Inflation is a reality. If you’re finding it harder in 2022 to afford any of your business expenses, you’re in the same boat as many other businesses. Talking to small businesses, 92% of small-business owners have reported that their cost to run their business has increased in the past couple years.

There is a general increase in prices over time which is called inflation. The reality is that inflation is always happening, so small-business owners need to be prepared for it. Inflation is generally around 2% per year, however when inflation starts to creep higher, it becomes troublesome for businesses and the overall economy.

Inflation is a complex topic on why it exists and why it is important. To summarize, inflation means more dollars which means more spending, which means more aggregated demand. More demand triggers more production to meet that demand.

Inflation also makes it easier for people who have debt because the money they borrowed in the past is less valuable than the money they make today. This is an incentive to borrow money which helps grow the economy.

What Inflation Means for Small Business

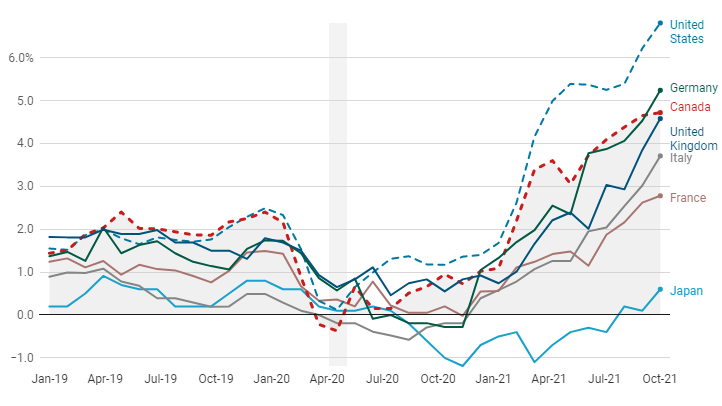

Inflation is normal, however as we stated, it becomes troublesome when inflation grows too much above the 2% target. The chart below shows the inflation rate of some of the top countries captured by the International Monetary Fund.

As you can see, the inflation rate is on a pace that is concerning. Today in mid 2022, the inflation rate is over 8%. That’s a problem.

Small businesses have been dealing with extra inflation and supply chain problems affecting prices since the pandemic began in 2020. Nearly 90% of small business owners say current economic trends, including inflation, ongoing supply chain issues and hiring challenges, are hurting how they operate.

All of this means is that businesses need to adapt faster and plan for increasing prices of goods and eventually increased cost of employee wages.

What can a Small Business do with Inflation?

To counter inflation, 89% of small-business owners have increased their prices. This is the unfortunate cycle. When your costs go up, you may raise your prices, so the cost for your customers go up. This is one reason why it is difficult to stop inflation quickly. Prices need to stabilize across the full value chain globally. The economy is all linked together.

Step one that small businesses can do is move to less expensive vendors. This is one reason Clearly Payments exists. To reduce costs. There are many vendors out there that focus on low cost with good service levels. They have kept their costs low so can offer lower prices than their competitors. If you do not want to switch vendors, attempt to renegotiate existing contracts with your vendors.

Step two is innovate. That’s a tough one, but during tough times and times of constraint, that’s when innovation comes out of the woodwork. The key is to look for new ways to do old things. Think out of the box. Compare your business to other industries that have nothing to do with yours. This can give you new ideas on how to create value with much less.

Inflation and Credit Card Processing

Payment processing and merchant services is not immune to inflation. For example, if banking fees increase, payment processing is very likely to increase too.

The main cost of payment processing is interchange. Interchange is the set of fees that are passed to merchants from banks and credit card associations. There are many payment processors that use complicated pricing methods that bake in extra fees on top of interchange. This is what merchants need to look out for. Watch out for the hidden fees and tricks.

Merchants should target credit card processors that use the interchange plus pricing model also known as cost plus pricing. That gives you transparent pricing and allows you to more easily see if extra fees are charged.