Interac remains one of the most important pieces of financial infrastructure in Canada. While global card brands like Visa and MasterCard dominate marketing visibility, Interac powers the majority of everyday debit transactions and an increasingly large share of real-time account-to-account transfers.

The data released through 2025 shows something clear: Interac is not stagnant legacy infrastructure. It is growing, evolving, and expanding further into business use cases. This report outlines the figures and provides 2025 data.

Canadian Payments Market Overview

The Canadian market is no longer in transition from cash to digital. It has fully shifted. Electronic payments dominate both consumer and business transactions across nearly every demographic. Digital payments now account for 88% of all transaction volume.

In 2025, Canada processed approximately 23.3 billion retail payment transactions, representing roughly $12.7 trillion in total payment value across consumer and business activity.

2025 Retail Payment Volume Breakdown

Based on national payment reporting and trend analysis:

- Credit cards: ~34% of total transaction volume

- Debit cards: ~30% of total transaction volume

- Online account-to-account transfers (including e-Transfer): ~15%

- Prepaid & other electronic methods: ~9%

- Cash: ~12%

Credit remains the single largest category by transaction count, but debit continues to hold a remarkably strong share compared to many global markets.

Cash, by contrast, continues its steady structural decline. A decade ago it represented a significantly larger share of retail volume. In 2025, it accounts for only about one in eight transactions.

Additional 2025 Market Indicators

- Contactless payments: ~60% of total transactions

- E-commerce share of retail spending: ~18–20% of total retail value

- Mobile wallet usage: Now embedded in over half of in-person contactless transactions

- Average non-cash transaction value: Increasing modestly year over year

Canada’s payments market is mature, stable, and highly digitized. Growth rates are steady rather than explosive, reflecting an established infrastructure rather than emerging adoption.

Interac operates squarely inside this digital majority. Debit and account-to-account transfers are core components of how Canadians transact daily.

For merchants, platforms, and financial institutions, the implication is straightforward: optimizing for digital debit and bank-based payment rails is not optional in Canada.

Interac e-Transfer Statistics

As of 2025, Interac has become a core national payment rail used by individuals, small businesses, marketplaces, property managers, contractors, and service providers across Canada.

Based on the most recent annualized data available entering 2025, e-Transfer processed:

- Approximately 1.6 billion transactions annually

- Roughly $620 billion in total transaction value

- An estimated 22% to 25% of transactions involving a business

Growth between recent years has been strong and structural, not temporary:

- 2022 to 2023: ~16% growth

- 2023 to 2024: ~20% growth

- 2024 to 2025: ~14% growth

At current 2025 levels, more than 350 million transfers per year involve businesses.

That scale fundamentally changes how e-Transfer should be viewed. It is no longer primarily consumer behaviour. It is embedded commercial infrastructure operating at national scale.

For merchants and platforms in Canada, e-Transfer is not experimental. It is mainstream.

Interac Debit Statistics 2025

While e-Transfer drives headline growth, Interac Debit remains the backbone of in-store payments in Canada. It is embedded in everyday retail behaviour and continues to operate at national scale.

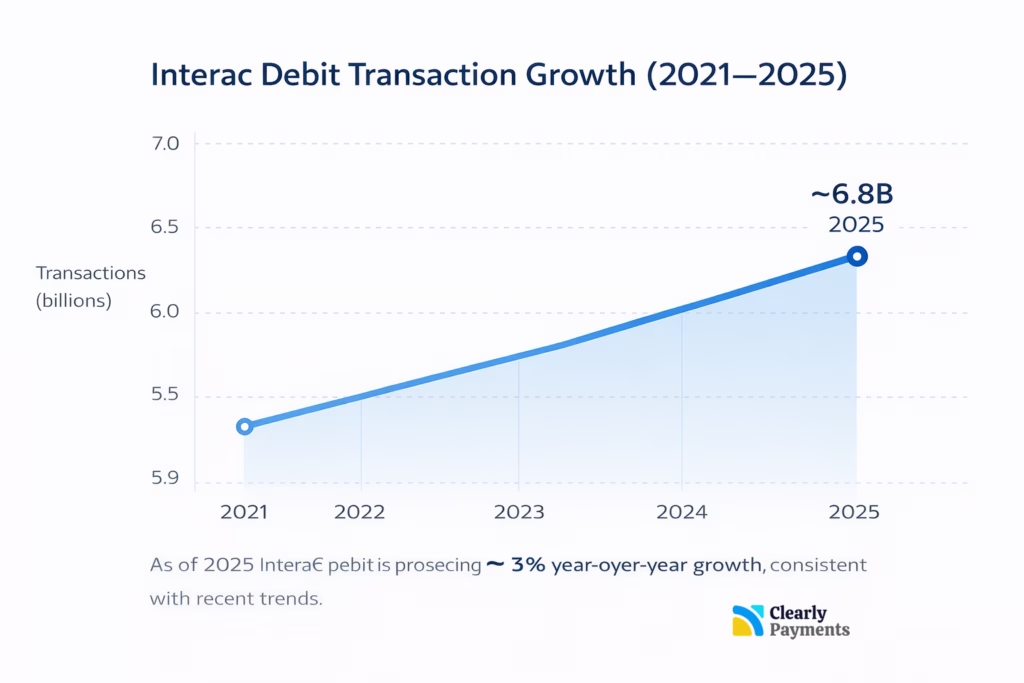

Annual transaction volumes show steady expansion:

- 2021: 5.86 billion transactions

- 2022: 6.2 billion

- 2023: 6.5 billion

- 2024: 6.6 billion

- 2025: ~6.8 billion transactions

The 2025 figure reflects approximately 3% year-over-year growth, consistent with recent trends.

Debit growth is slower than e-Transfer, but it is durable and consistent. Canada continues to maintain strong debit penetration due to:

- Lower merchant acceptance costs compared to credit

- Deep consumer familiarity and trust

- High contactless tap adoption

- Broad acceptance across small and mid-sized merchants

With debit representing roughly 30% of total retail transaction volume nationally in 2025, it remains a mandatory acceptance method for Canadian merchants.

10 Year Growth Trend: e-Transfer (2015–2025)

The most compelling story in Interac’s data is long-term compounding. Over the past decade, e-Transfer has expanded dramatically in both transaction count and economic significance.

Selected annual volumes:

| Year | Transactions |

|---|---|

| 2015 | 105M |

| 2016 | 158M |

| 2017 | 241M |

| 2018 | 371M |

| 2021 | 937M |

| 2022 | 1B+ |

| 2023 | 1.16B |

| 2024 | 1.4B |

| 2025 (Est.) | 1.6B |

From 105 million to approximately 1.6 billion transactions represents roughly 15 times growth in ten years. Few national payment systems demonstrate that level of structural expansion without being replaced or disrupted. Interac instead scaled.

2025 Regulatory and Market Developments

Interac’s growth has also attracted policy attention. In 2025, Canada’s Competition Bureau publicly stated it was monitoring Interac’s commitment to transition from volume-based wholesale pricing to a flat-fee structure effective November 1, 2025.

This signals two things:

- Interac is considered systemically important infrastructure.

- Pricing transparency and fairness are now regulatory priorities.

At the same time, Interac reported measurable increases in debit usage among small and medium-sized businesses in 2025 compared to prior periods.

The network is not just growing. It is being scrutinized and institutionalized.

What This Means for Canadian Merchants in 2025

For merchants, platforms, and SaaS providers operating in Canada, the data supports several conclusions.

First, debit remains essential. With nearly 7 billion annual transactions and approximately 30% share of national payment volume, optimization around Interac acceptance matters operationally and financially.

Second, e-Transfer is commercially viable. With over $600 billion in projected annual value and rising business participation, it supports use cases such as:

- Invoice settlement

- High-ticket transactions

- Marketplace payouts

- Deposits and recurring payments

Third, Canada is structurally comfortable with account-to-account transfers. Consumer trust in bank-based payment rails is high, and behavioural adoption is already proven at scale.