When you tap your card at a coffee shop or send crypto across the world, you’re using two very different payment systems. One is built on decades of banking relationships and centralized processing power, the other on decentralized code and open access. Both are chasing the same goal: moving money faster, cheaper, and more securely.

This article compares Visa, the world’s largest payment network, with Solana, one of the fastest blockchain networks, to see how each stacks up in speed, cost, and real-world scalability.

Global Scale: How Big Are These Networks?

Both Visa and Solana move staggering amounts of value, but in very different ways. Visa dominates traditional commerce with a reach that spans nearly every consumer and merchant on earth. Solana, meanwhile, represents the emerging digital rail for instant, borderless value transfer.

| Metric | Visa (2024) | Solana (2024) |

|---|---|---|

| Annual Transaction Volume | $15.1 trillion USD | ~40 billion transactions |

| Active Accounts / Wallets | 4.4 billion cards | ~2.5 million daily active wallets |

| Global Merchants / Apps | 100M+ merchants | 1,000+ DeFi & payment apps |

| Network Launch | 1958 | 2020 |

Visa’s dominance is built on decades of bank partnerships and consumer trust. Solana’s rapid rise shows how open-source technology can scale at lightning speed without relying on banks or intermediaries.

Speed and Throughput

When it comes to raw speed, both networks are astonishingly capable. Visa’s infrastructure can handle thousands of card taps per second, while Solana achieves near-real-time confirmations on a decentralized network.

| Feature | Visa | Solana |

|---|---|---|

| Peak Transactions per Second (TPS) | ~65,000 (VisaNet) | 65,000+ (theoretical), 5,000–8,000 sustained |

| Latency | ~150 milliseconds | 300–400 milliseconds |

| Final Settlement | 1–3 business days (bank clearing) | Instant (<1 second)

|

While Visa’s strength is proven uptime and global reliability, Solana’s power lies in instant finality, no waiting for banks to reconcile or clear funds.

The Real Cost of a Transaction

Behind every purchase is a complex web of fees. Merchants pay Visa and banks for the privilege of using their rails, while blockchain users pay tiny “gas” fees directly to validators (software programs that route and confirm transactions).

| Type | Visa (Typical) | Solana (Average) |

|---|---|---|

| Merchant Fee (Interchange + Acquirer + Network) | 1.5% – 3.5% per transaction | < $0.001 per transaction |

| Settlement Delay | Up to 72 hours | Instant |

| Chargeback Risk | High | None (immutable) |

| Fraud Management | Centralized (AI monitoring) | Decentralized consensus & smart contracts |

Solana’s cost advantage is massive, fractions of a cent per transaction, but Visa provides consumer protection, fraud tools, and compliance coverage that blockchain still lacks.

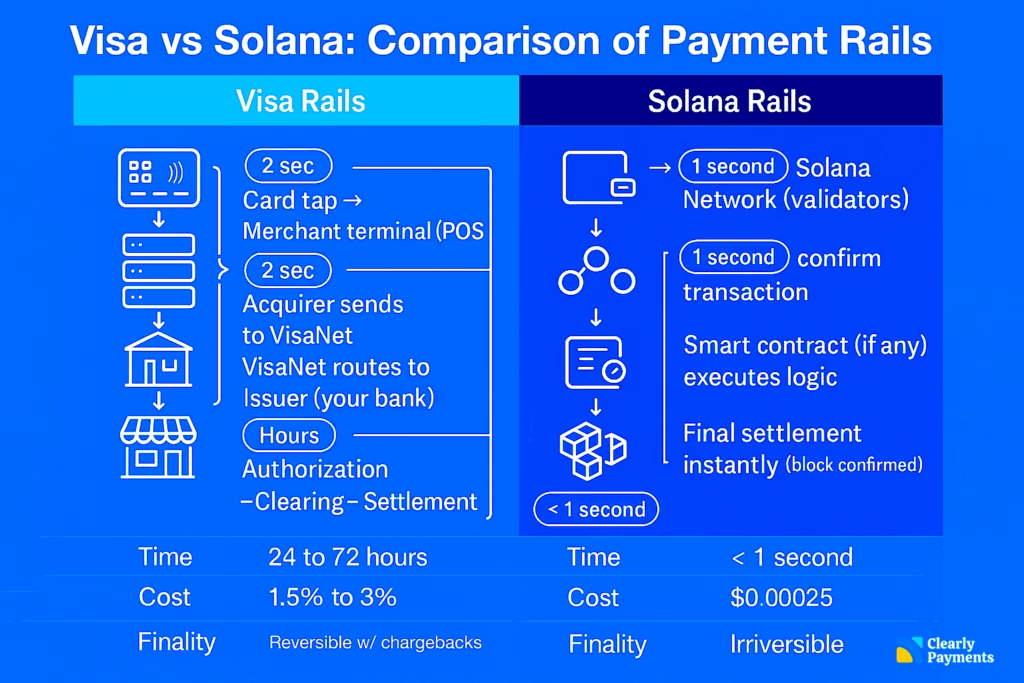

The Payment Flow: Tap vs. Token

Every transaction follows a path, one built on decades of centralized infrastructure (Visa) and the other on decentralized validators (Solana). While both move value, the differences in timing, cost, and trust layers are stark.

Visa transactions feel instant at checkout but settle days later; Solana transactions are instant, confirmed globally in under a second, at near-zero cost.

Visa Rails

- Card Tap (0.5–2 seconds): The merchant terminal reads card data and sends it through the acquirer’s payment gateway.

Acquirer → VisaNet (1 second): The acquirer’s system forwards the encrypted transaction to VisaNet, Visa’s global network handling over 1,700 transactions per second in production.

VisaNet → Issuer (150 ms routing time): The issuing bank checks available credit, fraud rules, and authorizes the charge.

Authorization, Clearing, Settlement (24 to 72 hours):

Authorization is instant.

Clearing batches occurs multiple times daily.

Settlement is completed 1–3 business days later as funds move through bank accounts.

Average total cost: 1.5%–3.5% of the transaction amount.

Finality: Reversible through chargebacks (30–90 days).

Solana Rails

Wallet → Solana Network (0.4 seconds): The user signs a transaction in their wallet and broadcasts it to Solana’s validator cluster.

Validators Confirm Transaction (0.5–1 second): Thousands of nodes validate in parallel using Proof of History and Proof of Stake, achieving consensus in under one second.

Smart Contract Execution (milliseconds): If the transaction involves a smart contract (like a swap or token transfer), logic is processed instantly on-chain.

Final Settlement (<1 second): Once confirmed, funds are final, no intermediaries, no batching.

Average total cost: ~$0.00025 per transaction.

Finality: Irreversible (crypto confirmation).

The “Trust Model” Difference

Every payment network relies on trust, but how that trust is achieved couldn’t be more different. Visa’s system depends on centralized oversight and brand reputation, while Solana’s trust comes from math, code, and thousands of independent validators.

| Visa | Solana | |

|---|---|---|

| Governance | Centralized corporation | Decentralized validator network |

| Security | Brand and bank trust | Cryptographic consensus |

| Dispute Resolution | Chargebacks | Code-based (no reversal) |

| Uptime | 99.999% | 99.8% (2024 average) |

Visa guarantees consumer protection through established legal frameworks, while Solana guarantees integrity through immutable code, two entirely different approaches to the same human need: confidence in money.

The Hybrid Future

Rather than competing, the two worlds are starting to converge. Visa has already settled USDC stablecoin payments on Solana, and many payment processors are exploring how to bridge card payments with blockchain settlements.

The future of payments will likely be hybrid, where a merchant’s terminal can process both Visa transactions and on-chain payments through one unified interface. For consumers, it will simply feel instant, secure, and seamless, regardless of what rails power it behind the scenes.