Credit card payments may feel instantaneous to your customers, but behind the scenes there’s a multi-step process that determines when you actually get paid. Most merchants see funds arrive in their accounts within 1–3 business days after a transaction, but that timeframe isn’t random, it’s rooted in how payment systems work and the way banks communicate with each other.

Below, we break down the timing, explain the stages, show industry benchmarks, and highlight variations that impact settlement times.

What “Settlement” Actually Means

Before we talk numbers, it’s important to understand what “settlement” means in payments.

Settlement is the point at which the issuing bank sends funds to your acquiring bank after a transaction has been authorised and batched. It’s not just authorisation, which happens in seconds, but the whole process of reconciling books and sending money. After settlement, your processor or acquiring bank deposits the net funds into your merchant account.

These processes take time because they involve multiple parties, card issuer, card network (like Visa/Mastercard), acquiring bank, payment processor, all reconciling and transferring funds securely before you can access them.

Typical Settlement Times for Credit Card Payments

Across most payment systems, standard credit card settlement times fall within a consistent range. Even though the customer sees approval instantly at the point of sale, it usually takes longer for the funds to transfer through the banking system.

Typical business settlement timing:

| Settlement Type | Typical Timeframe | Notes |

|---|---|---|

| Standard settlement | 1–3 business days | Most domestic Visa/Mastercard transactions settle here. |

| Cross-border transactions | 3–7 business days | Extra compliance and currency steps can extend timelines. |

| Same-day settlement | Within same business day | Some processors offer this as an option. |

This table reflects broad industry norms; actual timing depends on your processor, batching schedule, bank holidays, weekends and your specific merchant agreement.

Why Settlement Isn’t Instant

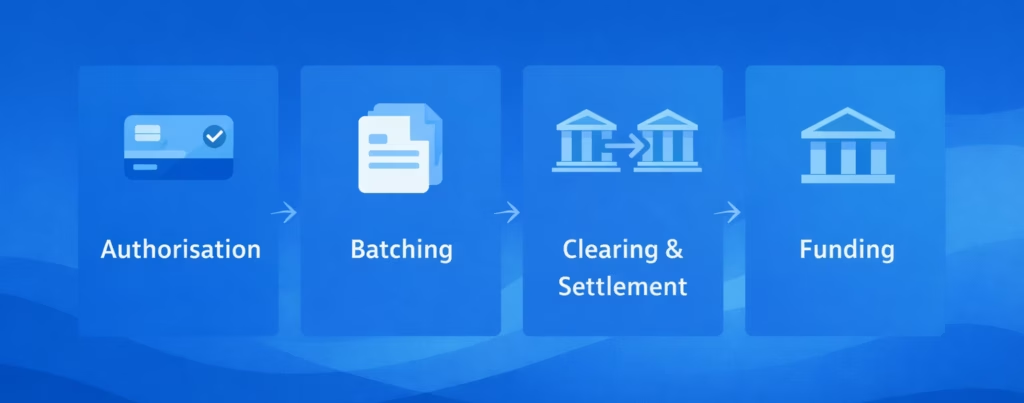

Even though authorisation takes milliseconds, settlement involves several stages that add lag:

- Authorisation: The card issuer approves the transaction immediately.

- Batching: Merchants or processors bundle transactions (typically daily).

- Clearing & settlement: The card network and issuing bank reconcile and transfer funds to the acquiring bank.

- Funding: The acquiring bank makes funds available in your account.

This multi-party workflow inherently takes more than a few seconds — that’s why settlement usually spans several business days.

Weekends and bank holidays also slow this down because many systems do not clear or settle on non-business days.

Real-World Industry Benchmarks

Industry sources agree on the 1–3 business day window for most credit card settlements:

- Stripe: Most credit card settlements finish within 1–3 business days, with funding often completing within 2–3 business days after transaction date.

- Ecommpay: Merchants typically receive funds in 1–3 business days, though specific timing varies by processor and bank routing.

- Other payment infrastructure resources list 1–3 business days for standard card settlements, with accelerated options available.

Some acquiring banks or processors in Europe and the UK may see settlement nearer 1–2 business days for simple domestic transactions, due to local clearing rules and banking hours.

Factors That Can Change Settlement Timing

Settlement isn’t a fixed clock — several things can speed it up or slow it down:

- Batch times: If your processor batches transactions late in the day, settlement may effectively shift to the next business cycle.

- Processor offerings: Some processors provide same-day or next-day funding options for faster cash flow.

- Transaction type: Domestic card transactions are usually faster; cross-border payments often take longer.

- Bank holidays/weekends: Non-business days extend settlement timelines.

- Fraud/security checks: Additional verification steps can delay settlement.

Because these variables matter, merchants looking to optimise cash flow often review payment provider capabilities beyond just headline settlement windows.

Summary: What Merchants Should Expect

For most businesses, credit card payments are approved instantly, but settlement usually takes 1–3 business days. Funding, when money actually hits your bank, often aligns with or follows shortly after settlement. Faster settlement options are available but may depend on your processor or cost structure.

If you’re seeing timelines consistently longer than these norms, it may be worth reviewing batching schedules or processor configurations.