Canadian business data gives a clear picture of how merchants accept payments, what tools they need, and where payment processors can offer real value. With nearly five million active businesses in the country, the payment landscape is large, diverse, and increasingly digital.

This overview highlights the most important statistics by region and industry, and explains how they relate to payment processing trends in 2025.

Nearly Five Million Businesses in Canada

Canada has one of the most diverse small business ecosystems in the world. According to Statistics Canada, there are:

- 1.38 million employer businesses

- 3.59 million non-employer businesses

- 4.97 million total business entities

Every one of these businesses accepts payments in some form, whether that is in person, online, by invoice, mobile, or recurring billing. The size of this merchant base underscores why transparent pricing and reliable support are crucial in the payment processing industry.

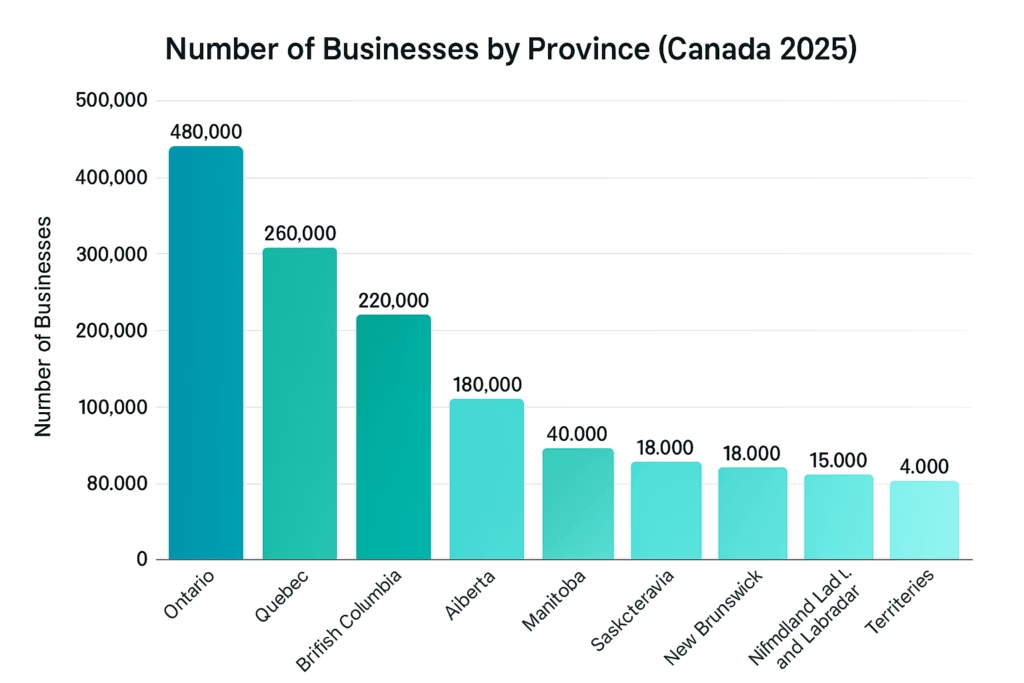

Where Canada’s Businesses Are Located

The distribution of businesses across regions affects the types of payment solutions they need. The top five provinces by employer business count are:

- Ontario: 480,000

- Quebec: 260,000

- British Columbia: 220,000

- Alberta: 180,000

- Manitoba: 40,000

These five provinces represent more than 85 percent of all employer businesses in Canada.

Urban provinces have high concentrations of retail, restaurants, professional services, and fast-growing e-commerce companies. These businesses typically need contactless terminals, online payments, integrated point of sale systems, and unified reporting that works across in-store and online channels.

Business Density in Major Metropolitan Areas

Canada’s largest metropolitan areas contain the highest number of merchants per square kilometer. These include:

- Toronto: 310,000 businesses

- Vancouver: 150,000

- Montreal: 140,000

- Calgary: 70,000

- Edmonton: 65,000

These regions are hotspots for retail, hospitality, professional services, and e-commerce fulfillment. Payment processing in these markets requires modern terminals, omnichannel payment flows, mobile wallet acceptance, and strong fraud prevention for online transactions.

Small-Town and Rural Canada Payment Needs

A significant share of Canadian businesses operate outside major cities. Rural and small-town regions represent more than 30% of all employer businesses. Small firms, categorized as businesses with 1 to 99 employees, make up 98.6% of all rural companies. The leading rural industries include:

- Construction, 14.7%

- Agriculture, forestry, fishing, and hunting, 14.3%

- Retail trade, 10.5%

Merchants in rural regions often need mobile terminals, equipment that works in low connectivity environments, simple pricing, and reliable technical assistance. These businesses rely heavily on tap transactions, quick settlements, and easy-to-use hardware.

Industry Mix and Merchant Payment Profiles

Canada’s business landscape covers a variety of sectors with very different payment behaviors. The largest industries by number of businesses include:

- Professional, scientific and technical services: 225,000

- Construction: 170,000

- Retail trade: 145,000

- Healthcare and social assistance: 140,000

- Accommodation and food services: 105,000

- Real estate: 100,000

The payment needs of these industries vary. Retailers and restaurants require fast in-person transactions, ordering integrations, and multi-station point of sale systems. Trades and contractors depend on mobile card readers and digital receipts.

Professional services lean toward online payments, invoicing, and subscription billing. Healthcare and dental clinics often use card-on-file and recurring billing. Real estate and property companies frequently use recurring and installment payments.

Canada Leads in Contactless and Digital Adoption

Canada is one of the most digital-forward payment markets in the world. More than 85% of in-person transactions now include tap payments, and mobile wallets such as Apple Pay and Google Pay continue to grow each year. More than 75% of online transactions use digital payment methods rather than cash on delivery, bank transfers, or manual card entry.

This rapid shift means merchants expect NFC-enabled hardware, online payment links, QR code payments, and unified checkouts that work across mobile, web, and in-person environments.

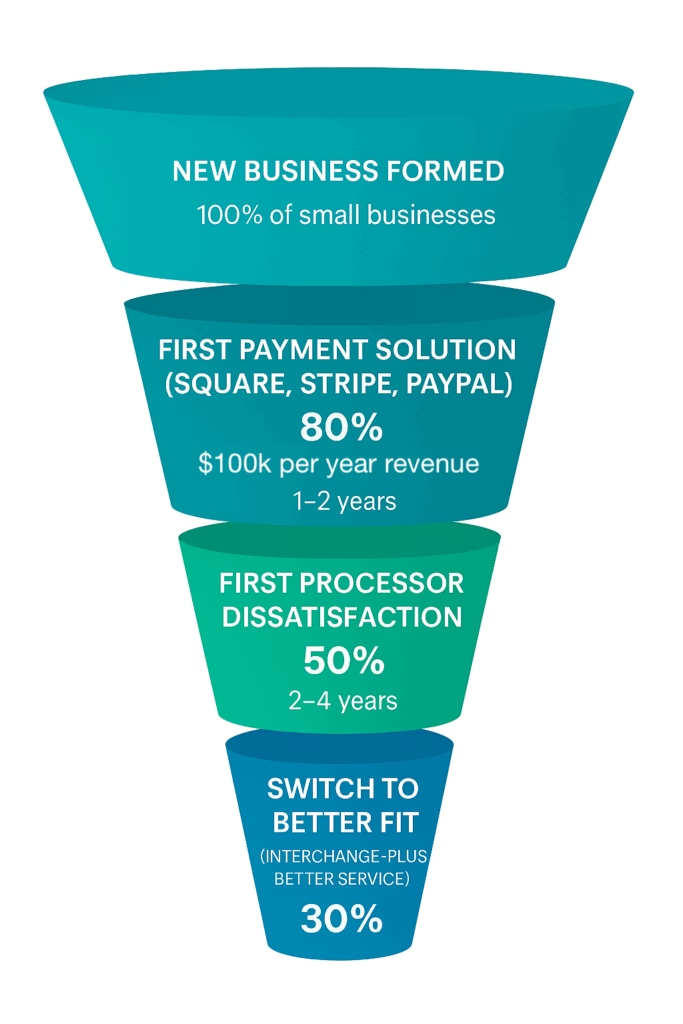

High Merchant Switching Creates Opportunity

Small businesses in Canada frequently change payment processors within 12 to 24 months. Many begin with entry-level solutions, hit limits as they grow, then look for something more reliable. The funnel illustrates a common path: most new businesses begin with tools like Square or Stripe, about half report dissatisfaction within a few years, and a significant share eventually switch to a better fit.

This creates a strong opportunity for processors that offer transparent pricing, fast onboarding, modern equipment, and responsive support. The Canadian market consistently rewards providers that keep payments simple, clear, and dependable.