Payment processing is often discussed at the checkout level, cards, terminals, and authorization speed. Behind the scenes, however, processors spend far more time dealing with settlement timing, reconciliation, cross-border complexity, and cost control. This is where blockchain infrastructure is starting to matter.

Blockchain is not replacing card networks or bank transfers. Instead, it is emerging as an alternative settlement and accounting layer that payment processors are increasingly paying attention to, even when merchants never interact with it directly.

Blockchain adoption in payments

Global blockchain-related payment activity is expanding across settlement rails, enterprise treasury flows, and cross-border corridors even as consumer checkout adoption remains limited.

The below figures show that blockchain’s place in payments in 2026 is primarily in back-end settlement and value movement, especially for cross-border flows and enterprise treasury functions, rather than replacing card rails at the point of sale.

Key adoption and usage statistics for 2026:

- Stablecoin market size: Total stablecoin market capitalization has grown to over $300 billion as of early 2026, reflecting sustained interest from institutions and fintechs.

- Stablecoin transaction volume: On-chain and adjusted transaction activity has reached trillions of dollars annually, with major tokens like USDC reporting massive volumes.

- Enterprise adoption: Platforms report rapid growth in active stablecoin users and transaction counts, with some providers noting 146 % growth in active customers into 2026.

- Settlement pilots by major processors: Visa’s pilots for stablecoin settlement have reached an annualized volume run rate in the billions.

- CBDC and national initiatives: The China-led cross-border digital currency platform (mBridge) processed over $55 billion in transactions.

- Retail blockchain payments: Global crypto card payment volumes, a proxy for consumer-facing blockchain usage, reached roughly $1.5 billion per month by mid-2025.

- Fintech growth: Fintech platforms integrating stablecoin rails saw payment volumes surge over 150 % in 2025, driven by new on- and off-ramps features.

Modern payment processing is still constrained by settlement

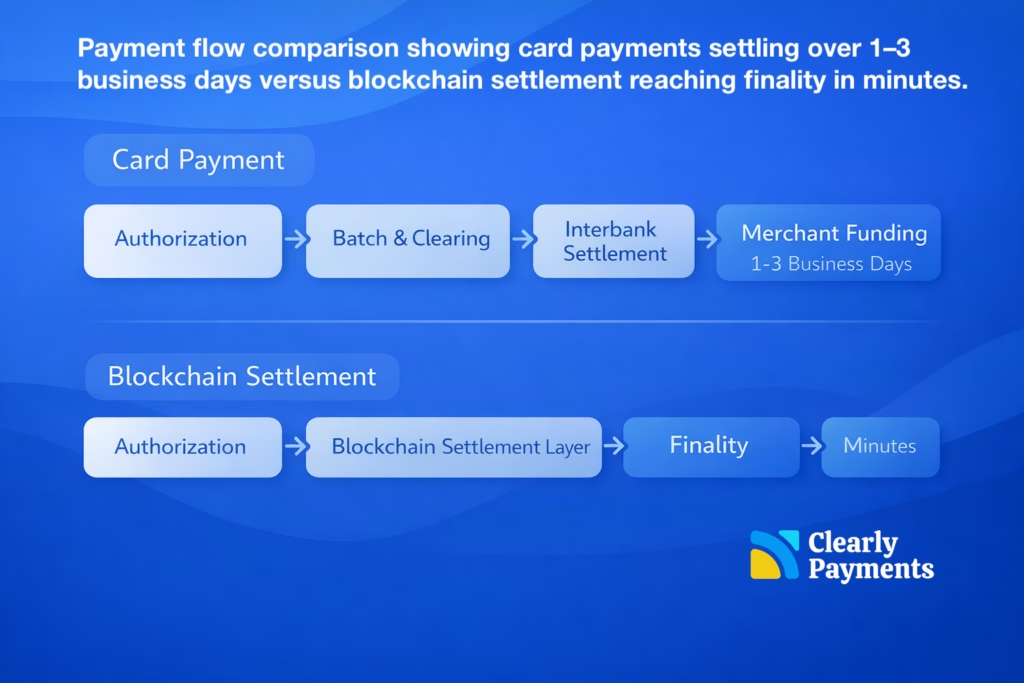

Card payments feel instant to consumers, but settlement remains slow and operationally heavy. In North America, most card transactions still settle on a T+1 to T+3 basis, depending on network rules, bank cutoffs, and weekends.

From a processor perspective, this delay creates real cost and risk:

- Merchants expect fast access to funds, but processors must pre-fund settlements or manage reserves

- Reconciliation across networks, banks, and currencies remains largely batch-based

- Chargebacks and reversals can surface days or weeks after the original transaction

Blockchain changes settlement mechanics, not checkout behavior

Blockchain infrastructure introduces a fundamentally different settlement model. Transactions are finalized continuously, rather than in daily or multi-day batches. Finality is cryptographic and timestamped, not dependent on intermediary clearing cycles.

For processors, this changes how money moves behind the scenes:

- Settlement can occur in minutes rather than days

- Funds can be moved 24/7, including weekends and holidays

- Transaction records are immediately auditable and immutable

Public blockchains routinely process settlement in under 5 minutes. Even conservative enterprise blockchain systems typically settle in under an hour. Compared to traditional payment rails, this represents a step-change in timing, not just marginal improvement.

Importantly, this does not require merchants or consumers to pay with crypto. Blockchain can sit entirely in the back end as a settlement and reconciliation layer.

Stablecoins are driving practical adoption

The most relevant blockchain development for payment processors is the rise of stablecoins. Stablecoins are digital tokens pegged to fiat currencies, typically USD, and are designed to minimize price volatility.

Stablecoin usage has grown rapidly for non-speculative reasons:

- Global stablecoin transaction volume exceeded $12T+ USD in 2025

- Over 60% of stablecoin volume is tied to payments, settlement, or treasury movement rather than trading

- Large financial institutions now use stablecoins for internal transfers and cross-border settlement

For processors, stablecoins function more like programmable cash than an investment asset. They enable:

- Faster cross-border settlement without correspondent banking chains

- Lower FX and wire costs for international merchants

- Near-real-time treasury movement between entities

This is especially relevant for marketplaces, platforms, and SaaS businesses that operate across multiple countries and currencies.

Reconciliation and auditability are where blockchain quietly shines

One of the least visible but most expensive parts of payment processing is reconciliation. Matching transactions across gateways, acquiring banks, networks, and merchant systems is still largely manual and exception-driven.

Blockchain introduces a single shared ledger that all parties can reference. This does not eliminate accounting work, but it reduces ambiguity.

Practical benefits include:

- A single transaction ID that persists across systems

- Timestamped settlement records available instantly

- Reduced need for end-of-day or end-of-month batch matching

In traditional card processing, reconciliation discrepancies of even 0.1% can represent millions of dollars at scale. Processors that can reduce exception rates gain a structural cost advantage.

Cross-border payments remain the clearest use case

Cross-border payments continue to be slower, more expensive, and less transparent than domestic transactions. According to World Bank data, the average cost of a cross-border payment remains above 6%, with settlement times ranging from 2 to 5 business days.

Blockchain infrastructure addresses several of these issues directly:

- Settlement does not rely on intermediary correspondent banks

- Fees are typically flat and predictable

- Transaction status is visible in real time

This is why many processors are exploring blockchain rails first for international payouts, supplier payments, and marketplace settlements rather than consumer checkout.

Blockchain does not replace cards, it complements them

Cards are extremely effective at authorization, consumer protection, and dispute handling. Blockchain does not replicate these strengths today, and it does not need to.

Instead, processors increasingly view payments as two layers:

- Front end, authorization, fraud controls, consumer experience

- Back end, settlement, treasury movement, reconciliation

Blockchain fits naturally into the back end. Cards remain dominant at the front end. This layered approach allows processors to improve efficiency without forcing behavior change on merchants or consumers.

What this means for merchants today

Most merchants do not need to adopt blockchain directly, and many never will. The value shows up indirectly through better processor capabilities.

Merchants benefit when processors can offer:

- Faster funding timelines

- Lower cross-border costs

- Cleaner reporting and fewer reconciliation issues

- More predictable settlement schedules

From a merchant perspective, these improvements feel incremental, but they are powered by meaningful infrastructure changes underneath.

Why payment processors are watching closely

Payment processors operate on thin margins at massive scale. Small improvements in settlement speed, reconciliation accuracy, or cross-border cost can materially change unit economics.

Blockchain is not a silver bullet, but it offers tools that align closely with processor pain points. That is why processors are evaluating it now, even if widespread merchant awareness comes later.

The processors that understand these rails early are better positioned to decide where they make sense, where they do not, and how to integrate them responsibly.