Security is a top priority in payment processing. Tokenization is widely used in payments, particularly with the growth of online payments.

There are two primary types of tokenization: Network Tokenization and PCI Tokenization. This article gives an overview of what these terms mean, how they work, and why they are important.

What is Tokenization?

Tokenization in payments is a security process that transforms sensitive payment data, such as credit card numbers, into a unique string of characters called a token. This token acts as a stand-in for the original data, rendering it useless to anyone who might intercept it.

The primary purpose of tokenization is to protect sensitive information from theft and fraud. When a payment is processed, the token is used instead of the actual card number, ensuring that the real data remains secure. If a token is stolen, it cannot be used to make unauthorized purchases because it lacks the meaningful information necessary for such transactions.

The process of tokenization involves creating a token that is linked to the original payment data within a secure database. This database, often referred to as a token vault, stores the mapping between tokens and the original data. When a transaction needs to be authorized, the token is sent to the token vault, where it is matched with the corresponding card details to complete the transaction.

Tokenization not only enhances security but also helps businesses comply with regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS), by reducing the amount of sensitive data they store and handle.

Network Tokenization

Network Tokenization is a security measure used by card networks such as Visa, MasterCard, and American Express. When a customer makes a payment, the card network replaces the credit card number with a token. This token is specific to a merchant and transaction.

For example, if you buy a pair of shoes from an online store, your credit card number is swapped with a token by the card network. This token is then used for the transaction, so the merchant never sees your actual card number.

Benefits of Network Tokenization

- Enhanced Security: Since the token is unique to each transaction and merchant, even if it gets stolen, it can’t be reused elsewhere.

- Reduced Fraud: It limits the risk of card information being stolen and used in fraudulent activities.

- Easy Updates: If your card is lost or stolen, the card network can update the token without needing to change it for every merchant you use.

Limitations of Network Tokenization

- Dependency on Card Networks: It relies on the infrastructure of the card networks, meaning merchants must adhere to their rules and protocols.

- Complexity: It can be more complicated to implement and manage, especially for smaller businesses.

PCI Tokenization

PCI Tokenization is guided by the Payment Card Industry Data Security Standard (PCI DSS). It involves merchants replacing credit card numbers with tokens within their own systems. This method ensures that sensitive card information is not stored in their databases.

For example, when you pay for your groceries at a supermarket, the supermarket’s payment system generates a token for your card number. This token is stored instead of the actual card number, reducing the risk of data breaches.

Benefits of PCI Tokenization

- Data Security: By not storing card numbers, merchants protect themselves and their customers from potential breaches.

- Compliance: It helps businesses comply with PCI DSS requirements, which are necessary for operating legally in many places.

- Flexibility: Merchants can manage and customize their tokenization process according to their needs.

Limitations of PCI Tokenization

- Cost: Implementing and maintaining PCI Tokenization can be expensive, particularly for small businesses.

- Internal Management: Merchants are responsible for managing the tokens and ensuring they are securely stored and used.

- Complexity: It can be technically challenging to set up and requires ongoing management and updates.

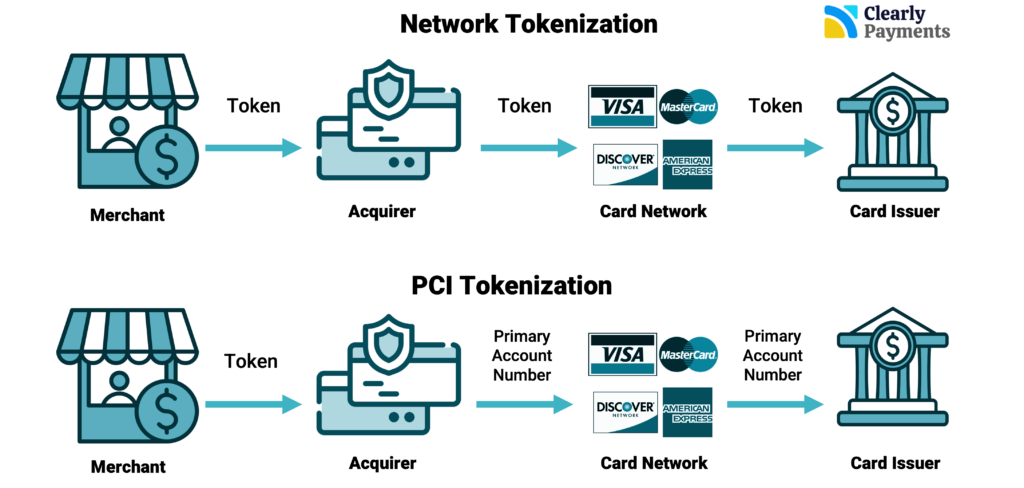

Comparing Network Tokenization and PCI Tokenization in Payment Processing

This section compares Network Tokenization and PCI Tokenization and how each method contributes to reducing fraud, enhancing security, and helping businesses comply with regulatory standards. This comparison highlights the strengths and weaknesses of both approaches.

The transaction flow where PCI tokenization and network tokenization is quite similar. However, in PCI tokenization, the payment acquirer will pass the actual Primary Account Number (PAN) to the card issuing bank. The PAN is the 12- to 19-digit number that appears on a credit, debit, or prepaid card. This makes network tokenization more secure than PCI tokenization.

Security

Ease of Implementation

Cost

Network Tokenization is generally more cost-effective for merchants, especially small to medium-sized businesses, because the card networks handle the infrastructure. PCI Tokenization can be more expensive due to the need for specialized software and ongoing management.

Flexibility

Payments Gateways and Tokenization

Many payment gateways support both Network Tokenization and PCI Tokenization. It’s important to know the types of supported tokenization when choosing a payment gateway.

Network Tokenization in Payment Gateways

- Integration with Card Networks: Payment gateways integrate their systems with card networks to facilitate the tokenization process. When a customer initiates a payment, the card network generates a token specific to that transaction and merchant.

- Token Management: The gateway manages these tokens and uses them to process transactions without exposing the actual card numbers to the merchants.

- Security: This method leverages the security infrastructure of the card networks, providing a robust layer of protection against fraud and data breaches.

PCI Tokenization in Payment Gateways

For PCI Tokenization, payment gateways implement the following steps:

- Token Generation: When a payment is made, the gateway’s system replaces the sensitive card information with a unique token generated according to PCI DSS guidelines.

- Storage and Processing: The token is stored in the gateway’s secure database. When needed, the gateway uses this token to retrieve the actual card information securely for transaction processing.

- Compliance: The gateway ensures that its tokenization process complies with PCI DSS standards, helping merchants meet regulatory requirements.

Get the best payment tokenization with Clearly Payments

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service