Payment processing fees are one of the few operating costs that scale directly with revenue. In Canada in 2026, as card usage continues to dominate consumer and B2B payments, the pricing model a merchant chooses can materially affect margins, especially as volumes grow.

The two dominant pricing models, flat-rate pricing and interchange-plus pricing, solve different problems. Flat-rate pricing prioritizes simplicity and predictability. Interchange-plus pricing prioritizes transparency and cost efficiency. Understanding how these models work, and where each becomes more or less economical, is essential for Canadian merchants trying to manage costs in a higher-expense environment.

This article breaks down how each pricing model works, current Canadian cost data, and the transaction levels where switching from flat-rate to interchange-plus typically makes financial sense.

How Payment Pricing Works in Canada

Before comparing pricing models, it is important to understand the underlying cost structure of a card transaction in Canada. Regardless of how pricing is presented to a merchant, every card payment is built from the same core components. The pricing model simply determines whether those components are bundled or itemized.

Each transaction includes three primary costs:

- Interchange: paid to the issuing bank

- Network fees: paid to Visa, Mastercard, or Interac (card networks)

- Processor markup: paid to the acquirer or payment processor

Flat-rate pricing bundles these costs into a single rate. Interchange-plus pricing separates them and adds a transparent markup. The total cost is always derived from these same inputs.

Flat-Rate Pricing Explained

Flat-rate pricing is designed to remove complexity from payment processing. Instead of seeing different rates for different cards, merchants pay one blended percentage for most transactions. This model became popular with small businesses, startups, and ecommerce platforms because it simplifies billing and forecasting.

In practice, flat-rate pricing shifts risk away from the merchant and onto the processor. The processor sets a rate high enough to cover expensive card types, which means merchants using mostly standard consumer cards often subsidize higher-cost transactions they rarely accept.

Typical Canadian Flat Rates in 2026

| Channel | Common Flat Rate |

|---|---|

| Card-present retail | 2.40% to 2.75% |

| Ecommerce | 2.70% to 3.40% |

| Amex blended | Often included, sometimes +0.30% |

| Interac Debit | Sometimes included, often excluded |

Advantages of Flat-Rate Pricing

The Cost Trade-Off

Interchange-Plus Pricing Explained

Interchange-plus pricing takes the opposite approach. Instead of blending costs, it passes through the actual interchange and network fees associated with each transaction and adds a fixed processor markup. This model exposes the real economics of card acceptance.

For merchants processing meaningful volume, interchange-plus pricing often results in lower effective rates because the processor markup remains constant while interchange reflects the actual card mix being used by customers.

Typical Interchange-Plus Markups in Canada, 2026

| Fee Component | Typical Range |

|---|---|

| Interchange | ~0.80% to 2.30% |

| Network fees | ~0.10% to 0.13% |

| Processor markup | 0.15% to 0.35% |

| Per-transaction fee | $0.05 to $0.12 |

Canadian Interchange Data Snapshot, 2026

| Card Type | Avg Interchange |

|---|---|

| Interac Debit | $0.04 to $0.07 |

| Visa Debit | ~0.40% |

| Visa, Mastercard standard | ~1.40% |

| Premium rewards | ~1.90% |

| Corporate, purchasing | ~2.30% |

Cost Comparison, Flat Rate vs Interchange-Plus

To understand the real-world impact of pricing models, it helps to look at a representative merchant example. Small percentage differences compound quickly at scale, especially for businesses with steady monthly volume.

Example Merchant Profile

- Monthly volume: $50,000

- Average ticket: $65

- Card mix: 55% standard, 35% premium, 10% debit

Flat-Rate Scenario

- Flat rate: 2.75%

- Monthly fees: ~$1,375

- Effective rate: 2.75%

Interchange-Plus Scenario

- Weighted interchange: ~1.62%

- Network fees: ~0.12%

- Processor markup: 0.25%

- Effective rate: ~1.99%

- Monthly fees: ~$995

In the interchange plus scenario, the monthly savings are ~$380 which translates to annual savings of ~$4,560. This difference reflects the embedded risk premium in flat-rate pricing rather than a change in underlying interchange costs.

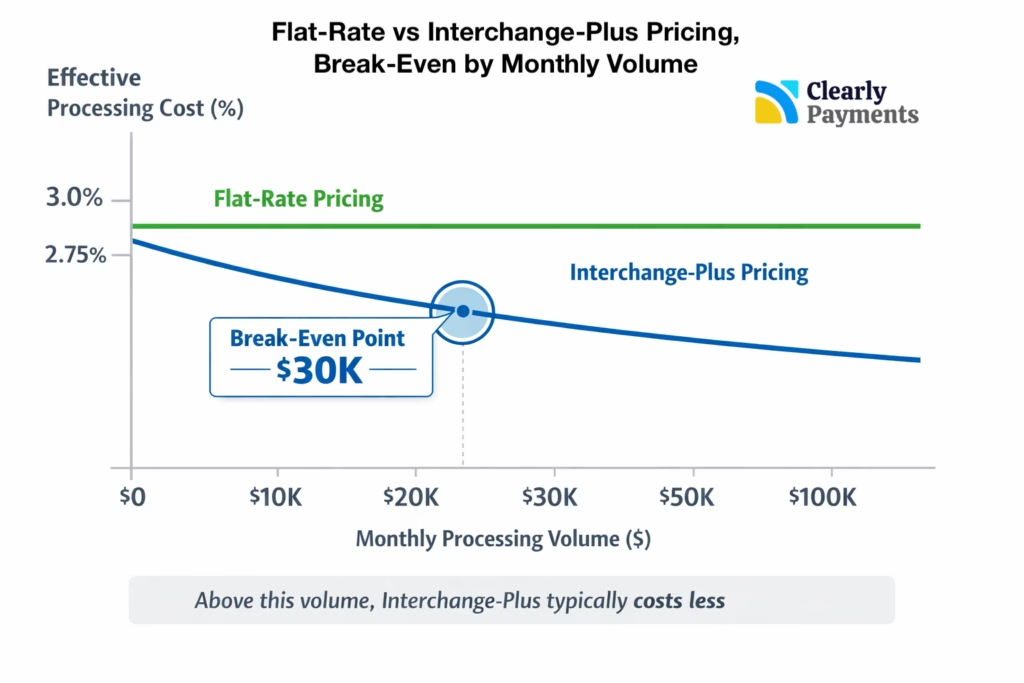

Break-Even Point and When to Switch

As volume increases, the simplicity premium of flat-rate pricing becomes more expensive than the transparency benefit of interchange-plus.

Typical Break-Even Thresholds in Canada

| Monthly Volume | Pricing Model That Usually Wins |

|---|---|

| Under $10,000 | Flat rate often fine |

| $10,000 to $25,000 | Case-by-case |

| $25,000 to $40,000 | Interchange-plus usually cheaper |

| Over $40,000 | Interchange-plus almost always cheaper |

Other Factors That Favor Interchange-Plus

Volume is not the only driver of savings. Certain operational characteristics amplify the benefits of interchange-plus pricing even at lower volumes.

Interchange-plus pricing tends to outperform when:

- Average ticket size exceeds $50

- Interac Debit usage is meaningful

- Premium card penetration is lower than assumed

- Corporate or purchasing cards are accepted

- The business can benefit from interchange optimization or Level 2 and Level 3 data

Transparency enables informed decision-making that flat-rate pricing obscures.

When Flat-Rate Pricing Still Makes Sense

Flat-rate pricing remains a valid option in specific scenarios. For early-stage or low-volume businesses, the absolute dollar difference may not justify additional complexity.

Flat-rate pricing can make sense when:

- Monthly volume is low or inconsistent

- Administrative simplicity is a priority

- The business is seasonal

- Financial reporting resources are limited

In many cases, flat-rate pricing is best viewed as a temporary solution rather than a long-term strategy.

The 2026 Reality for Canadian Merchants

While interchange rates in Canada have remained relatively stable, operating costs have not. Labor, rent, marketing, and fulfillment expenses continue to rise, compressing margins across industries.

In that environment, paying an additional 40 to 80 basis points in processing costs becomes increasingly difficult to justify. For growing businesses, moving to interchange-plus pricing is often one of the fastest margin improvements available without changing pricing or operations.

See What These Payment Costs Look Like for Your Business

- Get a free cost analysis and comparison

- Wide range of supported industries

- You get fast funding within a business day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service