants continue to see meaningful differences by card type:

- Visa and Mastercard: Usually 1.4 percent to 2.0 percent in person

- Amex: Often 2.0 percent to 3.0 percent

- Interac Debit: Typically 0.1 percent to 0.3 percent effective on most tickets

This report breaks down what those numbers look like in 2025 and how merchants can benchmark their statements.

What Your Processing Fee Is Really Made Of

Every card transaction contains three cost layers that together form your final effective rate:

Interchange: Paid to the issuing bank. For small Canadian merchants, domestic Visa and Mastercard consumer interchange for in-person transactions now averages 0.95 percent under the federal small business program.

Network Assessments: Small additional fees charged by the networks themselves. These usually land in the range of 0.08 percent to 0.10 percent, plus a few cents per transaction, depending on the brand.

Processor Markup: Your payment processor’s margin. Competitive interchange plus pricing in Canada usually looks like interchange plus 0.15% to 0.70% plus a $0.05 to $0.15 per transaction. A common example is interchange plus 0.40% plus 8 cents.

Interac debit is structured differently with flat per transaction fees that are dramatically lower than credit cards.

Average Effective Fees By Card Type In 2025

The following table uses a $100 in-person transaction at a Canadian retail or restaurant business to show typical 2025 benchmarks.

Table 1. Typical Fees For A $100 Transaction In 2025 with a Basic Credit Card

| Card Type | Interchange And Network Layer | Typical Markup | Total Cost of $100 | Effective Rate |

|---|---|---|---|---|

| Visa Consumer Credit | About 1.05% combined (0.95% interchange plus 0.10% assessments) | + 0.40% plus $0.08 | Approximately $1.53 | 1.53% |

| Mastercard Consumer Credit | About 1.05% combined | + 0.40% plus $0.08 | Approximately $1.53 | 1.53% |

| Amex OptBlue (Small Merchant) | Wholesale discount rate is typically 1.6% to 2.0% | + about 0.30% plus $0.10 | Around $2.40 | 2.40% |

| Interac Debit (In Person) | Flat $0.02 to $0.10 per transaction | + up to $0.05 markup | $0.10 to $0.20 | 0.10% to 0.20% |

What Merchants Should Notice

- Amex is roughly 50% to 70% more expensive than Visa or Mastercard.

- Interac debit is 8x to 15x cheaper than credit cards on typical tickets.

- Visa and Mastercard are nearly identical due to the coordinated 0.95% interchange reductions.

Card By Card Overview in 2025

Visa And Mastercard

- Domestic consumer interchange for eligible small merchants averages 0.95% for in-person transactions.

- Visa and Mastercard have nearly identical economics for most Canadian merchants.

- Typical total fees:

- In person: 1.4% to 2.0%

- Ecommerce: 1.8% to 2.4%

- Fees increase with rewards cards, foreign cards, online risk, and non chip fallback methods.

American Express

- OptBlue wholesale discount rates generally fall between 1.6% and 2.4% depending on industry and ticket size.

- After processor markup, typical totals are:

- In person: 2.0% to 3.0%

- Ecommerce: 2.5% to 3.5%

- Higher fees are often balanced by higher spending behaviour from Amex customers.

Interac Debit

- Interac uses a low flat fee per transaction, typically $0.05 to $0.15.

- Effective rates for most retail transactions land between 0.1% and 0.3%.

- One of the lowest cost payment options in Canada, especially for high volume or lower margin businesses.

- Encouraging customers to use Interac can meaningfully reduce blended processing fees.

Average Fees By In-Person Versus eCommerce

Online transactions carry higher fraud and chargeback risk, resulting in higher interchange and markups.

Table 2. Typical Effective Fee Ranges By Channel In 2025

| Card Type | In Person | E-commerce or Card Not Present |

|---|---|---|

| Visa Consumer Credit | 1.4% to 2.0% | 1.8% to 2.4% |

| Mastercard Consumer Credit | 1.4% to 2.0% | 1.8% to 2.4% |

| Amex Small Merchant | 2.0% to 3.0% | 2.5% to 3.5% |

| Interac Debit | 0.1% to 0.3% effective | Often 0.6% capped or low flat fees depending on the product |

If your numbers exceed these ranges, especially on tiered pricing, it is usually a sign of hidden or bundled fees.

How merchants can lower their average processing fees

There are several practical levers that merchants can use to bring their effective rate closer to the bottom of the ranges above. Studies of merchant statements show that the average small business loses around $2,400 per year to hidden payment processing fees, and that nine out of ten merchants overpay due to complex pricing.

- Check your pricing model: Before you change anything operational, confirm whether you are on flat, tiered, or interchange plus pricing. Interchange plus, with a transparent margin such as interchange + 0.40% and $0.08, is often 20 % to 30% cheaper than generic flat rate plans for many merchants.

- Steer appropriate transactions to Interac debit: If you operate in Canada, you can usually accept Interac debit for day-to-day in-person purchases. Encouraging Interac use for smaller tickets and recurring local customers can materially reduce your blended processing cost, especially in high-volume retail or food service.

- Track card present versus eCommerce mix: Online transactions are more expensive. Optimizing your checkout flow, fraud tools, and chargeback processes can reduce the need for expensive fallback methods and manual keyed entries, which often carry the highest fees.

- Review Amex economics by segment: If you accept Amex, compare the higher fee against Amex customer spend and profitability. Some merchants keep Amex acceptance for high-margin categories while steering lower-margin goods toward cheaper card types or debit.

- Audit for hidden and junk fees: Look for items such as statement fees, non-qualified surcharges, PCI non-compliance fees, and excessive gateway costs. These can meaningfully inflate the effective rate beyond the core interchange and markup.