In consumer finance, the way we pay for goods and services is changing rapidly. Once upon a time, cash was king, but now, it’s facing stiff competition from digital alternatives, especially credit cards.

As we step into the year 2024, this article serves as a guide to understanding the latest trends in cash and credit card usage. We’ll explore who’s using cash and who’s swiping (tapping) plastic, and we’ll dive into the reasons behind these shifts in financial behavior. We’ll break down the numbers, analyze the demographics, and uncover the driving forces behind the choices consumers are making when it comes to how they pay.

The Decline of Cash Use

As we march further into the digital age, the realm of consumer payments is witnessing a seismic shift, notably marked by the decreasing dominance of cash transactions. Here are the key factors contributing to this decline:

Shrinking Market Share:

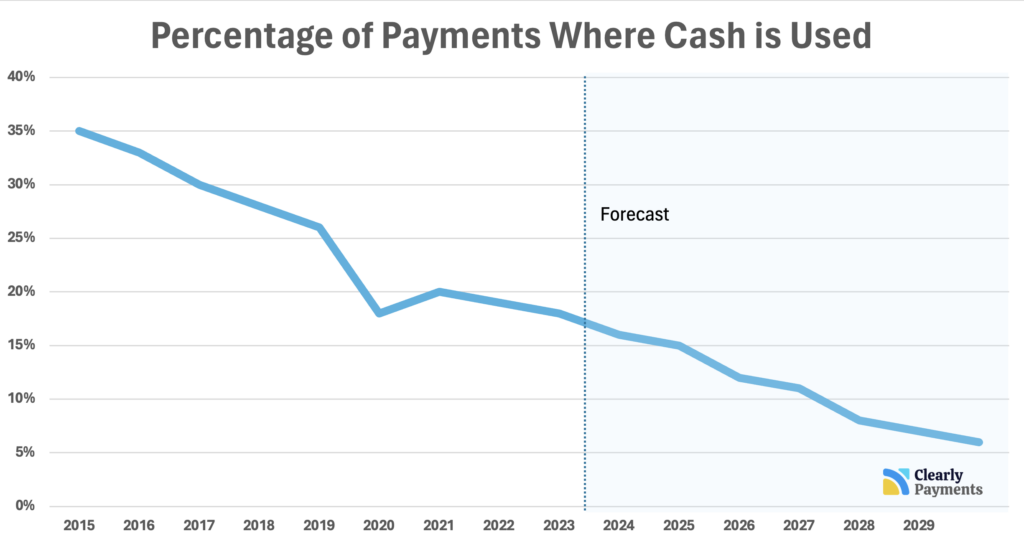

According to studies conducted by the Federal Reserve, cash usage has been on a steady decline. In 2021, cash was used for approximately 20% of all transactions. Fast forward to 2024, and the downward trend persists, with reports indicating that cash payments now represent a mere 16% of all transactions. This significant drop underscores a fundamental shift in consumer preferences towards digital alternatives.

Limited Business Acceptance: The decreasing popularity of cash is propogated by a decline in businesses willing to accept it as a form of payment. Data from the Federal Reserve reveals a stark reality—only 60% of businesses in the United States currently accept cash. This dwindling acceptance rate underscores a broader trend towards the adoption of digital payment infrastructure, signaling a paradigm shift in the way commerce is conducted.

Table of Data for Percentage of Payments Where Cash is Used

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Use | 35% | 33% | 30% | 28% | 26% | 18% | 20% | 19% | 18% | 16% | 15% | 12% | 11% | 8% | 7% | 6% |

Even though overall cash use is down, it’s still king for smaller purchases. The Federal Reserve reports that nearly half (49%) of transactions under $10 are made with cash [Federal Reserve Cash Usage]. This makes sense for situations where swiping a card might not be worth it.

As cash finds itself increasingly sidelined in favor of its digital counterparts, these statistics paint a clear picture of the evolving landscape of consumer payments in 2024.

The Rise of Credit Cards

Approximately 73% of North Americans get a credit card by age 25, making credit cards the most common first credit experience for young adults. Overall, 84% of adults in North America had a credit card in 2023.

The number of credit card holders globally has steadily grown to reach 1.25 billion in 2023, representing an annual growth rate of 2.79% from 1.1 billion in 2018. The United States accounts for 166 million credit card holders, while Canada has 36 million credit card holders.

Credit card usage is on the rise in both Canada and the USA, driven by various factors. In Canada, 70% of Canadians use credit cards for essential expenses like groceries and utilities in the past year. While convenience may play a part, this increase is likely linked to rising inflation rates, putting pressure on household budgets and leading Canadians to rely on credit to maintain their standard of living.

Similarly, the US has witnessed a significant surge in credit card use. According to the Federal Reserve, credit card debt in the US soared to $905 billion in the fourth quarter of 2023, surpassing pre-pandemic levels. Experts attribute this growth to factors such as increased travel and higher costs of goods, prompting Americans to turn to credit more often. It’s important to note that credit cards can be a useful financial tool if managed responsibly.

Demographic Trends in Payments

The data overwhelmingly points towards a digital revolution in payments, with younger generations leading the charge. However, cash usage persists for specific demographics and situations. The future likely holds a dynamic ecosystem where both traditional and digital payment methods coexist, catering to the diverse needs and preferences of a globalized society. Below are some statistics and trends in the demographics of how people pay, including by age, income, and location.

Payment Trends by People’s Age:

Gen Z & Millennials (born 1981-2012): Gen Z and Millennials (those born between 1981 and 2012) are leading the way in using contactless payments. A study by PYMNTS.com found that 54% of Gen Z shoppers like using contactless payments, while only 22% prefer cash. They’re also big fans of mobile wallets. A report by Juniper Research predicts that by 2024, there will be 4.6 billion mobile wallet users worldwide, with Gen Z and Millennials leading the pack. When it comes to credit cards, they’re using them smartly. A study by PayPal found that 77% of Gen Z and Millennials use credit cards for budgeting and rewards, but they’re also careful about not accumulating too much debt.

Gen X (born 1965-1980): This generation is in the middle when it comes to how they pay for things. According to the Federal Reserve’s Diary of Consumer Payment Choice, Gen Xers use debit cards for 32% of their transactions, which is more than Millennials at 22%. They still use credit cards too, for about 26% of their transactions. However, they might be a bit more careful with credit cards because they’ve seen older generations struggle with debt.

Baby Boomers (born 1946-1964): They still rely on cash quite a bit, according to a study by the Federal Reserve Bank of Boston. It found that they use cash for 40% of their transactions, which is higher than the national average of 29%. Maybe they feel more comfortable using physical money and think it helps them keep track of their spending. They’re also starting to use debit cards more, accounting for 29% of their transactions, while credit card use is lower at 22% compared to younger generations.

Payment Trends by Income:

Higher Income ($75,000+): This group enjoys a wider payment method spectrum. A Mercator Advisory Group: Mercator Advisory Group study suggests they leverage credit cards (38% of transactions) for rewards and building credit, debit cards (29%) for everyday purchases, and digital wallets (20%) for convenience. Cash usage dips to around 13%.

Lower Income (Under $35,000): Cash reigns supreme (around 52% of transactions) due to limited access to credit or banking services. Debit cards see some use (28%) for managing finances, but credit card use is minimal (10%) to avoid potential debt traps.

Payment Trends by Geography and Location:

- Urban vs. Rural: The convenience factor heavily influences payment choices. A Visa study shows that 78% of urban consumers made contactless payments in 2023, compared to 59% in rural areas. This disparity is likely due to easier access to technology infrastructure and a higher concentration of contactless-enabled merchants in urban centers.

- Cash Dominance in Developing Countries: Many developing countries lack widespread access to banks and financial institutions. This makes it difficult for people to obtain credit cards or debit cards, making cash the primary mode of payment.

- Credit Card Dominance in Developing Countries: Developed economies, like Canada and USA, typically have robust banking systems with high credit card penetration. This makes it easier for people to obtain credit cards and use them for transactions. Developed countries tend to have a higher adoption rate of digital technologies. This fosters a preference for cashless transactions due to their convenience, speed, and security benefits.

Europe: While credit cards are widely used, some European countries like Germany and Austria still have a relatively high reliance on cash. This might be due to cultural factors or privacy concerns surrounding digital payments.

- Asia: There’s a surge in digital wallets like Alipay and WeChat Pay in China, leading to a decline in cash use. However, cash remains important in some Southeast Asian countries.

Reasons for the Shift

Several factors contribute to the decline of cash and the rise of credit cards.

- The Evolving Retail Landscape: The growth of e-commerce necessitates digital payment methods, as cash is not a viable option for online transactions. This trend towards online shopping further incentivizes the use of credit cards.

- Security Concerns: Consumers are increasingly wary of carrying large amounts of cash due to the risk of theft or loss. Credit cards offer the advantage of chargeback options and fraud protection, mitigating these concerns.

- Rewards and Benefits: Many credit cards provide attractive rewards programs, cashback offers, and extended warranties, making them a financially advantageous option for many consumers.

FedNow: A Game Changer for Payments in USA

The introduction of FedNow serves to fortify the digital cash transfer landscape in the United States, offering a swifter and more efficient alternative to traditional ACH transfers, all while harmoniously coexisting with other convenient options such as mobile wallets.

In recognizing the significance of FedNow, we attain a comprehensive understanding of the ongoing enhancements in digital cash transfers across the nation.

Real-Time Settlement: Launched in July 2023, FedNow represents a novel payment system developed by the Federal Reserve. It facilitates instantaneous fund transfers between bank accounts, operating seamlessly 24/7/365. This eradicates the customary waiting periods associated with conventional ACH transfers, which often extend over several business days.

Reduced Friction: FedNow endeavors to streamline the digital cash transfer process by enabling immediate settlement between participating banks. This reduction in friction simplifies the process for both individuals and businesses, facilitating the swift transfer of funds.

Increased Efficiency: The accelerated settlement times facilitated by FedNow hold the potential to significantly enhance operational efficiency for businesses. Notably, companies stand to benefit from the instantaneous receipt of payments for rendered goods and services, thereby fostering expedited cash flow and bolstered financial management practices.

Complementing Other Solutions: While FedNow primarily focuses on facilitating instant transfers between bank accounts, it seamlessly complements existing solutions such as mobile wallets and peer-to-peer (P2P) applications. Users can leverage these platforms to initiate transfers, subsequently benefiting from instantaneous settlement facilitated by the FedNow network.

Interac eTransfer: Digital Payments in Canada

Interac e-Transfer stands as a cornerstone service within Canada’s banking ecosystem, offered by Interac, the nation’s interbank network. It facilitates seamless money transfers directly between bank accounts through email or mobile phone numbers.

Interac eTransfer saw significant growth with an 11.35% year-over-year increase in the total dollar amount sent in 2023 with over 1.16 billion transactions. October in 2023 hit a new high with over 103 million etransfer transactions.

Convenience and Speed: Renowned for their convenience and rapidity, e-Transfers are esteemed for their swift completion times. While transactions are typically processed almost instantly, some may take up to 30 minutes depending on the involved financial institutions.

Security: Interac e-Transfer upholds robust banking security measures, ensuring a safe and dependable means of fund transfer.

E-Transfers vs. Other Options: While FedNow addresses instant transfers within the United States, e-Transfers remain the preferred solution for prompt and hassle-free money transfers among Canadians. However, it’s essential to note that Interac e-Transfers are restricted to transactions within Canada. Unlike certain US-based money transfer services capable of international transfers, e-Transfers are not designed for sending money abroad.

The Future of E-Transfers: Interac continuously endeavors to enhance e-Transfer services. Anticipate forthcoming features such as augmented transfer limits, expedited processing times, and potential international transfer capabilities. Moreover, there’s a burgeoning trend toward integrating e-Transfers with mobile wallets like Apple Pay and Google Pay. This integration enables users to conduct e-Transfers even more conveniently through their smartphones.

The Future of Payments

The future of payments is poised to be shaped by a blend of convenience, security, and technological innovation, marking a significant departure from traditional methods.

Cash, once the ubiquitous symbol of transactions, is gradually yielding ground to digital counterparts. While still favored for certain transactions and in specific demographics, its decline is evident as consumers increasingly opt for the convenience and efficiency offered by digital payment methods. The rise of contactless payments, mobile wallets, and cryptocurrencies reflects a broader trend towards a cashless society, where physical currency becomes less prevalent in favor of digital transactions.

Credit cards, meanwhile, remain a staple in the payment arsenal of many consumers, offering flexibility, rewards, and fraud protection. However, they are also evolving in response to changing consumer preferences and technological advancements. The integration of biometric authentication, tokenization, and artificial intelligence into credit card systems enhances security and streamlines the user experience, positioning them as a competitive option in the digital payments landscape.

Beyond cash and credit cards, a multitude of alternative payment methods are gaining traction, catering to diverse consumer needs and preferences. Peer-to-peer payment apps and mobile wallets, such as Venmo and PayPal, provide seamless ways to transfer money between individuals, while buy now, pay later services offer flexible financing options for online purchases. Cryptocurrencies, with their decentralized nature and blockchain technology, present new opportunities for borderless transactions and financial inclusion, albeit with regulatory challenges and volatility concerns.

Looking ahead, the future of payments is likely to be characterized by further innovation and convergence of technologies. Central bank digital currencies (CBDCs) represent a notable development, offering governments and central banks the ability to issue digital versions of their national currencies. CBDCs have the potential to revolutionize the way we transact, providing faster, cheaper, and more inclusive payment solutions while enabling enhanced monetary policy tools and financial transparency.

In this rapidly evolving landscape, the key to success for payment providers lies in adaptability and user-centric design. Those that can anticipate and address evolving consumer preferences, security concerns, and regulatory requirements will stand to thrive in the future of payments. Whether it’s the gradual decline of cash, the evolution of credit cards, or the proliferation of digital alternatives, the future of payments promises to be defined by innovation, accessibility, and efficiency.