Insurance firms have increasingly been accepting credit cards as a convenient form of payment for their customers. Insurance firms, in the past, have been more cautious about accepting credit card payments, as they are often concerned about the associated processing fees.

Despite this, since 2020, there has been a significant shift in the industry with a growing number of both big and small insurance firms embracing credit card payments to streamline collections and simplify reconciliation. Overall, this trend is benefiting both insurers and customers by offering greater flexibility and ease of payment.

Benefits of accepting credit cards for insurance

Accepting credit cards can bring significant benefits to insurance brokers, including improved cash flow and greater convenience for clients. By processing credit card payments, insurance firms can speed up collections and avoid cash flow problems that can arise when waiting for payments from clients. In particular, Clearly Payments offers fast deposit times of about one day, which can make a significant difference to insurance firms’ financial stability and cash flow management.

In addition to improving cash flow, credit card processing can also offer greater convenience and flexibility to clients, who may prefer to use their credit card as a payment method. This can enhance the overall client experience, leading to stronger relationships and increased repeat business.

Security is also a key concern for insurance firms, who handle sensitive client data and must comply with strict data privacy laws. Credit card processing offers secure payment gateways that adhere to industry regulations, such as PCI, ensuring that client data is protected and minimizing the risk of data breaches or other security issues.

While it’s important for insurance firms to consider the costs of credit card processing, Clearly Payments is committed to offering the most competitive rates in the industry. Insurance firms can compare providers to find the most affordable option, but Clearly Payments stands out as a cost-effective choice for credit card processing.

How insurance firms accept credit cards

The insurance industry typically uses several options for accepting credit cards. These include the following which you can read more about below:

Credit card machines: This is a common option for insurance firms with a physical storefront. Credit card machines can be used to process payments in person, allowing clients to swipe, dip, or tap their credit card for payment.

Virtual terminals: This option is ideal for insurance firms that operate primarily online. Virtual terminals allow firms to process credit card payments through a web-based interface, which can be accessed from any computer with an internet connection.

Email invoicing: Some insurance firms prefer to send invoices by email, which can include a link to a secure payment gateway. This option allows clients to make payments online using their credit card, without having to leave their email client.

Hosted payment pages: This is a secure web page that insurance firms can use to process credit card payments. The page is hosted by a third-party payment processor, which ensures that client data is protected and transactions are secure.

By offering a variety of payment options, insurance firms can make it easier for clients to pay for their services using their preferred method of payment. This can improve the client experience and lead to stronger relationships, as well as faster and more efficient payment processing for the insurance firm.

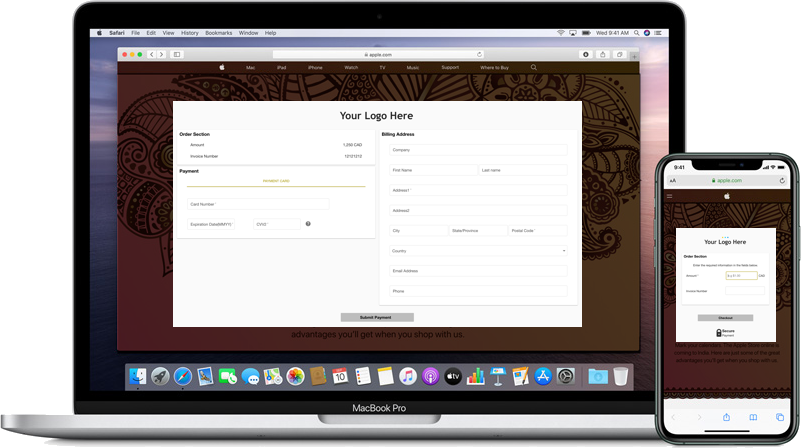

Hosted payment page for insurance firms

A hosted payment page is a simple and secure solution for accepting credit card payments on your website. By partnering with Clearly Payments, you can offer your customers a seamless payment experience that is easy to set up and fully customizable with your branding.

Here’s how hosted payment pages work: when a customer clicks on the “Pay Invoice” link on your website, they will be redirected to a secure checkout page hosted by Clearly Payments. This page will display your branding, ensuring a seamless and professional experience for your customers. From there, the customer can easily input their credit card information and other necessary details. We take care of all hosting, security, and development.

With a hosted payment page, you can streamline your payment process, boost customer confidence and loyalty, and ultimately increase your revenue.

Credit card machines in the insurance industry

Clearly Payments offers a comprehensive range of payment terminals to cater to the diverse needs of insurance firms. Whether you require a basic countertop model or a more advanced mobile solution, we have you covered. Our payment terminals come equipped with cutting-edge security features and offer dependable performance, giving you the confidence that your transactions are secure and efficient. One of the significant advantages of credit card machines is that they accept debit cards as well.

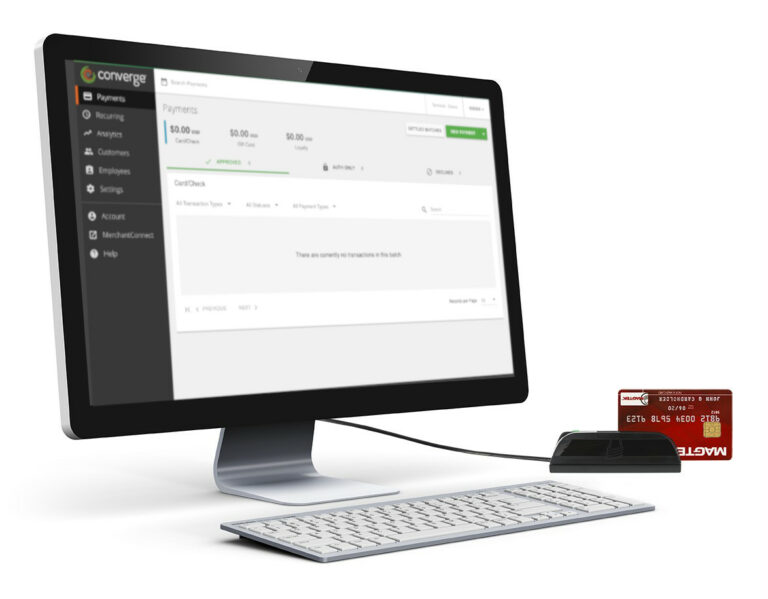

Virtual terminals for insurance firms

A virtual terminal is a versatile web-based application that provides insurance brokers with the flexibility to process payments via an internet browser or mobile phone. It replicates the functionality of a physical terminal, allowing brokers to accept credit card payments both over the phone and in person, making it a great option for businesses of all sizes.

Virtual terminals are especially popular among service-oriented businesses, such as insurance firms, where transactions may not be as frequent as in retail environments. Whether you’re operating out of an office building or in the field, a virtual terminal enables you to process payments quickly and securely, without the need for any specialized hardware or equipment.

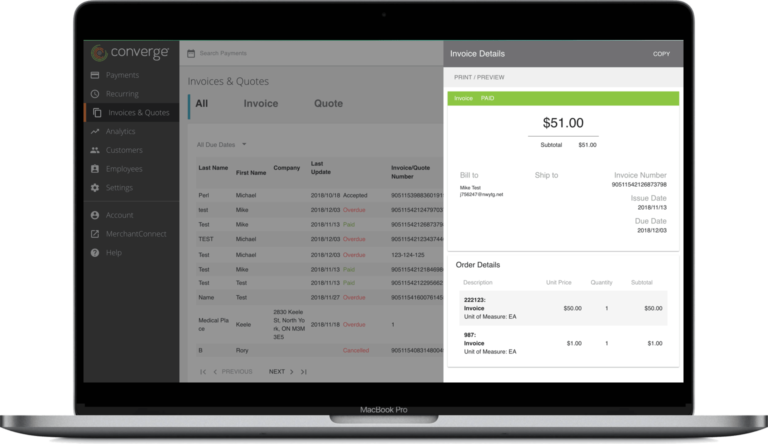

Electronic invoicing has become a popular tool for insurance firms looking to streamline their billing process. With Clearly Payments’ guided online invoicing tool, creating invoices is quick and easy. The system generates a digital invoice that can be sent directly to the customer via email, with a convenient “pay now” button included.

This approach has several advantages over traditional invoicing methods. First, it eliminates the need for follow-up phone calls and emails, saving you time and reducing the risk of errors. Second, it provides your customers with a user-friendly and convenient way to make payments, improving their overall experience and satisfaction with your service.

Clearly Payments’ invoicing and quoting system is designed with these benefits in mind. Our system is intuitive and easy to use, enabling you to create and send invoices with just a few clicks. Plus, our secure payment gateway ensures that all transactions are processed safely and efficiently. By using Clearly Payments’ invoicing and quoting system, you can simplify your billing process, reduce administrative burden, and enhance the customer experience.

The way fees work in payment processing

At Clearly Payments, we are committed to providing the lowest payment processing fees in the industry. That’s why more and more businesses are choosing us as their preferred payment processing partner.

Overall, payment processing fees are around 2.2% of the transaction amount, plus $0.10 per transaction. We have found many insurance firms are paying 2.9% up to 5% and $0.30 per transaction with other payment processors.

There are several types of fees involved in payment processing, including interchange fees, processing fees, and setup or monthly fees. Interchange fees are charged by the credit card networks (e.g., Visa, Mastercard) to the merchant’s bank for processing a transaction. They vary depending on various factors and average around 1.81%. Processing fees, on the other hand, are charged by the payment processor to the merchant for processing the transaction. They may be a flat rate per transaction or a percentage of the transaction amount, and they may include various fees such as authorization fees, card brand fees, and batch fees. Typically, these fees account for approximately 0.45% of the transaction amount. Additionally, some payment processors may charge setup or monthly fees, which are usually in the range of $10 to $15 per month.

As a merchant, you may also want to consider passing on some or all of these fees to your customers by adding a surcharge or convenience fee to credit card transactions. This can help you offset the cost of processing credit card transactions and improve your profit margins.

How insurance brokers can start accepting credit cards?

Determining whether or not to accept credit cards as a payment method is a significant business decision that requires careful consideration of your specific circumstances and preferences. Evaluating the pros and cons can help you determine what’s best for your insurance firm.

There are several benefits to accepting credit cards as a payment method, such as increased sales, streamlined payment processes, and improved customer loyalty. By accepting credit cards, your business can cater to customers’ preferences and provide them with a convenient and reliable payment option. Additionally, accepting credit cards can improve cash flow by allowing you to receive payments quickly and efficiently.

On the other hand, there are also some potential drawbacks to consider, such as transaction fees, chargebacks, and fraud risks. It’s essential to weigh these potential costs against the benefits to determine whether accepting credit cards aligns with your business goals.

If you decide to start accepting credit cards, Clearly Payments is here to help you navigate the payment processing landscape. With our user-friendly and secure payment processing solutions, you can streamline your payment processes and provide your customers with a reliable and hassle-free payment experience.

Get the best credit card processing for insurance firms

- Lowest-cost processing in the industry

- Fund transfers in less than one day

- A full set of payment products to accept payment anytime, anywhere

- World-class customer service